What’s The Difference Between Layer-1 vs. Layer-2?

When blockchain technology first appeared, it was revolutionary. Bitcoin, introduced in 2009, was the first decentralized digital currency, offering a secure and transparent way to transfer value without relying on banks. However, as more people began using the Bitcoin network, it faced some problems. Transactions became slower, fees increased, and the system struggled to handle the growing demand. And this […]

When blockchain technology first appeared, it was revolutionary. Bitcoin, introduced in 2009, was the first decentralized digital currency, offering a secure and transparent way to transfer value without relying on banks. However, as more people began using the Bitcoin network, it faced some problems. Transactions became slower, fees increased, and the system struggled to handle the growing demand.

And this issue wasn’t unique to Bitcoin. Ethereum, another blockchain that introduced smart contracts, faced similar challenges. The problem was clear: these networks weren’t built to handle large numbers of transactions quickly and cheaply.

This led to the idea of the Blockchain Scalability Trilemma, which says blockchains can only excel at two out of three things:

- Decentralization (being free from control by any one entity);

- Security (being protected from attacks);

- Scalability (handling lots of users).

Bitcoin and Ethereum focused on being decentralized and secure, which meant they struggled with scaling up.

To fix these issues, developers started improving layer-1 blockchains. They tried making blocks bigger or changing how transactions are verified. While these changes helped, they often required much time and agreement among the community.

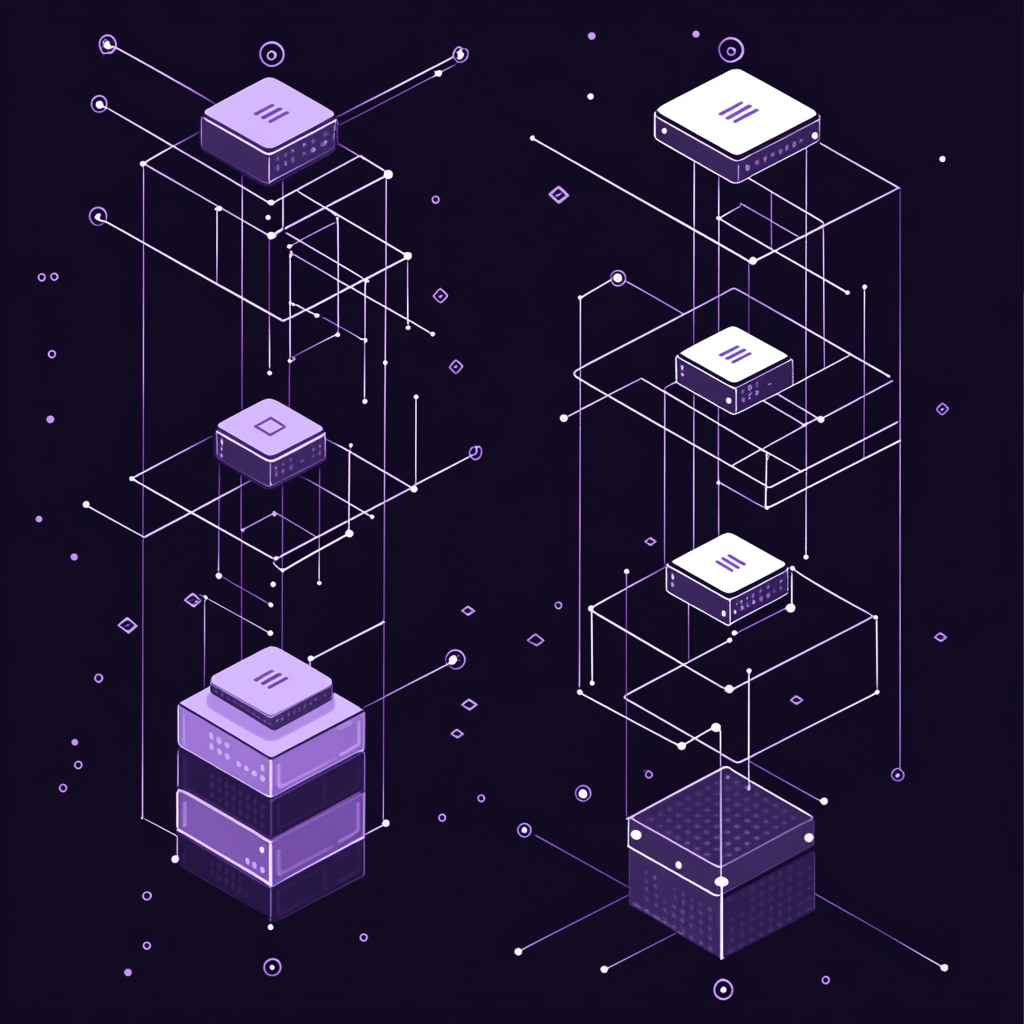

That’s when layer-2 solutions appeared. Instead of trying to make layer-1 do everything, developers created layer-2 systems that work on top of the underlying blockchain protocol. These systems process transactions faster and cheaper by handling them separately and only updating the main blockchain when needed.

But let’s go more in-depth to better understand the difference between layer-1 vs. layer-2, focusing on their major aspects: their role, scaling, and blockchains.

Layer-1 vs. Layer-2: At A Glance

| Feature | Layer-1 Blockchain | Layer-2 Blockchain |

| Definition | The primary blockchain network where all transactions and operations occur (e.g., Bitcoin, Ethereum). | A secondary framework built on top of layer-1 to enhance scalability and transaction speed (e.g., Polygon, Arbitrum). |

| Role | Handles core transactions, security, and consensus. | Works off-chain to process transactions faster and cheaper, then syncs with the main blockchain. |

| Scalability | Faces scalability issues as demand grows, leading to slower trades and higher transaction fees. | Increases scalability by reducing the workload on layer-1 and processing transactions off-chain. |

| Transaction Speed | Slower, often with delays in transaction processing. | Faster, as transactions are processed off-chain before being added to layer-1. |

| Security | Layer-1 is the base layer blockchain, ensuring security and decentralization. | Relies on layer-1 for security while processing transactions off-chain to speed up the system. |

| Consensus Mechanism | Directly involved in consensus and validation of transactions (e.g., Proof of Work or Proof of Stake). | Doesn’t handle consensus directly; instead, it submits data to layer-1 for final validation. |

| Use Case | Suitable for fundamental, high-security transactions and decentralized systems. | Ideal for applications needing fast, cost-effective transactions without overloading layer-1. |

| Example Projects | Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Solana (SOL). | Polygon (POL), Arbitrum (ARB), Optimism (OP), zkSync (ZK). |

| Blockchain Layers | It operates as the foundation of the blockchain network and handles all operations. | It operates on top of layer 1, enhancing performance as a second layer. |

| Implementation Complexity | Changes are often slow and require consensus from the network (e.g., upgrading block size or consensus mechanisms). | It can be implemented without changing the main blockchain, offering quicker scalability solutions. |

Need to move tokens across chains?

Discover the safest and fastest bridges for your next DeFi transfer explore top crypto bridges

Layer-1 vs. Layer-2: Their Role

Let’s start by understanding their roles because they differ. As mentioned, blockchain networks operate on a decentralized system. A group of nodes processes transactions, and a consensus protocol ensures everything is accurate. Once validated, these transactions are added to an unchangeable chain of data blocks, creating a secure and transparent record.

However, as blockchains become more popular, this system runs into a significant challenge: scalability. The more people use a blockchain, the more computational power it needs to process transactions.

The system can get overloaded as demand grows, slowing transaction speeds and frustrating users. For example, some transactions on popular blockchains can take up to 10 minutes, which isn’t practical for many applications.

To address this, different scaling solutions were developed. These solutions aim to handle the growing number of transactions without compromising the blockchain’s decentralized and secure nature. And from these blockchain scaling solutions, layer-1 and layer-2 solutions are the most popular. Both were developed to fix the scalability problem, but in different ways:

- Layer-1 blockchains, like Bitcoin and Ethereum, focus on improving the base system. They introduce updates to make the network more efficient, like changing the consensus mechanism, increasing block sizes, or sharding.

- Layer-2 blockchains work alongside layer-1 on top of the main blockchain, taking on some of the workload. By processing transactions on separate networks and then syncing them back to the main chain, layer-2 helps reduce congestion and speeds up the system.

Together, these layers tackle the bottleneck problem (but in different ways), ensuring blockchain technology can keep up with growing demand and remain effective for users worldwide.

Layer-1 vs. Layer-2: Scaling

Scaling solutions for blockchain networks differ significantly between layer-1 and layer-2, but both are designed to tackle the same issue: improving the network’s ability to process a growing number of transactions while preserving its core principles of security and decentralization.

Layer-1 upgrades strengthen the foundation by addressing limitations at the protocol level. These solutions are often permanent but require significant consensus among developers and users, which can delay implementation.

Layer-2, however, provides immediate relief by reducing the load on the main chain. It enables faster and cheaper transactions without requiring changes to the underlying blockchain, making it ideal for scaling in the short term.

By combining layer-1 improvements with layer-2 solutions, blockchain ecosystems can balance scalability, decentralization, and security, overcoming bottlenecks currently hindering mass adoption.

To further understand the scaling solutions for layer-1 and layer-2 blockchains, read below.

Layer-1 Scaling Solutions

1. Increasing Block Size

One of the earliest and simplest solutions for layer-1 scaling is increasing the size of transaction blocks. Each block contains a batch of transactions, and larger blocks can accommodate more transactions.

For example, Bitcoin Cash implemented this strategy, increasing its block size from 1 MB to 8 MB and later to 32 MB. This allowed Bitcoin Cash to process over 100 transactions per second, compared to Bitcoin’s much slower rate of around 7 transactions per second.

While effective for increasing capacity, this approach has trade-offs, such as higher node storage requirements and potential centralization risks.

2. Sharding

Sharding is a sophisticated technique inspired by traditional database systems. It involves breaking the blockchain into smaller, more manageable segments, or “shards,” which operate independently.

Each shard processes its own transactions and stores a portion of the blockchain’s data, allowing multiple shards to handle transactions simultaneously and increasing the overall throughput.

For example, the Ethereum blockchain has integrated sharding into its roadmap to complement its transition to Proof-of-Stake, enabling the network to process thousands of transactions per second.

3. Updated Consensus Mechanisms

Consensus mechanisms are the backbone of blockchain security and functionality, but not all are equally efficient.

Traditional Proof-of-Work (PoW), as Bitcoin uses, requires miners to solve complex mathematical puzzles to validate transactions. While secure, this method is computationally intensive and slow.

To address this, Ethereum shifted to Proof-of-Stake (PoS), which requires validators to lock up cryptocurrency as collateral instead of solving puzzles. PoS drastically reduces energy consumption and computational load while maintaining security and decentralization.

Some other layer-1 blockchains, like Cardano and Solana, have adopted PoS or similar mechanisms from the outset, prioritizing scalability.

Layer-2 Scaling Solutions

These methods don’t require modifying the core blockchain but interact with it to enhance performance. Key strategies include:

1. Rollups

Rollups are among the most popular layer-2 scaling solutions. They bundle multiple transactions into a batch, process them off-chain, and then submit the compressed transaction data to the main blockchain.

This reduces the workload on the layer-1 network, allowing it to focus on finalizing blocks instead of processing every transaction.

Rollups come in two primary forms:

- Optimistic Rollups, like those used by Optimism, assume transactions are valid by default and only perform checks if fraud is suspected.

- Zero-Knowledge (ZK) Rollups, seen in networks like StarkNet, use cryptographic proofs to validate transactions off-chain before submitting them to the main chain.

2. State Channels

State channels enable two parties to transact directly off-chain. Once the interaction is complete, the state channel remains open for multiple transactions, and only the final state is publicly recorded on the layer-1 blockchain.

Bitcoin’s Lightning Network is a well-known example. It allows users to send microtransactions quickly and inexpensively while maintaining the security of the main Bitcoin blockchain.

3. Side Chains

Side chains are independent blockchain networks connected to the main chain. Unlike rollups or state channels, side chains maintain their consensus mechanisms and validators, allowing them to operate in parallel with the main blockchain.

They can process large volumes of transactions independently and later synchronize with the primary network.

For example, Polygon operates as a layer-2 scaling solution for the Ethereum network, providing faster and cheaper sidechain transactions while periodically settling data on Ethereum’s main chain.

Layer-1 vs. Layer-2: Popular Blockchains

You’re probably wondering which layer 1 vs. layer 2 networks are the most well-known, right? Some of the most popular blockchain networks that are classified as Layer-1 include:

- Bitcoin (BTC);

- Ethereum (ETH);

- BNB Chain (BNB);

- Cardano (ADA);

- Solana (SOL);

- Polkadot (DOT);

- Avalanche (AVAX);

- Algorand (ALGO);

- Tezos (XTZ);

- Cosmos (ATOM), and others.

The most popular layer-2 blockchains are the following:

- Polygon (POL, ex-MATIC);

- Arbitrum (ARB);

- Optimism (OP);

- zkSync (ZK);

- StarkNet (STRK);

- Loopring (LRC);

- Immutable (IMX);

- Base (BASE), and others.

FAQs

What are Layer-1 and Layer-2 Blockchains?

Layer-1 blockchain refers to a blockchain’s primary infrastructure, like Bitcoin or Ethereum, which handles all transactions on its network. Layer-2 solutions, on the other hand, operate off-chain to improve scalability and transaction speed. While blockchains have multiple layers in their stack—hardware, data, network, consensus, and application—layer-1 and layer-2 specifically refer to scaling methods within the blockchain ecosystem.

Can a Blockchain Function Solely on Layer-1?

Many blockchains, including Bitcoin, initially operated exclusively as layer-1 networks. However, as user demand increased, scalability issues became apparent, leading to the development of layer-2 solutions to enhance performance.

Which Is Better: Layer-1 or Layer-2?

The choice depends on the specific use case. Layer-1 is essential for providing robust security and decentralization. In contrast, layer-2 is ideal for improving transaction speed and efficiency, making it a complementary solution rather than a direct comparison.

Can Layer-2 Exist Without Layer-1?

Layer-2 solutions depend on layer-1 networks for security and final transaction validation. They enhance functionality but rely on the foundational blockchain for integrity and trust.

Do Layer-2 Solutions Compromise on Security?

Layer-2 solutions are designed to maintain security by leveraging the underlying layer-1 blockchain for validation. While they operate differently, their connection to Layer 1 ensures that overarching security standards are upheld.

Final Thoughts

So, we hope that by the end of this article, you have understood the primary considerations of the layer-1 vs. Layer-2 dilemma. Indeed, they appeared because blockchain became a victim of its success. Thus, layer-1 provides a network security foundation, while layer-2 is an upgrade, making blockchains faster and easier to use.

Together, they solve the problems that came with blockchain’s growing popularity, making it ready for the future. Also, while layer-1 and layer-2 solutions significantly improve scalability, blockchain technology still faces ongoing challenges that require continuous innovation and development.