Crypto Market Cap Explained: What It Is and Why It Matters

With the crypto market’s surprisingly rapid evolution, investors constantly seek ways to analyze a coin’s value, stability, and growth potential. The market cap, or market capitalization, has become one of the most straightforward metrics for understanding how cryptocurrencies perform. You may wonder, but what is a market cap in crypto? Well, this is what we […]

With the crypto market’s surprisingly rapid evolution, investors constantly seek ways to analyze a coin’s value, stability, and growth potential. The market cap, or market capitalization, has become one of the most straightforward metrics for understanding how cryptocurrencies perform.

You may wonder, but what is a market cap in crypto? Well, this is what we will discuss today. This article will explore what market cap means in crypto, how it’s calculated, and why it’s a critical factor in making smart investment choices.

What Is Market Cap in Crypto?

In basic terms, market cap measures a cryptocurrency’s market value. It is usually calculated by multiplying a single coin’s current price by its total circulating supply. Thus, market capitalization indicates how valuable a cryptocurrency is perceived to be, which helps investors understand its relative size in the market compared to other coins.

In traditional (or corporate) finance, the market cap applies to the stock market, where it’s calculated by multiplying the share prices of publicly traded companies by the number of shares in circulation.

However, it can adapt to crypto assets’ decentralized and variable nature, focusing on circulating supply. Thus, a crypto company’s market cap can show how its native token performs on the market and other useful metrics such as the average price, the trading volume, etc.

The formula is straightforward: Market Cap = Current Market Price of One Coin x Circulating Supply. For instance, if EGCOIN (E.G. Coin) has 10 million coins in circulation, and each coin trades at $10, the market cap would be $100 million.

Market Cap vs. Fully Diluted Market Cap

There’s often confusion between market cap and fully diluted market cap. While the market cap only considers the circulating supply, the fully diluted market cap projects a coin’s total value as if all coins were in circulation. Simply put, you multiply its price at a given time by its maximum supply.

For instance, if a cryptocurrency has a limited supply of 100 million coins but only 10 million are circulating, its market cap will reflect just those 10 million. However, the fully diluted market cap assumes all 100 million coins are in circulation and calculates the value accordingly.

Confused by token metrics?

Learn how market cap and supply really affect a coin’s value — read the full breakdown

Why Is Market Cap Important in Crypto?

Anyone interacting with the crypto world must understand the importance of market cap. Why does market cap matter?

- Market cap is a value indicator widely used to analyze a cryptocurrency’s market value and compare it to others. It’s not a precise measure of a coin’s worth, but it provides a quick overview of how much the community values it, offering insight into investor confidence.

- It can and does categorize cryptocurrencies: Based on market cap, cryptocurrencies are generally grouped into three categories:

- Large-cap cryptocurrencies: Examples include Bitcoin, Binance Coin, Tether, and Ethereum, which have high market caps, generally over $10 billion. Large-cap companies (or tokens) are considered lower-risk investments due to their established position, higher liquidity, and broader investor interest.

- Mid-cap cryptocurrencies: These coins, like Chainlink, Bitcoin Cash, Litecoin, or Polkadot, are in the middle range, with market caps between $1 billion and $10 billion. They often balance growth potential and relative stability, making them attractive to investors looking for returns beyond large-cap assets without extreme risk.

- Small-cap cryptocurrencies: Coins with market caps below $1 billion fall into this category. They carry a higher risk but have the potential for significant growth. Small-cap assets attract more speculative investors willing to take on risk in exchange for higher growth potential. Some worthy examples include Polygon, Lido, or Brett.

Top Factors Affecting the Crypto Market Cap

Market cap isn’t static. However, it fluctuates based on multiple factors that impact cryptocurrency prices and the total number of coins in circulation. But what factors are we talking about?

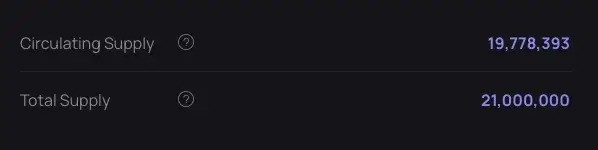

1. Total Supply

A coin’s supply structure affects its market cap. Cryptocurrencies with fixed or limited supplies may increase in value as demand grows, affecting the market cap.

Take Bitcoin, for instance. It has a limited supply of 21,000,000 and is close to reaching it (with 10,778,393 coins in circulation at the time of writing). Its limited supply can increase the price, thus also increasing the market cap. When the max supply is reached, demand will increase while supply will remain constant, thus increasing scarcity and, therefore, the crypto’s price.

2. Market Sentiment

Investor sentiment can significantly affect market cap, which often shifts according to current news and market trends. Positive sentiment leads to higher prices and can boost market cap, while negative sentiment has the opposite effect.

Remember the FTX crash? Back in 2022, it affected the entire crypto market and not only, leaving crypto investors with little to no hope of recovery for most of their funds. The market cap of every cryptocurrency was affected by this event, and it was not in a good way.

3. Trading Volume

High trading volume indicates strong market interest and can stabilize a coin’s price. Low trading volume, on the other hand, can make a coin more volatile, impacting the market cap as its price swings.

Not sure what volume really tells you?

Discover how trading volume signals market trends — read our simple guide

4. Economic Factors

Like traditional investments, cryptocurrencies are affected by macroeconomic conditions. Inflation, interest rates, and broader economic trends can influence the prices of crypto assets and, thus, their market cap.

How to Use Market Capitalization in Crypto

Market cap provides critical insights that can contribute to your investment decisions and help you manage your portfolio effectively. In general, you can use it for:

- Risk assessment: We have already discussed how the market cap can show some things about crypto’s volatility and evolution. Investors often consider this metric an initial measure of a coin’s risk level.

- Diversification: Investing in coins across various market cap categories helps balance risk and growth potential. For instance, a diversified portfolio could include a mix of large, mid, and small-cap cryptocurrencies.

- Growth Potential: Mid and small-cap cryptocurrencies are known for their potential to grow in value. While they carry more risk, they also offer the chance for significant returns, making them appealing to investors seeking high-growth opportunities. And who can tell you this about them if not their market cap?

- Compare the evolution of various tokens: You can compare the market cap of 2 or more tokens to see how they would perform in various situations. For instance, on MarketCapOf, you can compare the price of BTC with the market cap of ETH and vice versa, and the list of possibilities goes on.FAQ

Claim Free Crypto in Minutes

Join top platforms and unlock instant signup bonuses—no hassle, just rewards.

Claim Your BonusFAQ

Why should I consider market cap when investing in crypto?

The market cap is useful for assessing the coin’s value and comparing it with other cryptocurrencies.

Is a higher market cap better?

A higher market cap generally suggests stability, but smaller caps may offer higher growth potential.

Does the market cap change frequently?

Yes, the market cap fluctuates based on price changes and shifts in circulating supply.

Final Thoughts

In the crypto market, understanding the concept of market capitalization can help investors make better-informed decisions by comparing market caps across large, mid, and small-cap coins. Whether you’re investing for stability, diversification, or growth, leveraging market cap as part of your strategy can clarify your portfolio’s potential risks and rewards.