Understanding Solana vs. Ethereum: Which Reigns Supreme?

When it comes to the ongoing debate between Solana vs. Ethereum, it’s clear that there isn’t a simple, objective answer. Both networks have their strengths and unique qualities, making comparisons challenging. Indeed, Solana Labs and the Ethereum Foundation are two of the most important and respected groups in the crypto world. They have earned this […]

When it comes to the ongoing debate between Solana vs. Ethereum, it’s clear that there isn’t a simple, objective answer. Both networks have their strengths and unique qualities, making comparisons challenging.

Indeed, Solana Labs and the Ethereum Foundation are two of the most important and respected groups in the crypto world. They have earned this reputation for good reasons and shaped the future of blockchain technology.

We’ve created this comprehensive analysis of Solana vs. Ethereum to help you better understand each platform’s key differences, strengths, and potential.

Disclaimer: While we aim to provide helpful insights, always remember to take this information cautiously and conduct your research before making any decisions.

Solana vs. Ethereum: A Brief Overview

| Criterion | Solana (SOL) | Ethereum (ETH) |

| Price (at the time of writing) | $220 | $3,167 |

| Market Cap (at the time of writing) | $102,808,978,638 | $381,638,452,029 |

| Circulating Supply (at the time of writing) | 471,935,140 SOL | 120,423,804 ETH |

| Max Supply | ∞ | ∞ |

| Blockchain | Solana blockchain | Ethereum blockchain |

| Consensus Mechanism | Proof of Stake (PoS)Proof of History (PoH) | Proof of Stake (PoS) |

| Block Reward | N/A | N/A |

| Cryptographic Algorithm | SHA-256 | SHA-256 |

| Token Utility | Governance, fees, staking rewards, collateral for DeFi, and NFT minting | Governance, fees, staking rewards, collateral for DeFi, and NFT minting |

| Founders | Anatoly Yakovenko | Vitalik Buterin |

| Launch Date | 2020 | 2015 |

| Supporting Exchanges | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. |

| Communities | Reddit Discord X (Twitter) YouTube | Reddit Discord X (Twitter) YouTube |

The Genesis of Solana vs. Ethereum

Solana is often called the “Ethereum Killer” because it introduced several improvements over Ethereum’s original design. At a glance, Solana and Ethereum might seem to be competing directly in the same space. But they come from different origins and are driven by distinct goals.

Both aim to make blockchain technology faster, more accessible, and affordable, yet their unique beginnings and the challenges they address set them on different paths.

Ethereum was launched in 2015 by Vitalik Buterin, a 20-year-old programmer who wanted to build more than just a digital currency. Since Bitcoin had already paved the way as “digital gold,” Vitalik dreamed of a platform where developers could create apps that lived on the blockchain, where no one company or person could control them.

That vision led to smart contracts, programs that automatically execute agreements once certain conditions are met. Ethereum’s introduction of smart contracts set the stage for new possibilities in blockchain, like decentralized finance (DeFi), NFTs, and more.

However, as it became more popular, Ethereum hit some big speed bumps: high fees and slow transactions. With its Proof of Work system (similar to Bitcoin’s), Ethereum could only handle so much traffic, leading to higher user costs.

So, it began shifting to Ethereum 2.0 with a Proof of Stake model, aiming to make it faster and cheaper. And they did it! As Ethereum’s The Merge event happened, they transitioned to a Proof of Stake consensus mechanism, reducing gas fees by 99.95% and improving the network’s overall efficiency.

On the other hand, Solana was launched in 2020 by former Qualcomm engineer Anatoly Yakovenko with a different goal in mind.

Anatoly saw existing blockchains’ speed and cost issues and thought, “Why not build something fast from the start?”

Thus, Solana uses a unique method called Proof of History, which organizes and timestamps transactions to be processed more efficiently. This, combined with Proof of Stake, lets Solana handle thousands of transactions per second, making it one of the fastest blockchains.

With lower fees and high speeds, Solana has gained a lot of interest. This is especially true for developers who want to build applications like games, social networks, and DeFi platforms. As a result, users can enjoy these without long wait times or high costs.

Ethereum vs. Solana: Technical Comparison

Winner: Solana

1. Blockchain and Consensus Mechanisms

Solana and Ethereum currently use a Proof-of-Stake (PoS) consensus mechanism in some form, but they implement it in distinct ways that impact their performance.

Ethereum blockchain initially used Proof-of-Work (PoW) but transitioned to PoS with Ethereum 2.0. In PoS, validators stake ETH to participate in securing the network, which saves energy compared to PoW.

Solana’s case combines a PoS with a unique addition called Proof-of-History (PoH). PoH timestamps events on the blockchain to establish a historical sequence, allowing Solana to process transactions quickly. This combination enables Solana’s famously high throughput but requires substantial computing power.

After that, the first and biggest distinction between the two networks is scalability.

2. Scalability and Network Throughput

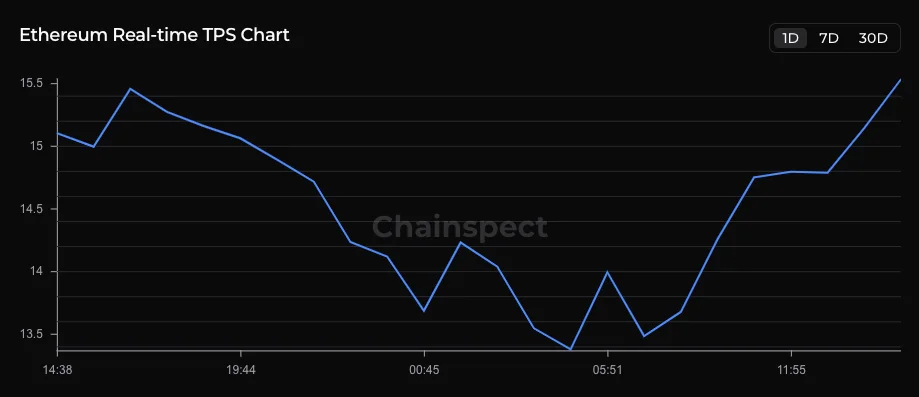

Even though Ethereum’s goal is to surpass 100,000 transactions per second (TPS) with its ongoing upgrades, as of November 2024, it processes around 15 TPS.

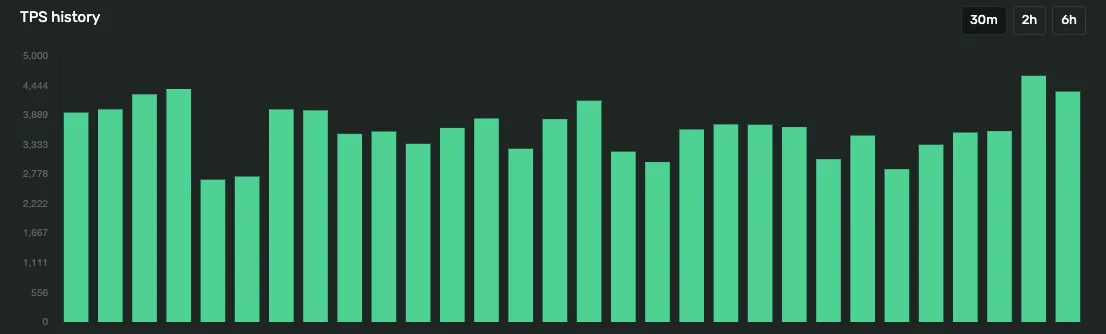

The Solana network was designed to handle up to 65,000 TPS, thanks to its Proof of History (PoH) and Proof of Stake (PoS) model. Right now, it achieves about 3,312 TPS.

3. Transaction Costs and Network Congestion

Solana ecosystem is known for its extremely low fees. Thus, Solana transactions only cost about $0.00025, a fraction of a cent. This affordability makes it a go-to for applications with high transaction volumes, like NFTs, DeFi projects, and gaming, where fees can otherwise add up quickly.

Moreover, Solana’s fast processing speed helps keep costs low even during peak times, making it a budget-friendly choice for users and developers.

However, despite Solana’s fast throughput, they have faced some performance issues and even network outages as it scales, which shows the challenges of maintaining stability at such high speeds.

By contrast, the Ethereum network has faced challenges with both high gas fees and network congestion. Gas fees are the charges users pay to complete Ethereum transactions, which can fluctuate widely based on network activity.

During high-demand periods, like major NFT drops or DeFi surges, fees can spike to hundreds of dollars per transaction, making it challenging for users who can’t afford those costs. Network congestion is a big factor here, as high activity can slow down transaction times and push fees even higher.

Ethereum increasingly uses Layer-2 solutions like Arbitrum, Optimism, and zk-Rollups to address these issues. These solutions work by handling transactions off-chain and then posting summary data back to Ethereum’s network, which eases congestion and helps keep fees down. While Layer-2 adoption is growing and these solutions are helping reduce costs, high fees during peak times can still be an obstacle for Ethereum users.

4. Programming Languages and Smart Contracts

Smart contracts—self-running code on the blockchain that executes agreements automatically—are a key feature of Ethereum and Solana, though each approaches them differently.

Ethereum, which introduced smart contracts to the blockchain, has a wealth of decentralized applications (dApps) primarily developed in Solidity, a language made specifically for the Ethereum Virtual Machine (EVM).

Solidity’s syntax draws from familiar languages like C++, Python, and JavaScript, making it relatively accessible to developers from those backgrounds and solidifying Ethereum as a go-to platform for complex, secure dApp development.

Solana’s smart contracts, however, aim for speed and scalability with its Sealevel platform, allowing it to handle many of them in parallel, significantly boosting its transaction processing capabilities. Solana’s contracts are typically written in Rust, a language known for speed and strong memory safety features. Rust is becoming more popular among developers for its performance and efficiency, especially for high-speed applications.

In a way, Solidity on Ethereum is like painting with oil, ideal for fine detail but slower, while Rust on Solana is more like acrylic, fast-drying and efficient, perfect for rapid, high-throughput applications. This makes Solana attractive to developers building high-speed apps that need to handle heavy loads without slowing down.

5. DeFi and NFT Capabilities

Ethereum is widely recognized as the trailblazer in decentralized finance (DeFi), largely due to its early introduction of smart contracts in 2015.

As of 2024, the Ethereum ecosystem supports over 4,800 decentralized applications (dApps) and boasts 442,402 active wallets, capturing over half of the total value locked (TVL) in the DeFi sector.

Key DeFi protocols, including Uniswap, MakerDAO, and Compound, have reshaped borrowing, lending, and trading, making Ethereum a core platform in the DeFi landscape.

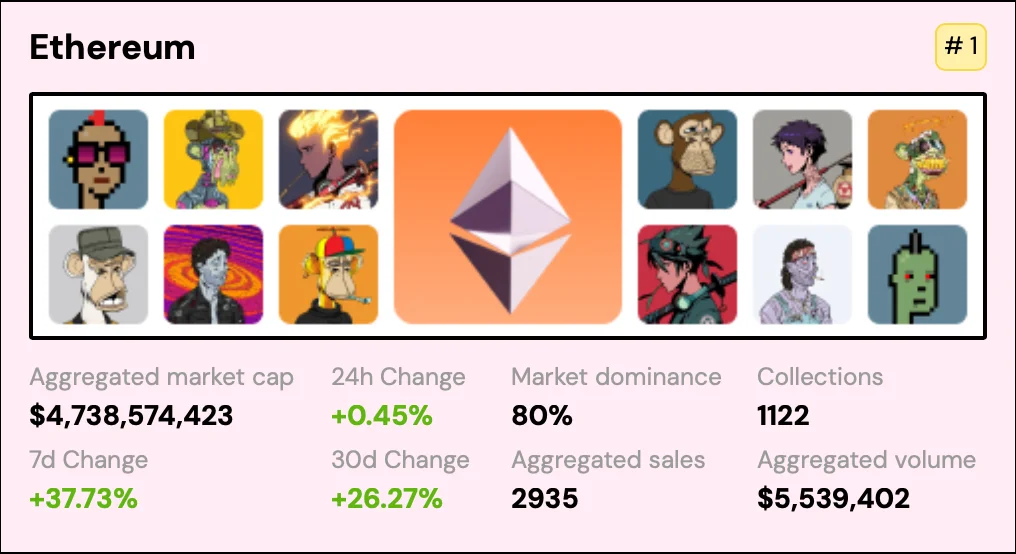

And when it comes to the NFT market, Ethereum dominates it, claiming around 80% of the market. Platforms like OpenSea, Rarible, and Nifty Gateway are central to Ethereum’s NFT ecosystem, providing a vast marketplace with a substantial base of buyers and sellers.

Despite the expense, Ethereum’s large user base and established royalty standards make it the primary choice for many artists and collectors.

Though newer, Solana has built a rapidly growing DeFi ecosystem focused on high-speed, low-cost transactions. With over 350 dApps and an impressive 5.03 million unique active wallets, Solana has quickly attracted high-performance DeFi projects like Jupiter, Raydium, and Orca.

These platforms leverage Solana’s speed, delivering smooth user experiences at a fraction of Ethereum’s transaction costs.

In the NFT market, Solana is emerging as an attractive, low-cost alternative for NFT creators and collectors. Currently, Solana claims around 5% of the market.

With marketplaces like Solanart and Raydium, Solana offers significantly lower transaction fees, often under $1, making it a budget-friendly option for frequent transactions or micro-NFTs.

Minting on Solana is also faster, providing a streamlined experience that appeals to users looking for a quicker, more affordable NFT environment.

Market Performance

Winner: Ethereum

1. Market Capitalization

Ethereum remains a dominant force in the cryptocurrency market. As of November 11, 2024, its market capitalization is approximately $384 billion, making it the second-most valuable crypto asset. This surpasses Solana, which has a market capitalization of around $102 billion and ranks fourth.

Ethereum’s dominance is driven by its pioneering role in smart contract technology, its well-established ecosystem of decentralized apps (dApps) and DeFi protocols, and growing institutional adoption.

While Solana has gained considerable attention for its high performance and scalability, it still faces challenges in matching Ethereum’s entrenched market position.

However, Solana’s potential for innovation, particularly in high-performance DeFi and gaming, presents opportunities for future growth and could enhance its competitive edge.

2. Supply and Price Action

Ethereum (ETH) and Solana (SOL) have slightly different supply mechanisms and price behaviors.

Ethereum has no fixed supply cap, meaning its supply continuously increases. However, Ethereum 2.0, which uses Proof of Stake, reduces inflation by introducing staking rewards and the burning of ETH through EIP-1559, which can make the supply deflationary when network usage is high.

Over time, as more ETH gets staked, the circulating supply decreases, potentially adding upward pressure on the price.

Solana’s native token, SOL, uses the SPL token standard and lacks a maximum supply cap. Instead, Solana has a fixed year-on-year inflation schedule. The initial inflation rate was 8%, distributed as staking rewards to incentivize network security. This rate will decrease by 15% annually until reaching a long-term inflation target of 1.5%. This gradual reduction in inflation makes the supply growth predictable over time but ensures that supply will continue to grow indefinitely.

Ethereum has generally experienced steady upward movement in price action, driven by its large ecosystem, demand for decentralized applications (dApps), and Ethereum 2.0 upgrades. Although its price has been volatile, Ethereum remains a dominant player with a relatively high market cap, fluctuating between $2,000 and $3,200 recently.

Solana’s price action is more volatile. After rapid growth due to its fast transaction speeds and low fees, it has faced significant price drops, particularly after network outages and performance issues. As of 2024, its price fluctuates around $100 to $200, lower than its peak above $250 in 2021.

3. Trading Volume and Market Sentiment

Ethereum consistently ranks among the top cryptocurrencies by trading volume, generally holding the third position after Tether and Bitcoin.

As of November 11, 2024, Ethereum’s 24-hour trading volume is $45.04 billion, reflecting its high liquidity and strong market demand.

Ethereum also enjoys generally positive market sentiment, supported by its solid fundamentals, technological advancements, and institutional investors, though sentiment can vary with broader market conditions.

Although Solana’s trading volume has grown substantially in recent years, it remains lower than Ethereum’s, currently ranking seventh.

As of November 11, 2024, Solana’s 24-hour trading volume is $9.79 billion. Its increasing popularity and innovative potential could support future growth.

Market sentiment for Solana is generally positive, shaped by factors like network performance, scalability, and developer engagement. While it has experienced volatility, positive developments in these areas often bolster investor confidence.

Practical Uses

Winner: Solana

Both Ethereum and Solana offer unique strengths within the blockchain ecosystem, with practical uses that set them apart.

1. Decentralized Finance (DeFi)

Ethereum is the leader in DeFi, powering a full-bodied ecosystem of lending platforms, decentralized exchanges, and stablecoins. While Ethereum’s mature DeFi infrastructure is unmatched, high fees and scalability limitations can make it less accessible for smaller users.

Solana also supports DeFi applications, focusing on speed and cost-efficiency. This makes it attractive for developers and users seeking affordable, scalable DeFi solutions. However, Solana’s DeFi ecosystem is still developing, and it lacks the depth and variety of Ethereum’s established projects.

2. Non-Fungible Tokens (NFTs)

Ethereum pioneered the NFT industry, offering standards and platforms supporting secure, decentralized digital asset ownership. Although it dominates NFT marketplaces, Ethereum’s high transaction fees can be a barrier to entry.

With its low fees and fast transactions, Solana has become a popular alternative for NFTs, especially for artists and collectors who want affordable transactions. While it’s rapidly growing in popularity, Solana’s NFT ecosystem isn’t as extensive or trusted as Ethereum’s.

3. Smart Contracts and dApps

Ethereum introduced smart contracts and remains the primary platform for decentralized applications. Its wide range of developer tools and resources makes it attractive for building and deploying dApps, though transaction speeds can be slow during peak times.

Solana offers fast, low-cost transactions for smart contracts, making it ideal for dApps that require high transaction throughput. Solana’s ecosystem is still growing, so it lacks the developer resources and variety that Ethereum has built up over the years.

4. Decentralized Autonomous Organizations (DAOs)

Ethereum has a strong track record with DAOs, and its ecosystem provides a secure infrastructure for decentralized governance. However, high fees can make smaller, more frequent transactions challenging within DAOs.

Solana offers a low-fee solution for DAOs needing frequent updates or votes, though it doesn’t yet have the same reputation or scale as Ethereum’s DAO ecosystem.

5. Payment Method and Transactions

Ethereum can be used for payments, but high fees often make frequent or smaller transactions impractical.

Solana shines here. Its minimal fees and fast processing times make it suitable for micropayments and high-frequency transactions, especially in gaming and commerce.

Solana vs. Ethereum: Short and Long-Term Perspectives

According to crypto analysts and experts, Ethereum and Solana have growth potential in the short and long term, but in different ways.

According to experts, Ethereum is expected to grow moderately, mainly due to the Dencun upgrade and ongoing interest in DeFi, NFTs, and dApps. However, while Ethereum’s recent upgrades and the potential for Ethereum ETFs raised hopes, they’ve mostly helped stabilize the price rather than boost it significantly.

When discussing Solana vs. Ethereum long-term, analysts predict ETH could reach $4,000 by 2025, possibly hitting $5,000 if institutional interest grows. However, market volatility and competition from other blockchains might keep its growth in check.

On the other hand, Solana looks set for faster growth in the short term. Its strengths lie in low fees, fast transaction speeds, and interest in DeFi and NFTs. Some also see the approval of a Solana ETF as a potential price driver.

Experts believe Solana could reach $300 by 2025, with a chance to surpass $500 if it grows in DeFi and NFT markets. Still, market risks and competition, especially from Ethereum, could limit its gains.

When comparing Solana vs. Ethereum long term, ETH will be in a strong position due to its role in smart contracts, DAOs, and DeFi. By 2030 it could reach $20,000 or more as it benefits from widespread blockchain adoption in sectors like finance and healthcare.

However, scalability issues and high gas fees might limit its growth if other blockchains, like Solana, offer more efficient solutions.

Solana’s high-speed transactions and scalability give it a promising future. By 2030, it could hit $1,000 or more, driven by its support for dApps and enterprise adoption. Solana’s low fees and speed make it attractive for industries seeking decentralized solutions.

However, centralization concerns and competition from Ethereum and others could be challenges. If Solana continues to grow and address these issues, it could see strong growth in the coming decade.

Both have strengths but remember: this is not investment advice. Always do your research before making any decisions.

Where Are They Heading?

Regarding future goals and developments, Solana and Ethereum have ambitious plans that cater to different strengths and needs within the blockchain space.

Solana aims to improve network stability and scalability in the short term by boosting its already high transaction speed and low fees.

The Solana Foundation works on token extensions to enable more flexible and programmable tokens. This update could attract more developers and enterprises, particularly in areas like stablecoins, where such flexibility is valuable.

Solana also emphasizes integration with real-world applications, including exploring partnerships in DeFi, gaming, and NFTs.

In the long term, Solana is expanding its ecosystem to incorporate mainstream technology, like the Solana Saga smartphone, which aims to connect mobile tech with blockchain. These efforts show a commitment to attracting new users, enhancing the developer experience, and improving user accessibility.

Ethereum’s short-term plans focus on addressing its scalability and usability challenges. Although the transition to Proof-of-Stake (PoS) was a major milestone, the blockchain’s developers are still working on key updates, like the Pectra upgrade, to improve performance.

Additionally, Ethereum plans to implement Single-Slot Finality, a feature that will reduce the time required for finalizing transactions, making the user experience smoother.

Over the long term, Ethereum aims to tackle the “blockchain trilemma” by balancing decentralization, security, and scalability. Upgrades like Verkle Trees will reduce storage demands, enhancing scalability without compromising decentralization.

Ethereum’s focus on account abstraction will simplify interactions with smart contracts, making DApps more user-friendly and accessible to non-technical users.

FAQs

Why is Ethereum Worth More than Solana?

Ethereum has existed longer and has a larger, more established ecosystem with various decentralized applications (dApps), DeFi protocols, and NFTs. Ethereum’s dominance is also supported by its strong institutional interest and role in pioneering smart contracts, giving it more market confidence and value than Solana.

Can Solana Reach Ethereum’s Market Capitalization?

Solana can reach Ethereum’s market cap if it expands its ecosystem, attracts more developers, and efficiently scales its network. Use our calculator to determine the price $SOL would need to reach to match Ethereum’s market cap.

Will Ethereum’s Upgrades Allow It to Surpass Solana’s Speed?

Ethereum’s transition to Ethereum 2.0 with its Proof of Stake model is designed to improve key metrics such as scalability and transaction speeds, which could bring it closer to Solana’s level of performance. However, Solana’s unique Proof of History mechanism still gives it a speed advantage for high-volume transactions.

Final Thoughts

The competition between Solana vs. Ethereum is far from clear-cut. Ethereum is a market leader. It has a large ecosystem and strong developer tools. It also has a strong presence in decentralized finance (DeFi) and NFTs. Meanwhile, Solana has strong benefits, like fast speeds and low transaction fees.

Solana’s innovative POH mechanism combined with Proof of Stake (PoS) allows it to handle thousands of transactions per second, making it a powerful contender for high-performance applications, particularly in DeFi and gaming.

Looking to the future, both blockchains are on track for further innovation and growth. Ethereum’s ongoing upgrades aim to enhance scalability and efficiency, solidifying its leadership in the smart contract space.

Meanwhile, Solana’s focus on speed and cost-efficiency positions it as a promising alternative that could eventually surpass Ethereum in specific use cases.

Both networks will continue to evolve, but Solana’s trajectory suggests it could become a powerful force in blockchain technology, potentially altering the balance of power in the blockchain ecosystem.