XRP vs. Bitcoin: Understand Their Differences and Similarities

Curious about the differences between XRP vs. Bitcoin? Whether you’re new to cryptocurrencies or want to understand how their technologies compare, you’ve come to the right place! This guide will cover the basics, including blockchains’ purpose, transaction speeds, and coin supply. We’ll also examine each blockchain’s decentralization and scalability, followed by its market performance. By […]

Curious about the differences between XRP vs. Bitcoin? Whether you’re new to cryptocurrencies or want to understand how their technologies compare, you’ve come to the right place!

This guide will cover the basics, including blockchains’ purpose, transaction speeds, and coin supply. We’ll also examine each blockchain’s decentralization and scalability, followed by its market performance.

By the end, you’ll have all the information to decide which cryptocurrency is better for you. Let’s get started!

XRP vs. Bitcoin: A Brief Overview

| Criterion | Bitcoin (BTC) | Ripple (XRP) |

| Native Token | BTC | XRP |

| Price (at the time of writing) | $97,646.43 | $2.22 |

| Market Cap (at the time of writing) | $1.9 trillion | $126 billion |

| Circulating Supply (at the time of writing) | 19.79 million BTC | 57 billion XRP |

| Maximum Supply | 21,000,000 BTC | 100 billion XRP |

| Blockchain | Bitcoin | Ripple |

| Consensus Mechanism | Proof of Work (PoW) | Ripple Protocol Consensus Algorithm (RPCA) |

| Block Reward | 3.125 BTC | – |

| Cryptographic Algorithm | SHA-256 | SHA-256 |

| Token Utility | Store of value, medium of exchange | Facilitating cross-border payments, especially for financial institutions |

| Founders | Satoshi Nakamoto | Chris Larsen, David Schwartz, Author Britto, and Jed McCaleb |

| Launch Date | 2009 | 2012 |

| Supporting Exchanges | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. |

| Communities | Reddit X (Twitter) BitcoinTalk Forum Bitcoin Conferences And Events | Reddit X (Twitter) GitHub |

Need to move tokens across chains?

Discover the safest and fastest bridges for your next DeFi transfer explore top crypto bridges

The Genesis of XRP vs. Bitcoin

In 2008, after the financial crisis, trust in banks was crumbling, so a mysterious figure—or group—called Satoshi Nakamoto published a nine-page white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

This document introduced the world to Bitcoin, laying out a bold vision: a new kind of money that didn’t need banks or governments to function. Instead, people could send and receive money directly, securely, and transparently using a revolutionary technology called blockchain.

Bitcoin officially launched in 2009 when Satoshi released the software and mined the first block, the Genesis Block.

Bitcoin’s blockchain was like nothing the world had seen before, and over time, people started calling it “digital gold” because of its value and security.

However, in 2012, another game-changer entered the scene: XRP, created by Ripple Labs (originally called OpenCoin). But what is XRP? Unlike Bitcoin, the XRP blockchain wasn’t designed to bypass banks. Instead, it was meant to work with them, solving one of the biggest headaches in finance—slow and expensive international money transfers.

Thus, XRP’s approach was very different from Bitcoin’s. While Bitcoin relied on mining and a proof-of-work system, XRP used a much faster and more energy-efficient consensus mechanism. Bitcoin’s supply was released gradually through mining, but XRP’s 100 billion tokens were pre-mined from the start, with a large portion kept by Ripple Labs to fund partnerships and projects.

The goals of these two technologies couldn’t have been more different. Bitcoin was built for financial independence, allowing people to store and move money without banks or governments. XRP, on the other hand, focused on making the existing financial system faster and cheaper, especially for cross-border payments.

Today, Bitcoin and XRP represent two very different visions of the future of money. Bitcoin is seen as a symbol of freedom, like digital gold, while XRP has become a practical tool for global payments.

Bitcoin vs. XRP: Technical Comparison

Winner: Ripple (XRP)

1. Blockchain and Consensus Mechanisms

Bitcoin operates on a public blockchain, which ensures security and trust. A blockchain network of nodes records and verifies all transactions. Thus, Bitcoin’s consensus mechanism is Proof-of-Work (PoW), where miners compete to solve complex mathematical problems to validate transactions and secure the network.

While PoW provides a high level of security, it can be energy-intensive and limit scalability.

Unlike Bitcoin, XRP operates on a unique distributed ledger technology called the XRP Ledger (which is a private blockchain). As a result, XRP’s consensus mechanism is the Ripple Protocol Consensus Algorithm (RPCA). In the RPCA, a group of trusted validators agrees on the order and validity of transactions.

The Ripple network participants select validators and do not require mining or energy-intensive operations like Proof-of-Work (PoW). This allows for efficient transaction processing and network security without the high energy consumption associated with traditional PoW systems.

2. Scalability and Network Throughput

Bitcoin’s blockchain scalability has long been a concern, with the network capable of processing only about 7 transactions per second (TPS). This limited throughput often leads to network congestion, particularly during high-demand periods, resulting in slower transaction times and increased fees.

Efforts to address these issues include layer-2 solutions like the Lightning Network, which enables faster off-chain transactions, and SegWit (Segregated Witness), which optimizes block space. However, Bitcoin’s core protocol remains unchanged, prioritizing security and decentralization over faster transaction speeds.

Ripple’s network is designed with speed, boasting a theoretical capacity of 1,500 TPS under normal conditions and up to 50,000 TPS in optimized scenarios. However, in practical use, the network currently processes around 38 TPS, which is still significantly faster than Bitcoin.

Ripple’s focus on efficiency and scalability positions XRP as a leading solution for fast and cost-effective cross-border transfers, maintaining its reputation as a practical tool for real-world financial applications.

3. Transaction Costs and Network Congestion

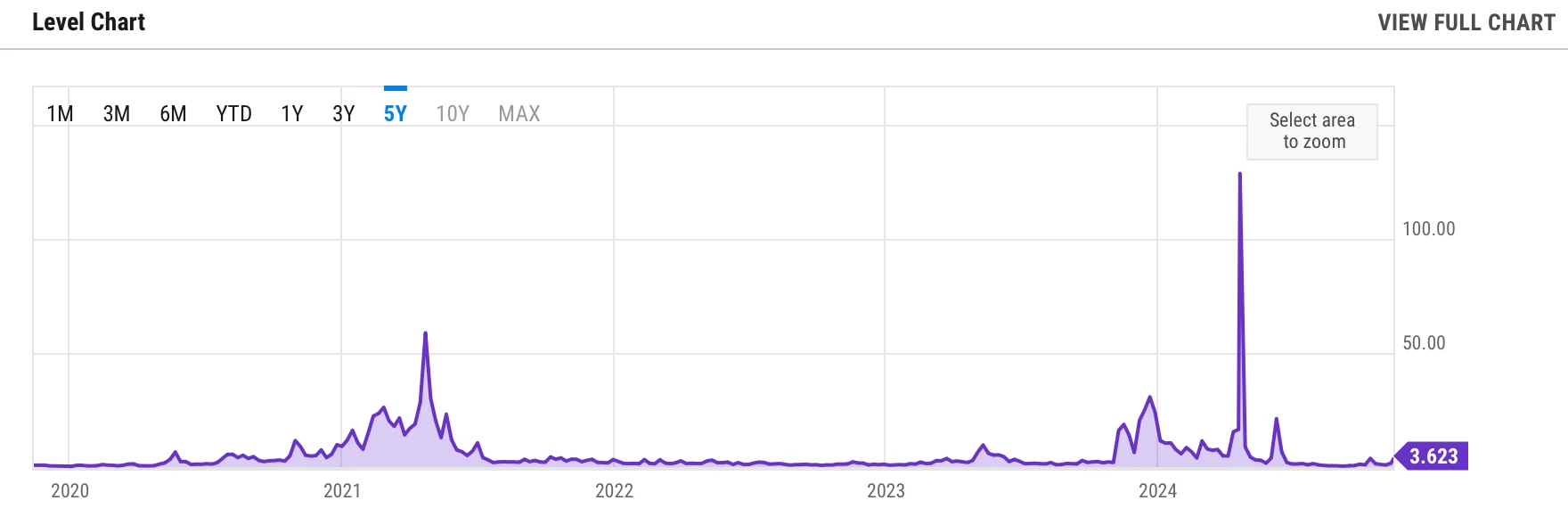

Bitcoin transactions cost an average of $3.62, a significant decrease from last year’s high of $9.27. However, during periods of heavy demand, such as in April 2024, fees can spike dramatically, reaching nearly $128 per transaction.

This volatility is tied to Bitcoin’s block size limit, which restricts how many transactions can be processed simultaneously. As a result, the network becomes prone to congestion and delays during peak usage, leading to wait times and higher user costs.

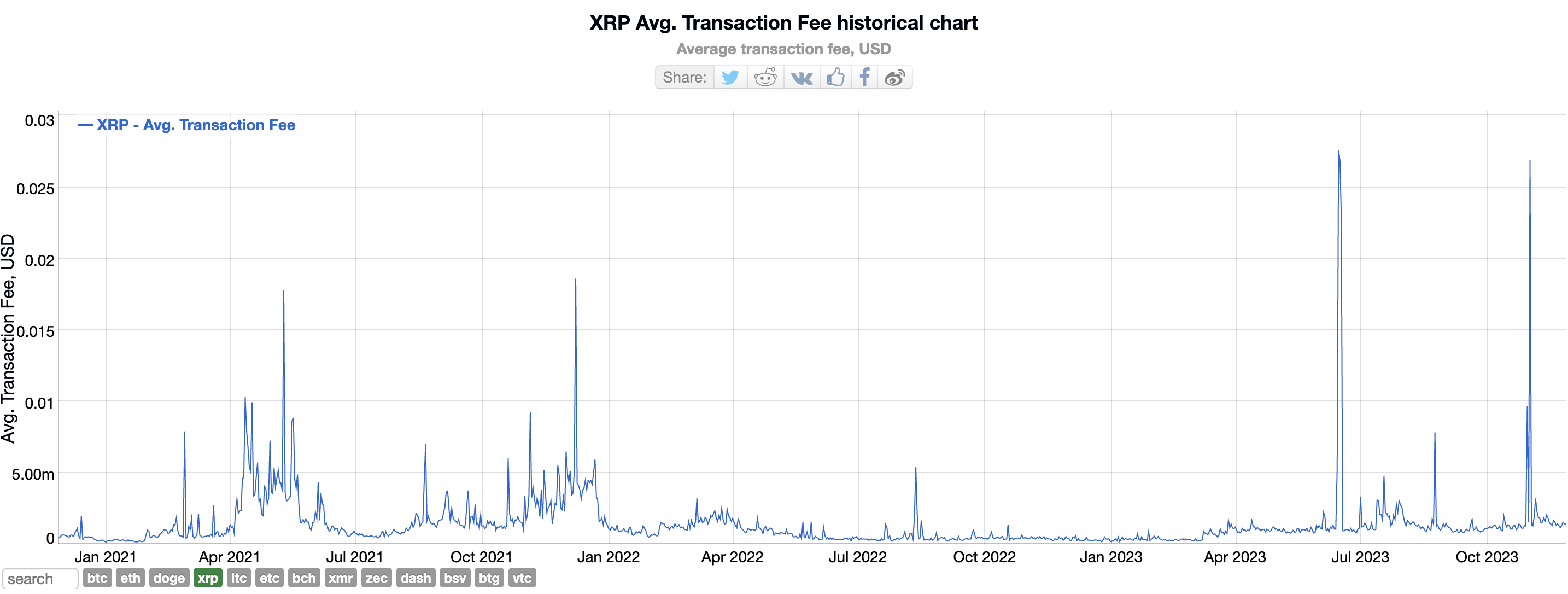

In contrast, Ripple (XRP) offers extremely low transaction fees, typically ranging from 0.00001 XRP to 0.0005 XRP. In any case, negligible amounts compared to Bitcoin. Unlike Bitcoin, Ripple’s network is designed to resist congestion, thanks to its efficient consensus mechanism, which processes transactions quickly and at consistently low costs.

While Bitcoin’s fees and performance can fluctuate significantly based on network demand, XRP remains a cost-effective and reliable option, particularly for high-frequency or cross-border transactions.

4. Programming Languages and Smart Contracts

Bitcoin utilizes Script, a simple and security-focused programming language. While limited in functionality, it supports essential features like multi-signature transactions and time-locked contracts. This deliberate simplicity reduces potential vulnerabilities, ensuring Bitcoin’s role as a secure and reliable store of value.

Bitcoin relies on the Omni Layer, a platform built on its blockchain, to create and manage custom digital assets. Omni enables advanced features like token issuance and trading, most notably used for stablecoins.

However, its adoption remains niche, focusing primarily on stablecoins rather than broader applications for tokenized assets or decentralized programs.

On the other hand, Ripple (XRP) is primarily built using C++, a language known for its speed and efficiency. Thus, the XRP Ledger is highly optimized for fast transactions. Yet, unlike platforms like Ethereum, Ripple does not natively support smart contracts.

Ripple Labs, the organization behind XRP, is actively exploring ways to introduce smart contract functionality into its ecosystem. While this development is in its early stages, it reflects Ripple’s ambition to expand beyond its core use case of efficient payments and into more advanced decentralized applications in the future.

XRP vs. Bitcoin: Market Performance

Winner: Bitcoin (BTC)

1. Market Capitalization

As of December 2024, Bitcoin (BTC) remains the clear leader in cryptocurrencies, with a market value of around $1.94 trillion. It recently reached a new all-time high, hitting $103,900 per coin. Thus, Bitcoin’s strong position comes from being the first cryptocurrency, its secure network, and its limited supply.

On the other hand, XRP, although much smaller, has been making impressive progress, especially recently. In the past month alone, it saw a 330% growth. With a market value of about $136 billion in December 2024, XRP has established itself as a major player in cross-border payments. Its fast transaction speeds, low fees, and solid partnerships with financial institutions have driven its success.

While Bitcoin’s market value is still much higher, XRP’s focus on real-world use cases and its potential for further growth could make it more valuable.

2. Price Surge vs. Adoption Rate

Bitcoin is currently priced at $99,686, while XRP traded at $2.43 on December 9, 2024, reflecting their differing roles and levels of adoption.

Bitcoin has become synonymous with financial success, and the rise of “Bitcoin billionaires” has inspired a wave of entrepreneurs and traditional investors to embrace it. Although the original Bitcoin white paper didn’t promise wealth, BTC has evolved into the most profitable store of value, continuing to attract investors as “digital gold.”

XRP, by contrast, plays a more specialized role as a bridge currency. It excels in speed and cost-efficiency for cross-border transactions, outperforming traditional fiat currencies. Thanks to Ripple’s strategic partnerships with major global banks and financial institutions, XRP leads the cross-border remittance space. Thus, the XRP ecosystem drives adoption through diverse use cases, particularly in traditional payments.

Central to its structure, Ripple’s founders were gifted 80 billion XRP, with 55 billion XRP (55% of the total supply)locked into blockchain-based escrow accounts in 2017. Ripple initially committed to releasing up to 1 billion XRP monthly into circulation over 55 months, with any unused tokens being returned to an escrow account. This mechanism helps manage supply and supports the ecosystem’s long-term growth.

Despite their distinct characteristics, BTC and XRP are heavily traded on major cryptocurrency exchanges and widely supported by wallets, highlighting their sustained popularity.

3. Trading Volume and Market Sentiment

Bitcoin (BTC) and XRP differ in how much they are traded and how people view them.

Bitcoin’s daily trading volume of $67 billion shows its huge popularity and trust, especially during uncertain economic times. It is widely seen as a safe-haven asset with a positive market sentiment driven by optimism and FOMO (fear of missing out), attracting individual and institutional investors.

XRP, on the other hand, based on the fact that the project recently saw whale activity, now exceeds $13 billion in trading volume, signaling growing confidence from large investors. Although XRP’s trading volume is smaller than Bitcoin’s, its recent surge in activity has excited investors about its potential for major price growth.

XRP’s rally has been supported by regulatory progress in Ripple’s legal battles and increased institutional accumulation, which have boosted optimism about its future.

So, Bitcoin remains dominant, trusted for its long-term investment stability and reputation as “digital gold.”Meanwhile, XRP’s newfound momentum and regulatory clarity have attracted attention, making it appealing to investors and users seeking practical transaction solutions.

Bitcoin vs XRP: Practical Uses

Winner: Ripple (XRP)

Bitcoin and XRP have their strengths, but when it comes to everyday, practical use, XRP takes the lead. Here’s why:

1. Fast Global Payments

XRP was designed to make sending money across borders quick and easy. With XRP, transactions are almost instant and have lower fees than Bitcoin. This makes it a great option for banks, businesses, and even regular people who need to send money anywhere in the world.

2. Multiple Tokens

Unlike Bitcoin, which is limited to processing transactions in its native cryptocurrency, the XRP Ledger is built for versatility.

XRP Ledger accounts can tokenize almost any asset, including other cryptocurrencies, stablecoins, and utility tokens. This makes it a powerful platform for creating and transferring digital assets beyond XRP and more versatile than Bitcoin accounts.

3. Helping Banks with Liquidity

XRP works as a bridge currency, helping financial institutions exchange different currencies more smoothly. By using XRP, banks can speed up their operations and reduce the time it takes to settle payments.

Though not explicitly designed for liquidity management, Bitcoin is increasingly being held by some banks and institutions as a reserve asset, recognizing its potential role in diversifying liquidity strategies.

4. Micropayments

Because XRP has such low fees, it’s perfect for small, frequent transactions—like tipping creators online, buying in-game items, or other things that wouldn’t make sense with higher transaction costs.

So, while Bitcoin shines as a way to store value and act as a decentralized digital currency, XRP’s focus on solving real-world problems, especially in global payments and liquidity, gives it an edge regarding practical uses.

XRP vs. Bitcoin: Short and Long-Term Perspectives

If you’re desperately searching for the best crypto to buy right now, read on to learn what cryptocurrency experts are advising.

Bitcoin continues to lead the cryptocurrency market, demonstrating significant growth potential driven by factors such as the recent halving event, increased interest in Spot Bitcoin ETFs, the involvement of Bitcoin whales, and external influences like Trump’s U.S. presidency win. However, despite these positive developments, Bitcoin faces hurdles, including market volatility, tightening global regulations, and competition from other investment opportunities.

From a short-term perspective, Bitcoin’s outlook has already shifted, as it has broken through the psychological $100,000 threshold. If demand remains strong and institutional players continue to invest, Bitcoin could see its price reach approximately $120,000 by 2025.

Looking further into the future (2030 and beyond), Bitcoin has the potential to solidify its status as “digital gold,” valued for its limited supply and independence from central banks. If more individuals and businesses adopt it to hedge against inflation and economic instability, its price could surge to $500,000 or even higher. Ultimately, Bitcoin’s future hinges on navigating ongoing challenges and maintaining its dominance in the cryptocurrency space.

Regarding XRP, recent technical indicators show a bullish trend, with the 50-day and 200-day moving averages sloping upward, suggesting sustained positive momentum. This optimism is driven largely by the expected resolution of Ripple’s legal battle with the SEC, a development anticipated to restore investor confidence and encourage institutional adoption.

Before December 2024, based on market conditions, many experts predicted that XRP would gradually rise to $2.50 by 2025.

But now that Bitcoin has already surpassed the $100,000 milestone, it has set a strong precedent for altcoins. Following this trend, XRP could exceed conservative predictions of a maximum of $3, possibly reaching $10 or more, especially as adoption by financial institutions accelerates.

Beyond 2030, XRP could see its price climb to $100 or more as it solidifies its role in global finance. Analysts believe that if XRP achieves widespread adoption for trade settlements and inflation hedging in unstable economies, its value could soar even higher.

With continued innovation and expansion into decentralized finance ecosystems, XRP could eventually rival Bitcoin’s status as a cornerstone of the crypto market, potentially reaching $500 in a scenario where global adoption accelerates dramatically.

Disclaimer. This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks due to high volatility. Always perform in-depth research or consult a financial advisor before investing.

Where Are They Heading?

From this moment to the future, Bitcoin is set to continue its journey as “digital gold,” a go-to choice for people and institutions looking to protect their money in uncertain times. It has become a trusted store of value, and its role as a hedge against inflation and economic instability keeps attracting more investors.

Solutions like the Lightning Network are being developed to address Bitcoin’s speed and cost issues and make transactions faster and cheaper. However, Bitcoin remains focused on security and decentralization rather than being a tool for everyday payments.

As more big companies and financial institutions include Bitcoin in their plans, its future looks bright. Its success depends on how well it can adapt to new rules and continue to prove itself a reliable long-term investment. Conversely, Ripple is focused on being the top choice for fast and low-cost international payments.

Its recent partial win against the SEC has eased worries about legal troubles and boosted investor confidence. This could lead to more banks and companies using XRP as a bridge currency to move money across borders.

Ripple is also working on adding more features, like smart contracts, to make its network even more useful. The company is preparing to launch its regulated stablecoin, RLUSD, which could open up more growth opportunities.

However, Ripple faces competition from government-backed systems like FedNow, which aim to do similar things. Ripple’s future will depend on its ability to stay ahead by partnering with more banks and improving its technology.

FAQs

What are the key differences between Bitcoin vs. XRP?

Bitcoin is a public, decentralized cryptocurrency based on a proof-of-work algorithm, while XRP is privately owned and uses a consensus protocol. Bitcoin processes about 7 transactions per second with an average cost of $3.62 and a speed of 10 minutes per transaction. In contrast, XRP handles up to 38 transactions per second, with a much lower cost of $0.0002 and a 3-5 seconds speed.

Why is Bitcoin considered more decentralized than XRP?

Bitcoin’s network relies on thousands of independent miners and nodes worldwide, ensuring decentralization. XRP, while decentralized in validator nodes, is influenced more heavily by Ripple Labs, which raises questions about its level of decentralization.

How are new tokens or coins minted for Bitcoin and Ripple?

For Bitcoin, new coins are minted through mining. Miners use the proof-of-work algorithm to solve puzzles and are rewarded with new coins. The total supply is capped at 21 million. In contrast, Ripple doesn’t use mining. XRP’s supply was pre-mined with 100 billion tokens, and Ripple Labs gradually releases new tokens from escrow, typically at 1 billion per month.

Final Thoughts

So, while Bitcoin and XRP are significant players in the crypto market, they serve different purposes and cater to distinct use cases.

Bitcoin remains the leading digital store of value, often viewed as “digital gold,” and continues to attract investors seeking long-term security. On the other hand, XRP is positioned as a practical solution for fast, low-cost cross-border payments, gaining traction among financial institutions.

When considering a currency pair, Bitcoin and XRP offer unique opportunities for investors and traders, depending on their preferences and market conditions. Each has its strengths, making it an important option in the broader cryptocurrency market.