Arbitrum Bridge Guide (2026)

Transfer ETH and Tokens to Arbitrum Layer-2 Transferring assets on Ethereum often involves high gas fees and long confirmation times. This remains a significant obstacle for users who want faster, cheaper, and more scalable blockchain interactions. These limitations slow down access to efficient Layer-2 environments and create uncertainty when users attempt to move tokens between […]

Transfer ETH and Tokens to Arbitrum Layer-2

Transferring assets on Ethereum often involves high gas fees and long confirmation times. This remains a significant obstacle for users who want faster, cheaper, and more scalable blockchain interactions.

These limitations slow down access to efficient Layer-2 environments and create uncertainty when users attempt to move tokens between networks. Without a clear, trusted way to bridge assets, users risk delays, failed transactions, or unnecessary costs.

To address this, we examine how the Arbitrum bridge facilitates direct Ethereum-to-Arbitrum transfers with enhanced speed and lower fees. You can access the official Arbitrum Bridge now and follow the step-by-step quickstart guide below.

What is Arbitrum and the Arbitrum Bridge?

Arbitrum is a Layer-2 network that uses optimistic rollups to process transactions off the Ethereum base layer. It aggregates multiple transactions into a batch and then submits that batch to Ethereum. This reduces congestion and transaction fees while retaining compatibility with Ethereum-based smart contracts.

Arbitrum is used extensively across DeFi, gaming, and infrastructure protocols. It supports general-purpose applications and is widely supported across major dApps and tooling.

There are two chains within the Arbitrum ecosystem:

- Arbitrum One: General-purpose Layer-2 network;

- Arbitrum Nova: Optimized for high-throughput use cases like gaming and social apps.

The Arbitrum bridge is a web-based tool allowing users to move assets between Ethereum and Arbitrum. It supports:

- Deposits from Ethereum to Arbitrum (Layer-1 to Layer-2);

- Withdrawals from Arbitrum to Ethereum (Layer-2 to Layer-1).

Transfers are processed via smart contracts developed and maintained by the Arbitrum team. The bridge interface is simple, secure, and directly integrated into the Arbitrum ecosystem.

By bridging assets to Arbitrum, users gain access to a lower-cost environment while relying on Ethereum’s base-layer security.

Why Use the Official Arbitrum Bridge?

The official bridge is built and maintained by Offchain Labs, the creators of Arbitrum. Its key advantages include:

- Direct integration with Ethereum and Arbitrum rollup contracts;

- Security inherited from Ethereum;

- No intermediary tokens or custodial risk;

- Clean interface with accurate fee estimates;

- Compatibility with leading wallets and explorers.

There are no additional fees beyond standard Ethereum gas costs when using the official bridge.

How to Bridge from Ethereum to Arbitrum Using the Official Arbitrum Bridge

Bridging assets using the Arbitrum bridge allows users to benefit from reduced transaction fees, faster settlement times, and improved scalability, while maintaining Ethereum-level security. Follow these steps to transfer ETH or ERC-20 tokens to Arbitrum One or Arbitrum Nova.

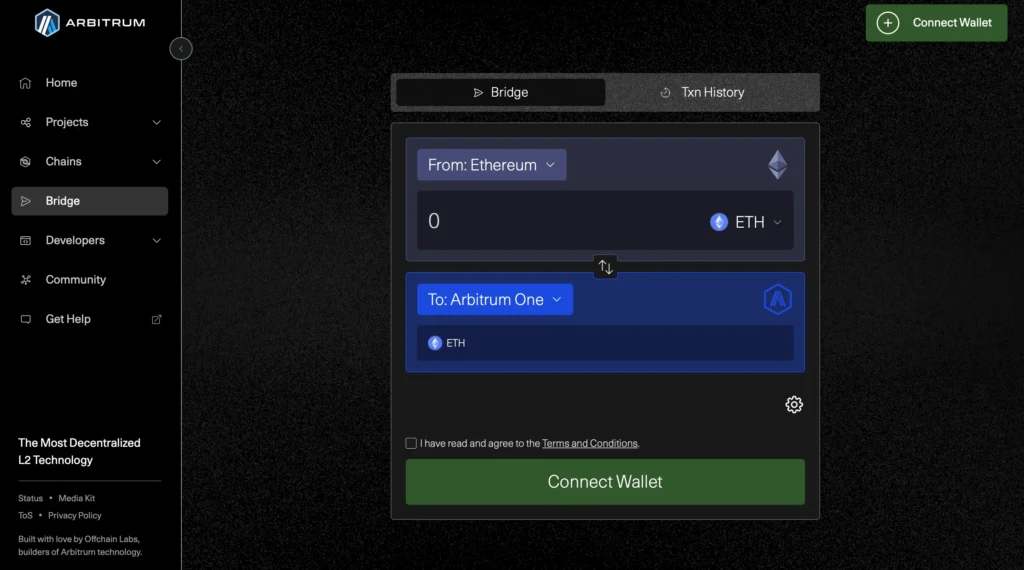

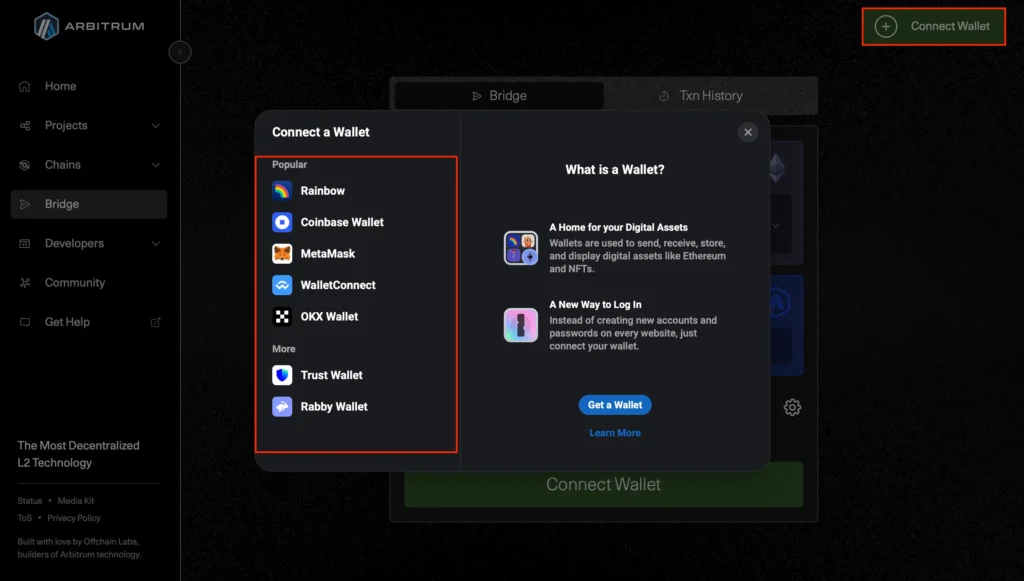

Step 1. Connect Your Wallet

Visit bridge.arbitrum.io to begin. Click “Connect Wallet” to authorize your session. The official bridge supports all major Ethereum-compatible wallets:

- MetaMask;

- Coinbase Wallet;

- Trust Wallet;

- WalletConnect-compatible mobile wallets;

- Ledger, Trezor (via MetaMask interface).

You must add the Arbitrum network to your wallet before use. For MetaMask, this can be done automatically during the bridging process or manually via RPC configuration. Thus, ensure your wallet is switched to the Ethereum Mainnet as the source network for the initial bridge operation. A proper wallet connection is required to bridge assets securely and efficiently.

Before bridging USDT to Arbitrum, make sure it’s properly added to your wallet. This step-by-step guide on how to add USDT to MetaMask walks you through the setup.

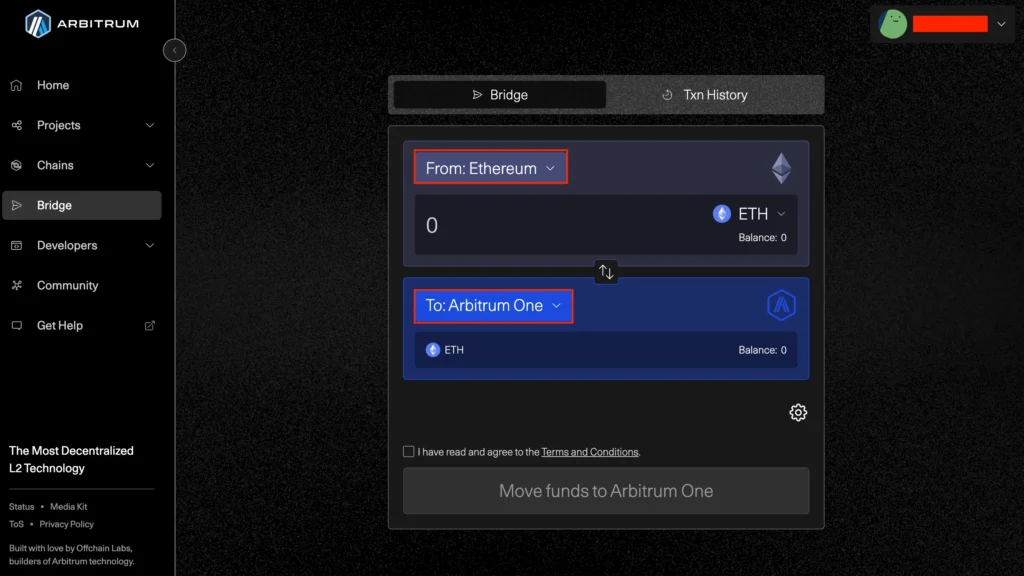

Step 2. Select Source and Destination Chains

Set the source network to Ethereum, and select Arbitrum One or Arbitrum Nova as the destination chain, depending on your intended use case.

This action initializes the bridge transaction and prepares the network routing. For developers, this step ensures contract compatibility and the rollup’s optimistic verification model.

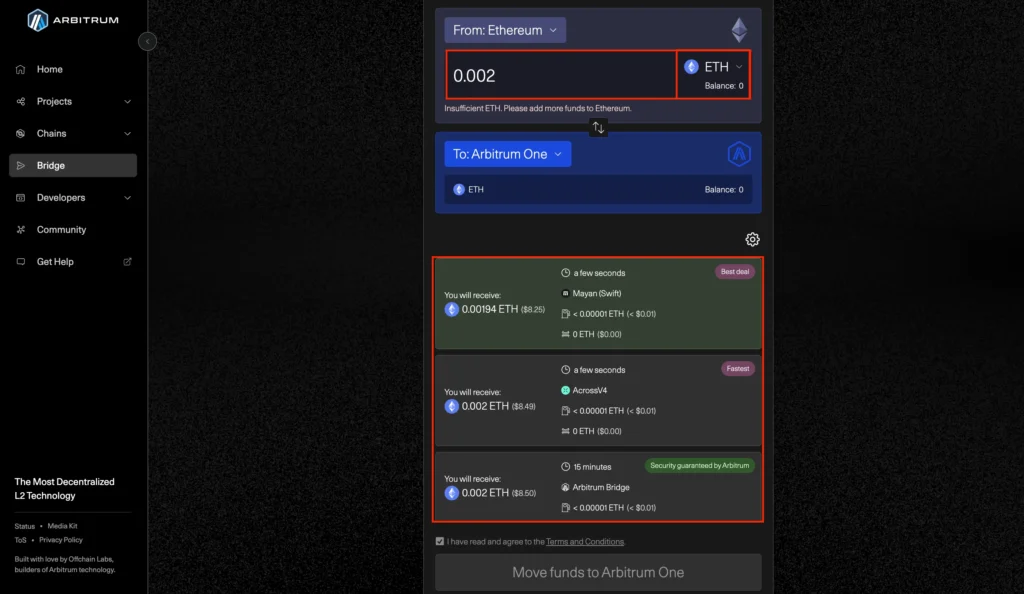

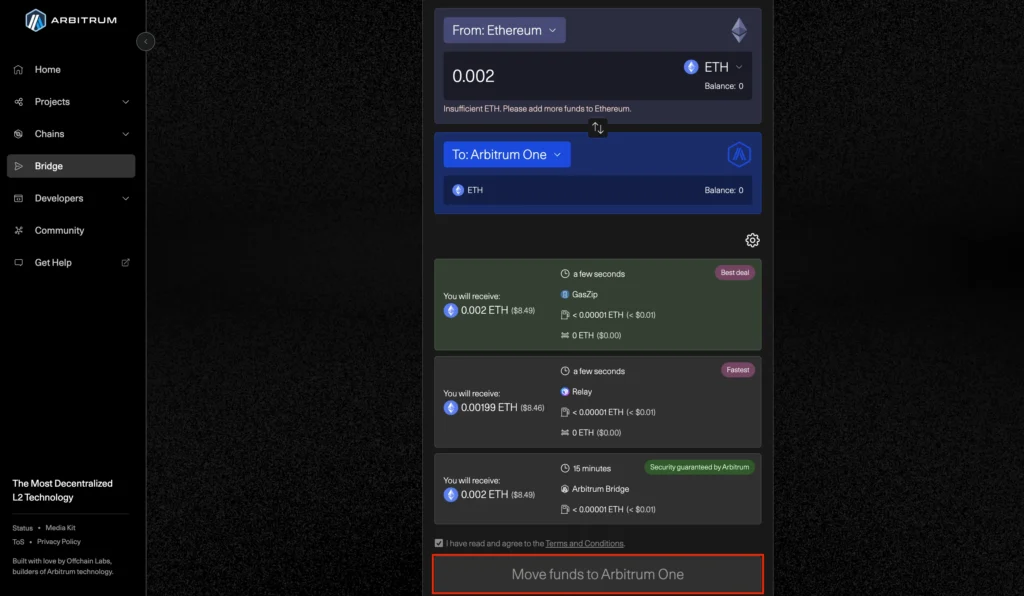

Step 3. Choose the Token, Enter the Amount, and Select the Route

From the dropdown, choose the token you want to transfer (for example, ETH, USDC, or DAI). Enter the amount to bridge and select the route. The interface will automatically calculate:

- The estimated gas fee;

- The total cost in ETH;

- The receiving balance on Arbitrum will be after the bridge is complete.

Ensure your wallet contains enough ETH to cover the transfer and network costs.

Step 4. Submit the Bridge Transaction and Confirm Asset Arrival on Arbitrum

Click “Move funds to Arbitrum” to initiate the process. Your wallet will request confirmation to submit the transaction and pay the associated gas fee.

This transfer request is sent to Ethereum’s Layer-1, where the Arbitrum smart contracts process it. These contracts handle batching, rollup processing, and state synchronization with Arbitrum’s Layer-2 infrastructure.

The bridge operation usually completes within 5–15 minutes, depending on Ethereum network congestion. Once the transaction is finalized, the bridged assets (including ETH or ERC-20 tokens) will be visible in your Arbitrum wallet.

Users can review the transaction on Arbiscan or use wallet-integrated explorers to verify the transfer status. Switch your wallet’s network to Arbitrum One or Nova to view updated balances.

Withdrawing Assets from Arbitrum to Ethereum

The Arbitrum Bridge also supports asset withdrawals, or better say, bridging from Arbitrum back to Ethereum. Follow these steps to complete the process:

- Visit bridge.arbitrum.io;

- Connect your wallet and switch to the Arbitrum network;

- Select “Arbitrum One” or “Nova” as the source chain;

- Choose “Ethereum” as the destination;

- Select the token and input the withdrawal amount;

- Confirm and submit the transaction.

Note: Withdrawing assets from Arbitrum involves a 7-day challenge period. This waiting time is part of the optimistic rollup technology used for verifying withdrawals securely. After the delay ends, users must return to the bridge interface to claim and finalize the transfer on Ethereum. This process ensures interoperability between layers while preventing fraud and unauthorized changes to transaction state.

Alternatives to the Official Arbitrum Bridge

All alternative Arbitrum bridge solutions follow the same general process as the official interface:

- Connect your wallet;

- Select the source and destination networks;

- Choose the token and amount;

- Submit the transaction and pay the gas fee;

- Wait for confirmation and verify receipt.

These third-party bridges simplify specific use cases (such as faster ETH withdrawals, reduced transaction fees, or support for non-Ethereum source chains), but the transfer flow remains consistent.

Below are the most commonly used Arbitrum-compatible bridges:

| Bridge Platform | Chains, Assets & Features |

|---|---|

| Hop Protocol | Chains: Ethereum Mainnet, Arbitrum One, Arbitrum Nova, Optimism, Polygon, Gnosis Chain, Base, Linea Assets: ETH, USDC, USDT, DAI, MATIC, HOP, hToken variants (e.g., hETH, hUSDC) Features: Uses hTokens and AMM-based liquidity pools; bonding system for near-instant transfers; 24-hour fraud challenge period; optimized for L1↔L2 and L2↔L2 movement |

| Across Protocol | Chains: Ethereum, Arbitrum, Optimism, Polygon, zkSync Era, Base, etc. Assets: ETH, USDC, DAI, WBTC, and various stablecoins Features: Liquidity pool and relayer model; designed for fast, low-cost transfers; emphasizes gas efficiency and minimal slippage for L2 interoperability |

| Stargate Finance | Chains: Ethereum, Arbitrum, BNB Chain, Avalanche, Polygon, Optimism, Fantom, Metis, Base, Linea, Mantle, zkSync Era, Sei, and more. Assets: ETH, BNB, USDC, USDT, DAI, FRAX, STG, and other native tokens Features: Built on LayerZero protocol; native asset bridging without wrapping; unified liquidity pools; includes staking, yield farming, and governance functionality |

| Synapse | Chains: Ethereum, Arbitrum, Optimism, BNB Chain, Polygon, Avalanche, Fantom, Base, Harmony, Boba, Moonbeam, Moonriver, Aurora, and more Assets: ETH, USDC, USDT, SYN, wrapped assets, LP tokens Features: Supports both canonical and liquidity-based bridging; includes cross-chain stable swaps; optimized for wide multi-chain interoperability |

Security Guidelines for Using the Arbitrum Bridge

To ensure safe bridging:

- Use the verified URL: https://bridge.arbitrum.io;

- Bookmark the official site to avoid phishing;

- Connect wallets only on trusted devices and networks;

- Confirm all transaction details before approval;

- Cross-check token contract addresses before bridging non-standard assets;

- Avoid bridging during peak volatility without prior planning;

- Never input private keys or seed phrases into any bridge interface. The official bridge does not request them.

FAQ

The official Arbitrum bridge URL is https://bridge.arbitrum.io.

Yes. It is developed and maintained by Offchain Labs, using Ethereum smart contracts. Always verify you are using the official site.

Most deposits finalize within 5–15 minutes. Delays may occur during periods of Ethereum network congestion.

Yes. The bridge supports various ERC-20 tokens, including USDC, DAI, LINK, WBTC, and others.

Initiate the withdrawal on the same interface. Wait 7 days, then return to claim the funds on Ethereum. Use fast bridges to avoid delays.

Conclusion

The Arbitrum bridge is the most reliable method to transfer assets between Ethereum and Arbitrum. It is directly integrated into the Arbitrum protocol, secure by design, and accessible with most Ethereum wallets.

Users benefit from lower transaction costs, faster execution, and a seamless transition into the Arbitrum ecosystem. When speed is critical or when bridging from other chains, consider using vetted third-party alternatives.

And if you’re xpanding to multiple ecosystems, here’s our guide on staking MATIC (POL).