What is Fully Diluted Market Cap in Crypto?

Have you ever wondered how investors determine a cryptocurrency project’s future potential? If so, understanding what is a fully diluted market cap becomes essential. Just like Bitcoin’s market cap shows the current value of its available coins, the fully diluted market cap (FDV) gives a bigger picture by estimating the total value of a project […]

Have you ever wondered how investors determine a cryptocurrency project’s future potential? If so, understanding what is a fully diluted market cap becomes essential. Just like Bitcoin’s market cap shows the current value of its available coins, the fully diluted market cap (FDV) gives a bigger picture by estimating the total value of a project if all its tokens were available.

This number helps you see a cryptocurrency’s growth potential and risks, making it an important tool for anyone in the crypto industry. In this article, we’ll explain FDV, how it is calculated, and how it differs from regular market cap to make you invest smarter.

Disclaimer. This article primarily explores the crypto industry’s fully diluted market cap (FDV). While we briefly touch on its relevance in the stock market, the main focus is crypto. Also, check out our dedicated articles for more details on market cap and how to calculate it.

What is a Fully Diluted Market Cap?

A fully diluted market cap refers to the total potential value of a crypto asset, calculated as if all tokens in the project were already in circulation.

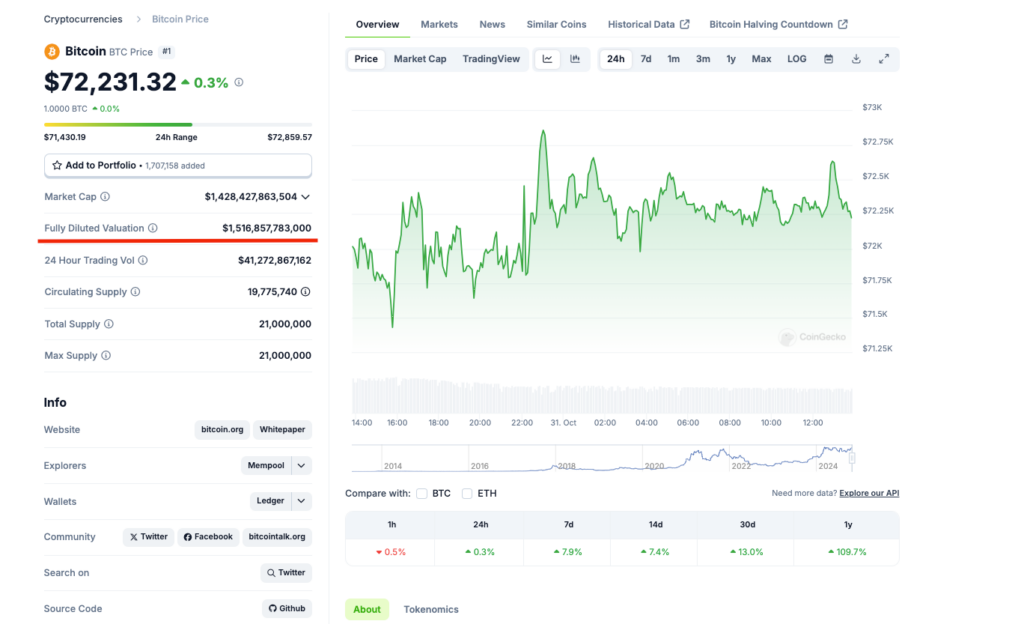

It is represented as a numerical value, usually in the form of a dollar amount, and investors use it to assess the project’s future potential, similar to how they evaluate total issuable shares in the stock market. For a clearer understanding of how FDV appears on various platforms, see the example below from CoinGecko.

In the finance industry, this metric is also known by other names, such as “diluted valuation,” “fully diluted valuation (FDV),” “expanded market cap,” and “total diluted value.” However, it’s most commonly referred to as either a fully diluted market cap or a fully diluted valuation (FDV).

FDV is essential because it provides a broader view of a project’s potential value, showing how future token releases could impact demand and supply conditions.

How is Fully Diluted Market Cap Calculated?

FDV is calculated by multiplying the current price per token by the total maximum supply of tokens, representing the theoretical market cap if all tokens were in circulation.

The formula is: FDV = Current Price × Total Supply

Let’s take a real-world example to help you understand it even better. Bitcoin has a limited hard cap of 21 million coins. At the time of writing, its FDV is approximately $1.52 trillion if its current price is $72,351. We calculated it like that:

- FDV = $72,351 x 21,000,000

- FDV ≈ $1.52 trillion

This figure assumes that all 21 million Bitcoins will eventually be mined and entered into circulation. This may not be the case due to various factors, such as lost coins or changes in mining difficulty. Thus, calculating FDV can be more complex for tokens with an unlimited supply because there is no fixed maximum supply on which to base the calculation.

However, many cryptocurrencies with an unlimited supply have defined inflationary models that can provide a practical framework for estimating their future supply. Factors such as the token’s emission schedule, inflation rate, and other economic parameters can guide these estimations.

In cases of unlimited supply, the focus often shifts from FDV to other metrics, such as tokenomics, real-world use cases, and the project’s overall value proposition.

Also, while FDV is typically higher than the current market capitalization, remember that if a cryptocurrency has an unlimited supply or has reached its maximum supply, its FDV will match the market cap.

Who doesn’t love free tokens?

Find legit airdrops that reward you with real crypto just for participating check the latest airdrops

Market Cap vs. Fully Diluted Market Cap

| Aspect | Market Cap | Fully Diluted Market Cap (FDV) |

| Definition | Reflects the current market value of circulating tokens | Estimates value if all tokens were released |

| Formula | Token Price × Circulating Supply | Token Price × Total Supply |

| Focus | Current valuation | Potential future valuation |

| Supply Basis | Circulating Supply | Total Supply (circulating + locked/unreleased) |

| Usefulness | Gauges present-day market position | Project value under total supply conditions |

| Investor Insight | Shows current demand and liquidity | Help assess inflationary risks and growth potential |

Make sure to distinguish the market cap from the fully diluted market cap. While both market cap and fully diluted market cap (FDV) help investors evaluate a cryptocurrency’s potential and sometimes can have small similarities, they usually focus on different aspects of its value.

The market cap reflects a project’s current valuation based on circulating tokens. FDV projects the market cap if all tokens, including those not yet released, were in circulation. Basically, market cap is a present-day measurement, while FDV offers a forward-looking estimate, helping investors assess a crypto project’s full potential and possible inflationary pressures.

Here’s a look at the mathematical differences between market cap and FDV:

- Market Cap = Token Price × Circulating Supply

- FDV = Token Price × Total Supply

As a potential similarity (already mentioned in the article), the total supply matches the circulating supply if a project’s tokens are fully distributed and actively traded. In this scenario, the FDV and market cap will be identical.

A significant distinction between the two is their relevance to the timeframe. Market cap reflects a project’s current valuation, calculated by multiplying the current price per token by the number of currently circulating tokens. This provides a real-time assessment of the project’s active market value.

On the other hand, FDV projects the project’s future value, assuming all tokens are in circulation. For example, suppose a project with a lower market cap has a large portion of tokens yet to be released. In that case, its FDV represents an estimated value as if those tokens were already available in the market. However, this projection doesn’t account for future demand changes.

Another key difference between market cap and FDV lies in investor insights. Market cap reflects current demand and liquidity, giving investors a sense of how established or stable a project might be. In contrast, FDV helps investors assess potential inflationary risks and future success potential by considering the value of all tokens in circulation.

This way, the market cap focuses on present conditions, while FDV offers a forward-looking view of supply-related risks and the project’s long-term potential.

Start your crypto journey with free rewards

Grab sign up bonuses from trusted platforms and grow your wallet faster see the full bonus list

Fully Diluted Market Cap and Trading

The concept of fully diluted market cap (FDV) is utilized in stock and cryptocurrency markets, but it has evolved in distinct ways within each context.

In the stock market, FDV refers to the total value it would cost to buy all outstanding shares, including any potential shares from options or convertible securities. This metric helps investors assess a company’s future potential value, considering the impact of dilution from future share issuances.

Similarly, in the crypto market, FDV provides insights into a cryptocurrency’s projected value, considering all tokens that could enter circulation. As stock traders use FDV to evaluate growth and risks, crypto investors leverage this metric to understand a project’s future potential.

By drawing on the principles of FDV from stock trading, crypto investors can better understand how future token releases may influence supply and demand dynamics.

Think price shows a coin’s real value?

Market cap reveals the bigger picture behind rankings and hype learn how market cap works

When to Consider the Fully Diluted Market Capitalization?

It is a good idea to consider the fully diluted market cap for these situations:

Evaluating Long-Term Value and Dilution Risk

- Large Token Supplies—If a project has many unreleased tokens, looking at the fully diluted market cap can help you understand how this might affect the token’s current price. A high FDV compared to the current market cap can suggest that the price might drop.

- Token Vesting Schedules—For projects with a plan for when team members, investors, or advisors will receive their tokens, FDV can give you an idea of how these tokens entering the market over time could impact the price.

Understanding Inflationary Pressures

- Inflationary Tokenomics—In projects where the number of tokens grows over time, the value of each token can decrease. FDV helps you see how this inflation might affect the token’s worth in the long run.

Comparing Projects and Spotting Opportunities

- Fair Comparisons—FDV makes it easier to compare different projects, especially when two projects have similar market caps but different amounts of tokens currently available.

- Finding Potential Deals—If a project’s FDV is low compared to its current market cap, it might mean it is undervalued and has room for growth.

Making Smart Investment Choices

By understanding FDV, investors can:

- Evaluate a project’s long-term value and possible dilution risks.

- Spot projects that have solid fundamentals and appealing tokenomics.

- Make better choices about when to buy, sell, or hold their cryptocurrencies.

Keep in mind that while FDV is a helpful tool, other factors, such as the project’s fundamentals, the team’s experience, market sentiment, and overall economic conditions, should also be considered when deciding on investments.

Is volume the real market signal?

Learn how trading volume reveals buyer strength and short term momentum see how volume really works

FAQs

Is Fully Diluted Market Cap Good or Bad?

FDV isn’t inherently good or bad—it’s simply a measure. A high FDV can signal important growth potential if demand holds as more tokens enter circulation; however, it can also imply dilution risk as additional tokens unlock.

What is the Difference Between Initial Market Cap and Fully Diluted Market Cap?

The initial market cap represents the total value of tokens currently in circulation. In contrast, the fully diluted market cap projects the asset’s total valuation assuming full issuance of all tokens, including those locked or scheduled for release.

Why is FDV Higher Than the Market Cap?

FDV is often higher than market cap because it includes all potential tokens, while market cap only includes those currently circulating.

When Are Market Cap and FDV The Same?

If a project fully distributes its tokens, the circulating supply equals the total supply. In this case, the market cap and FDV will be the same, as all tokens are in the market, giving a clear, consolidated picture of value.

What are the Limitations of FDV?

The limitations of FDV include its nature as an estimate, which may not always be accurate in predicting future prices. Additionally, the total supply of tokens can fluctuate due to various factors affecting the FDV. Therefore, investors must use FDV alongside other metrics and conduct thorough research to make well-informed financial decisions.

Final Thoughts

So, a fully diluted market cap (FDV) helps investors see a crypto project’s full potential by estimating its value if all tokens were in circulation. Unlike the market cap, which shows present value, FDV offers a future perspective on supply and demand.

By comparing FDV with the current market cap, investors can spot growth potential and inflation risks, making it a valuable tool for smarter investment decisions.