The Complete Ethereum vs. Bitcoin Guide

Let’s be real: there is a longstanding but silent battle between Ethereum vs. Bitcoin since both played major roles in shaping the world of cryptocurrency, each with its unique vision. The two leading cryptocurrencies are often compared, but understanding their differences can be difficult. In this article, we’ll discuss the key differences between Ethereum and Bitcoin: what they do, how they work, […]

Let’s be real: there is a longstanding but silent battle between Ethereum vs. Bitcoin since both played major roles in shaping the world of cryptocurrency, each with its unique vision. The two leading cryptocurrencies are often compared, but understanding their differences can be difficult.

In this article, we’ll discuss the key differences between Ethereum and Bitcoin: what they do, how they work, and what their native cryptocurrencies are all about.

We’ll also examine how they relate to traditional fiat currency and what sets them apart in today’s crypto industry. Whether you’re trying to understand the tech behind them or determine which one might be a better investment, we’ve got you covered.

Disclaimer: While we aim to provide helpful information, please do your own research before making any investment choices.

Key Difference Between Bitcoin and Ethereum

| Criterion | Bitcoin | Ethereum (ETH) |

| Price (at the time of writing) | $87,502.25 | $3,167 |

| Market Cap (at the time of writing) | $1,736,620,711,430 | $381,638,452,029 |

| Circulating Supply (at the time of writing) | 19,781,609 BTC | 120,423,804 ETH |

| Max Supply | 21,000,000 BTC | ∞ |

| Blockchain | Bitcoin | Ethereum blockchain |

| Consensus Mechanism | Proof of Work (PoW) | Proof of Stake (PoS) |

| Block Reward | 3.125 BTC | N/A |

| Cryptographic Algorithm | SHA-256 | SHA-256 |

| Token Utility | Store of value, medium of exchange | Governance, fees, staking rewards, collateral for DeFi, and NFT minting |

| Founders | Satoshi Nakamoto | Vitalik Buterin |

| Launch Date | 2009 | 2015 |

| Supporting Exchanges | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. |

| Communities | Reddit X (Twitter) BitcoinTalk Forum Bitcoin Conferences And Events | Reddit Discord X (Twitter) YouTube |

Understanding the Genesis of Bitcoin vs. Ethereum

Bitcoin, created in 2009 by the anonymous Satoshi Nakamoto, was the first cryptocurrency. It emerged as trust in banks and traditional systems waned after the 2008 financial crisis. Satoshi’s vision was a secure, scarce, government-free digital currency without intermediaries.

Bitcoin introduced a peer-to-peer cash system, allowing people to store and send value without banks. Its rarity and security earned it the nickname “digital gold.”

In 2015, Vitalik Buterin launched Ethereum with a different goal: to create a platform for developers to build decentralized apps. This led to smart contracts—self-executing programs that power decentralized finance (DeFi), NFTs, and apps without reliance on big tech.

Ethereum vs. Bitcoin: Technical Comparison

Winner: Ethereum

1. Blockchain and Consensus Mechanisms

Bitcoin and Ethereum use public blockchains, but Ethereum’s blockchain is more versatile, enabling smart contracts and decentralized applications.

Bitcoin employs a Proof-of-Work (PoW) consensus mechanism. In PoW, miners compete to solve complex mathematical problems using computational power. The first miner to solve the puzzle adds a new block to the blockchain and is rewarded with a newly minted Bitcoin. This process ensures the security and integrity of the network.

On the other hand, Ethereum initially used a PoW mechanism, similar to Bitcoin. However, it has transitioned to a Proof-of-Stake (PoS) mechanism. In PoS, validators stake ETH to participate in securing the network. Instead of mining, validators verify blocks and are rewarded with transaction fees and newly minted ETH.

This shift to PoS has significantly reduced Ethereum’s consumption, making it 99.95% more energy efficient.

2. Scalability and Network Throughput

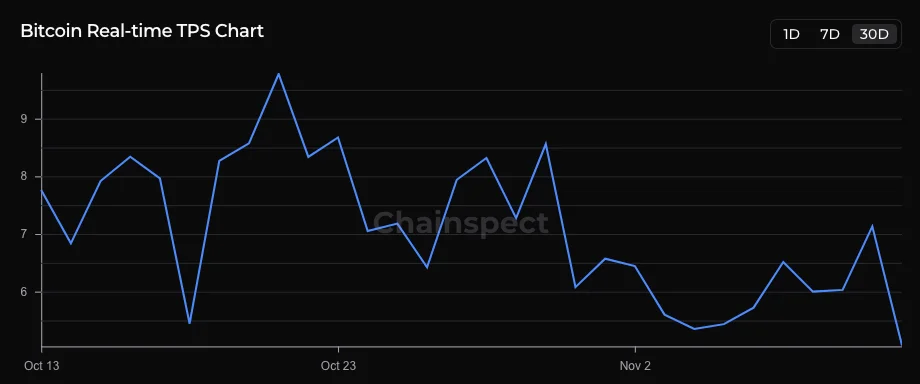

Bitcoin’s network has always struggled with scalability due to limits in its block size and relatively slow transaction speeds.

Currently, Bitcoin can only process around 7 transactions per second (TPS). This limitation means the network can get congested during high-demand periods, leading to slower processing times and higher transaction fees for users.

Although there have been ideas to improve scalability—like increasing block sizes, using layer-2 solutions, or even implementing the Lightning Network—the main Bitcoin protocol has stayed pretty much the same, keeping the TPS low.

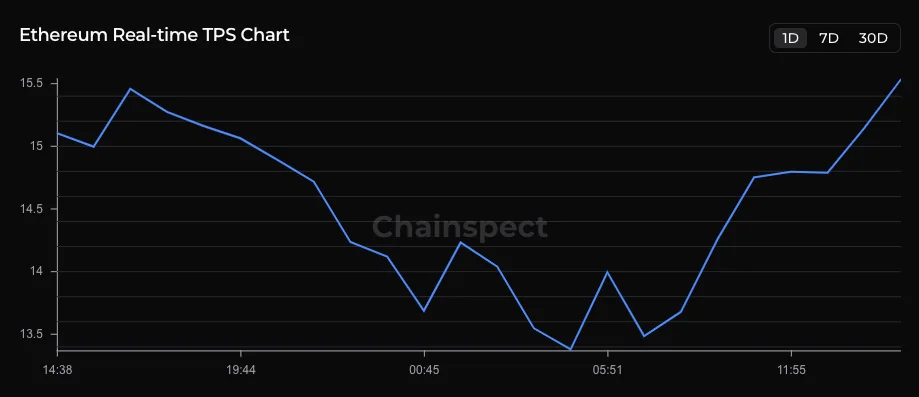

Ethereum also faces challenges with scalability, especially during peak times when there’s a lot of network activity. However, Ethereum has seen major improvements over the last few years. The network transitioned to Proof-of-Stake (PoS) and added layer-2 solutions like rollups, which have greatly boosted its scalability.

As of November 2024, Ethereum’s network can handle around 15 TPS—more than Bitcoin but still far from the 100,000 TPS target it aims for in the long run. While Ethereum’s current capacity is a big step up, it still needs further advancements to support widespread use and handle high volumes at scale.

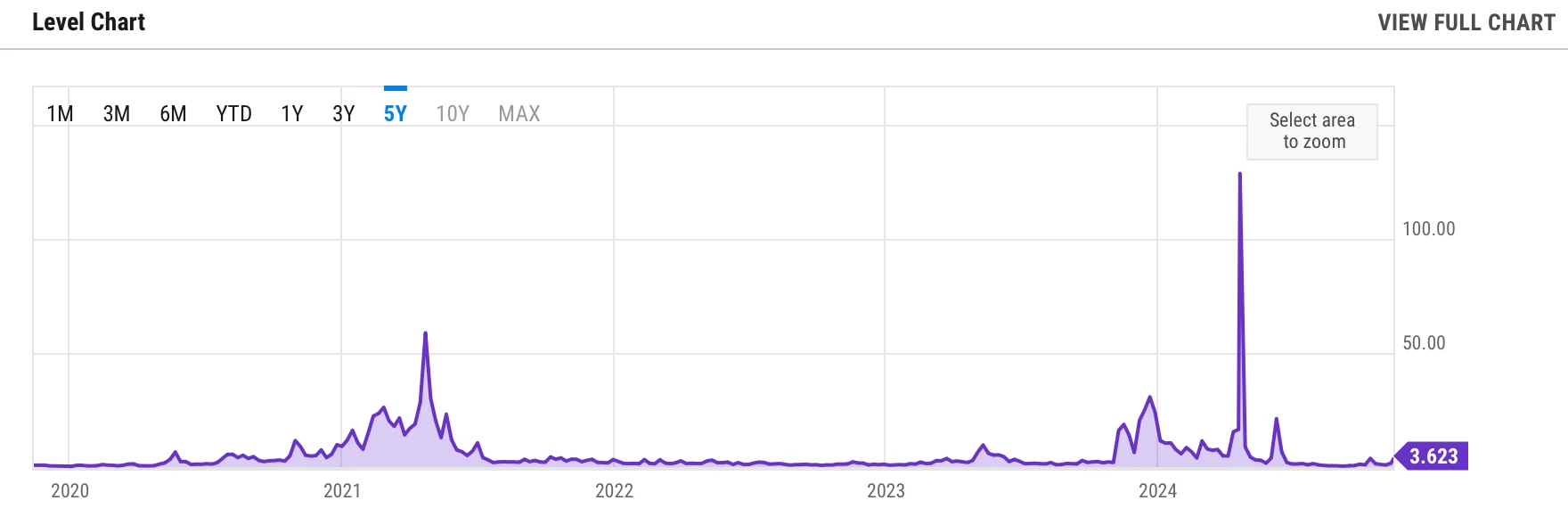

3. Transaction Costs and Network Congestion

Bitcoin transactions currently average around $3.62, which is lower than last year’s $9.27. However, during high congestion, like in April 2024, fees can skyrocket—reaching almost $128 per transaction. This network congestion usually means slower transaction times and higher costs for users.

Bitcoin’s block size limit plays a big role here; while it’s good for security, it does restrict how many transactions the network can handle at once, making it more prone to congestion when demand spikes.

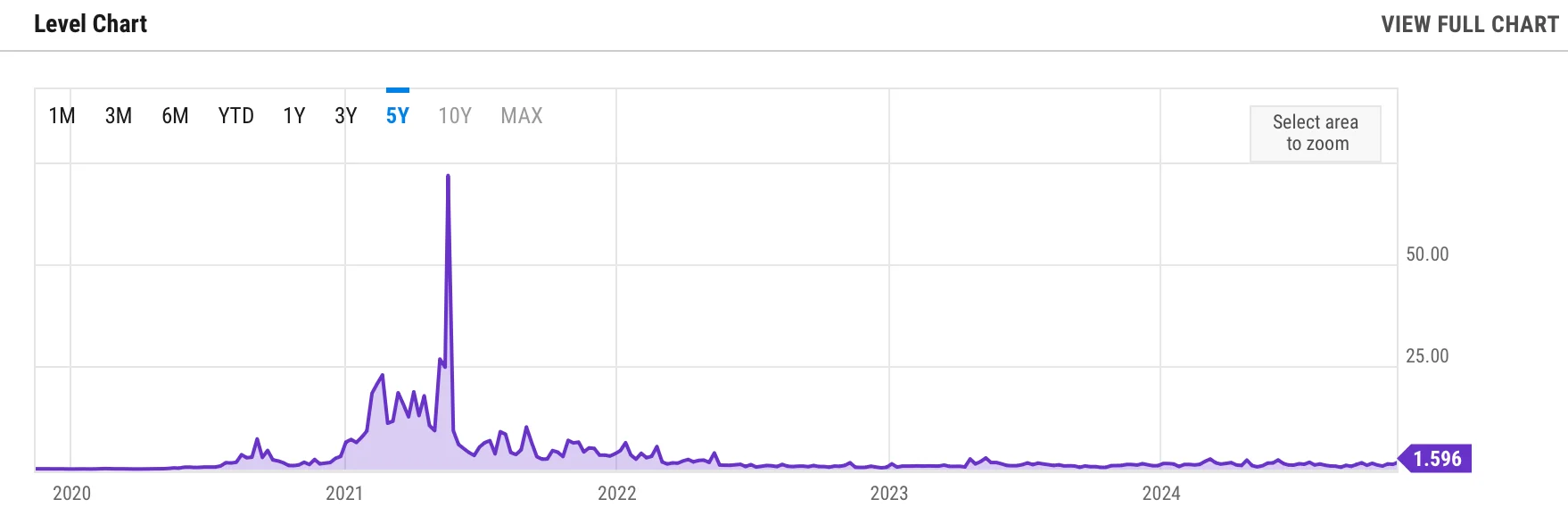

Ethereum’s transaction costs, known as “gas fees,” vary widely depending on how busy the network is. Right now, the average fee for an Ethereum transaction is around $1.60. This is fairly reasonable compared to past highs—like in May 2021, when fees spiked to around $3 or more.

Congestion has been a common issue on the Ethereum network, especially during periods of intense usage, leading to delays and higher fees. To help manage this, Ethereum has implemented several upgrades, including layer-2 solutions like Arbitrum, Optimism, and zk-Rollups.

So, Ethereum’s gas fees are currently lower on average than Bitcoin’s, making Ethereum a more affordable transaction option.

4. Programming Languages and Smart Contracts

Bitcoin has its own programming language, Script, which is simple and focused. It allows for basic functions like multi-signature transactions and time-locked contracts, but it’s pretty limited in its capabilities.

Script was designed with security and simplicity in mind, so it doesn’t support the more complex, flexible smart contracts you’ll find on Ethereum.

On the other side, Ethereum introduced smart contracts. This innovation opened the door for various decentralized applications (dApps), from DeFi protocols and NFT marketplaces to gaming platforms.

Ethereum’s smart contracts are mostly written in Solidity, a language designed specifically for the Ethereum Virtual Machine (EVM). Solidity has a syntax similar to C++ and JavaScript, so it’s easier for developers to learn and start building on the platform.

With this more versatile programming setup, Ethereum has become the go-to choice for building complex, decentralized applications.

5. DeFi and NFT Capabilities

Bitcoin’s blockchain wasn’t designed with NFTs in mind, so it can be challenging to create NFTs directly on it. However, new developments like the Ordinals protocol have made NFTs on Bitcoin possible.

Ordinals use a system that assigns a unique number to each satoshi (the smallest unit of Bitcoin), allowing it to be tracked and verified even if it moves to another wallet. Though Ordinals have brought Bitcoin into the NFT world, it’s still not as advanced or NFT-friendly as Ethereum.

Layer-2 solutions like Stacks, RSK, and Liquid Network have been introduced to make NFT creation more practical on Bitcoin. These layers add smart contract and NFT capabilities to Bitcoin’s base layer, allowing NFTs to be created and traded at lower costs. Despite these developments, Bitcoin only holds about 12% of the NFT market, and awareness about Bitcoin NFTs like Ordinals remains limited.

When it comes to DeFi, Bitcoin also has its limitations. Unlike Ethereum, Bitcoin’s blockchain lacks built-in smart contract functionality, which limits its role in the DeFi space.

However, Ethereum is considered a leader in DeFi and NFTs. Its early adoption of smart contracts in 2015 laid the groundwork for decentralized finance and the explosion of NFTs.

Today, Ethereum supports over 4,800 decentralized applications (dApps) with a robust user base and significant value locked in DeFi projects. Major DeFi protocols like Uniswap, MakerDAO, and Compound have become foundational to DeFi on Ethereum, driving innovation in lending, borrowing, and trading.

Ethereum dominates the NFT space, with around 80% of the market. Platforms like OpenSea, Rarible, and Nifty Gateway make Ethereum a vibrant hub for NFTs, providing a large network of buyers and sellers.

Despite the often high transaction fees, Ethereum’s established ecosystem and user base make it a top choice for artists and collectors.

ETH vs. BTC: Market Performance

Winner: Bitcoin

1. Market Capitalization

Bitcoin and Ethereum are still the two biggest digital assets in market value. As of November 12, 2024, Bitcoin has a market cap of about $1.7 trillion, making it the largest by far. Ethereum is in second place, with a market cap of around $395 billion.

Bitcoin’s dominance comes from being the first and most well-known cryptocurrency. Its strong reputation, limited supply, and decentralized nature have all helped keep its popularity and high value.

On the other hand, Ethereum has gained much attention because of its innovative technology. It supports smart contracts and decentralized apps (dApps), which has helped create a growing ecosystem of DeFi projects and other blockchain-based applications, boosting its market value.

2. Supply and Price Action

Bitcoin and Ethereum have distinct supply mechanisms and price behaviors.

Bitcoin has a hard cap of 21 million coins (finite supply), making it a deflationary asset. This fixed supply contributes to its value proposition as a store of value. As Bitcoin’s supply approaches its limit, the scarcity of new coins can potentially drive its price higher.

Ethereum’s supply is not fixed. While Ethereum 2.0 introduced a mechanism to burn ETH, its supply can still increase, especially during periods of high network activity. However, the burning mechanism can offset some of this inflationary pressure.

Bitcoin’s price action has been characterized by significant volatility and long-term upward trends. Network adoption, regulatory developments, and macroeconomic events have historically influenced its price. As of November 12, 2024, Bitcoin’s price hovers around $87,396.

Ethereum’s price has also experienced considerable volatility, but its price action is often tied to the growth and development of its ecosystem, particularly DeFi and dApps. As of November 12, 2024, Ethereum’s price fluctuates around $3,284.

3. Trading Volume and Market Sentiment

Bitcoin and Ethereum continue to dominate the crypto market, and their trading volumes show the interest they’re generating.

As of November 12, 2024, Bitcoin’s daily trading volume is a massive $118 billion, while Ethereum, often right behind, sees $53.5 billion in trades in a single day. Aside from others, Donald Trump’s return to the U.S. presidency is a big driver of Bitcoin’s recent growth in trading activity. His win has spiked interest in Bitcoin, as many investors see it as a hedge against potential economic shifts under his policies.

Moreso, Trump’s victory has added fuel to the already positive sentiment surrounding Bitcoin, making retail and institutional investors more confident and, in some cases, even a little greedy as they rush to buy more and drive up the price.

Ethereum also benefits from this overall market excitement, even though its appeal is slightly different.

With its role in powering decentralized apps (dApps) and DeFi projects, Ethereum has become essential for new tech developments in the blockchain world. This strong use case keeps its demand steady, giving Ethereum a daily trading volume of $53.5 billion and solidifying its position after Bitcoin and Tether.

Market sentiment is generally very positive, leaning toward an aggressive or “greedy” attitude as investors scramble to take advantage of the upward trend in Bitcoin and Ethereum.

Bitcoin’s current popularity boost is mainly driven by optimism and some FOMO (fear of missing out), while Ethereum keeps attracting attention for its technology and real-world applications. The entire crypto market is buzzing right now, with Bitcoin and Ethereum at the center of the action.

Ethereum vs. Bitcoin: Practical Uses

Winner: Ethereum

When it comes to practical uses, there isn’t as much to say about Bitcoin compared to Ethereum. That’s because Ethereum can do what Bitcoin does—and much more. This makes sense, considering that Bitcoin was the first digital currency, while Ethereum came along six years later with additional core features (and is also in ongoing development to improve).

First, we’ll go over the practical uses that both Bitcoin and Ethereum networks have in common. Then, we’ll highlight the areas where Ethereum has a clear advantage regarding use cases.

1. Store of Value

Bitcoin is widely viewed as “digital gold,” and its core utility lies in serving as a store of value. With a fixed supply and decentralized structure, Bitcoin has become a sought-after asset for long-term investment, protecting against inflation and currency devaluation.

While also usable as a store of value, Ethereum primarily serves a different purpose. Its main strength lies in its ability to facilitate smart contracts and power decentralized applications (dApps), making it more versatile than Bitcoin but with a different focus.

2. Payments

Bitcoin can be used for payments, yet its relatively slow transaction speeds and high fees make it impractical for small, everyday transactions. It is more commonly used for larger, infrequent transactions or cross-border transfers where security and decentralization are prioritized over speed and cost.

Similarly, Ethereum’s transaction fees and speeds can limit its practicality as a payment method for routine transactions, but compared with Bitcoin, it’s a much better option.

It is generally more adaptable for peer-to-peer payments and scenarios that leverage smart contracts, offering unique benefits for specific payment needs within decentralized ecosystems.

3. Practical Advantages of Ethereum vs. Bitcoin

- Smart Contracts & dApps – Ethereum pioneered smart contracts and remains the most popular platform for decentralized applications. Its strong developer tools and extensive resources make Ethereum the top choice for creating and launching dApps, although network congestion can slow transactions during peak times. By contrast, Bitcoin’s scripting language is more limited, making it unsuitable for complex smart contracts and dApps.

- NFT Ecosystem – Ethereum leads the NFT (non-fungible token) space, providing standards and a secure decentralized digital currency ownership platform.

- DeFi Hub – Ethereum powers a vibrant ecosystem of DeFi (decentralized finance) applications, including lending protocols, decentralized exchanges, and stablecoins.

- DAO Development – Ethereum also has a strong history with DAOs (decentralized autonomous organizations), providing a secure and flexible infrastructure for decentralized governance.

Ethereum vs. Bitcoin: Short and Long-Term Perspectives

When comparing Ethereum and Bitcoin in the short term and long term, according to crypto analysts and experts, both have growth potential, but in different ways.

Bitcoin, the original cryptocurrency, continues to dominate the market. Experts expect it to grow steadily, largely due to factors like the recent halving event, the rise of Spot Bitcoin ETFs, interest from large investors, or “Bitcoin whales,” and external factors, such as Donald Trump’s second term in the White House.

Despite these positive indicators, Bitcoin’s growth may be constrained by market volatility, global regulations, and competition from alternative investments.

Analysts suggest that if demand remains strong and major financial institutions continue to show interest, Bitcoin could reach around $120,000 by 2025.

Some very optimistic predictions even speculate it might reach $1,000,000 by that time, although this would require massive adoption and substantial investment from institutions and sovereign funds. However, rising interest rates or stricter regulations, especially in large markets like India, could moderate its growth potential.

In the long term (by 2030 and beyond), Bitcoin could strengthen its reputation as a “digital gold,” valuable for its limited supply and decentralized nature. If global adoption continues, this could push its price to $500,000 or more, with investors seeing it as a hedge against inflation and currency instability.

Regarding Ethereum, experts also believe Ethereum’s growth will be steady (as in Bitcoin’s case), driven by the Dencun upgrade and continued interest in DeFi, NFTs, and decentralized applications (dApps).

Although recent upgrades and the possibility of Ethereum ETFs have sparked some optimism, these developments have largely stabilized Ethereum’s price rather than delivered major gains.

Projections suggest that Ethereum might reach $4,000 by 2025, potentially approaching $5,000 if institutional backing grows. However, market fluctuations and competition from newer blockchains could limit these gains.

Looking ahead to 2030 and beyond, Ethereum is well-positioned due to its foundational role in smart contracts, DAOs, and DeFi.

By then, Ethereum could climb to $20,000 or more as broader blockchain adoption takes root in industries such as finance and healthcare.

However, while Ethereum’s growth is promising, it is unlikely to match Bitcoin’s dominance and massive growth, as Bitcoin’s position as the original cryptocurrency and its strong market presence are hard to surpass.

Disclaimer: This is not financial or investment advice. Predictions involve uncertainty, and all investments carry risks.

Ethereum vs. Bitcoin: Where Are They Heading?

While both major players in the crypto space, Bitcoin and Ethereum are heading in different directions with their development priorities.

Bitcoin’s main focus is preserving its decentralized, secure network while attempting to improve scalability, though it’s gradually making these changes.

Efforts like the Lightning Network aim to increase transaction speed and reduce fees, but Bitcoin’s core design remains conservative to ensure security and resistance to centralization.

This means Bitcoin is advancing slowly but steadily as a “digital gold” and a secure, decentralized asset, though it still struggles with smoothly processing a high volume of transactions.

Ethereum, in contrast, is more aggressive in its roadmap for scalability and user-friendliness.

After it transitioned to Proof-of-Stake (PoS), Ethereum’s developers are prioritizing features to make the network faster and easier to use, like the upcoming Pectra upgrade and Single-Slot Finality to speed up transaction finalization.

In the long term, Ethereum’s focus is on addressing the “blockchain trilemma“—achieving scalability without sacrificing decentralization and security.

Future updates like Verkle Trees will reduce storage needs, and account abstraction will simplify how users interact with a decentralized platform.

This makes Ethereum more adaptable for widespread use cases like DeFi and NFTs, positioning it as a flexible, evolving platform for a broader range of applications.

FAQs

What are the Key Differences Between Ethereum and Bitcoin?

While both Bitcoin and Ethereum are cryptocurrencies, they serve distinct purposes. Bitcoin primarily functions as a store of value. It’s designed for secure, peer-to-peer transactions and is known for its robust, energy-intensive Proof of Work consensus mechanism. On the other hand, Ethereum is a platform for decentralized applications (dApps) and smart contracts. Its blockchain technology allows users to access decentralized financial services, including non-fungible tokens (NFTs) and many other innovative solutions.

Is It Better to Buy Ethereum or Bitcoin?

It depends on what you’re looking for. Bitcoin is mainly seen as a store of value and an alternative to fiat currencies. On the other hand, Ethereum is a platform for creating decentralized applications and supports things like DeFi, smart contracts, and NFTs. Your decision should align with your investment goals and how you see the market evolving.

Is Ethereum Going to Outperform Bitcoin?

It’s hard to say. Both Bitcoin and Ethereum have their strengths and appeal to different types of investors. Each’s future performance will depend on market trends, technological progress, and adoption, making it impossible to predict with certainty.

Can Ethereum Beat Bitcoin?

Ethereum serves a different purpose, focusing on Web3 development and decentralized apps, while Bitcoin is mainly a store of value and a payment system. It’s tough to say whether one will outperform the other in the long run, as each has its unique role in the crypto world.

Final Thoughts

So, Bitcoin and Ethereum are both major players in cryptocurrency but serve different purposes.

Bitcoin is seen as a store of value, with its native cryptocurrency being a secure, decentralized asset. On the other hand, Ethereum focuses on decentralized apps and smart contracts, using its native cryptocurrency to power a versatile platform for DeFi and NFTs.

Ethereum’s underlying technology is more flexible, allowing for complex applications, while Bitcoin focuses on security and scarcity. Ultimately, your choice between the two depends on whether you prefer a secure asset or a platform for innovation.