How to Stake MATIC (POL) in 2026

As Polygon continues to expand, many investors are unsure how to stake MATIC or POL correctly. With the transition from MATIC to POL, new users face confusion about which platform to use and how to earn staking rewards safely on the Polygon network. Without clear guidance, it’s easy to choose the wrong method, locking your MATIC tokens for too long, missing staking rewards, or exposing your crypto […]

As Polygon continues to expand, many investors are unsure how to stake MATIC or POL correctly. With the transition from MATIC to POL, new users face confusion about which platform to use and how to earn staking rewards safely on the Polygon network.

Without clear guidance, it’s easy to choose the wrong method, locking your MATIC tokens for too long, missing staking rewards, or exposing your crypto assets to potential risks.

Moreover, whether you’re using a Polygon wallet, a centralized exchange, or a liquid staking platform, each method comes with different benefits, fees, and reward structures.

In this comprehensive guide, you’ll learn everything you need to know about staking Polygon (MATIC or POL) in 2026. We’ll briefly explain what Polygon is, how it evolved from MATIC to POL, and why staking is important for network security and earning consistent rewards.

Then, we’ll show you three easy ways to stake your tokens, suitable for every type of investor:

- Through the official Polygon staking platform, users can stake Polygon directly.

- On a centralized exchange – for those who prefer a more straightforward, all-in-one approach.

- Via a liquid staking platform – for DeFi users who want to stake MATIC while keeping liquidity.

By the end, you’ll know exactly how to stake Polygon (MATIC or POL), which option fits your goals, and how to start earning rewards confidently in 2026 and beyond.

About Polygon (Previously MATIC Network)

Polygon is a layer-2 scaling solution for Ethereum designed to enhance speed, scalability, and transaction efficiency while maintaining the security of the main Ethereum chain.

Formerly known as the MATIC Network, Polygon enables developers to build decentralized applications (dApps) without encountering Ethereum’s congestion or high gas fees.

From MATIC to POL

In 2023–2025, Polygon began its major token upgrade, replacing MATIC with POL, the next-generation token of the Polygon ecosystem.

POL is designed to power all Polygon chains, enabling multi-chain staking and governance across the network.

While users still see the term MATIC staking in most guides, it now effectively refers to staking POL tokens. Holders can migrate their MATIC to POL at a 1:1 ratio through the official Polygon migration portal.

Why Stake MATIC (POL)?

Staking POL supports the Polygon network’s Proof-of-Stake (PoS) consensus mechanism. In return, users earn staking rewards while contributing to the network’s security and decentralization.

Other benefits include:

- Passive income: Earn yield while holding POL.

- Validator support: Secure the network by delegating tokens.

- Governance rights: Influence upgrades and ecosystem changes.

How to Stake MATIC (POL) on the Official Polygon Platform

The safest and most direct way to stake MATIC (POL) is through the Polygon Staking Portal, the official platform.

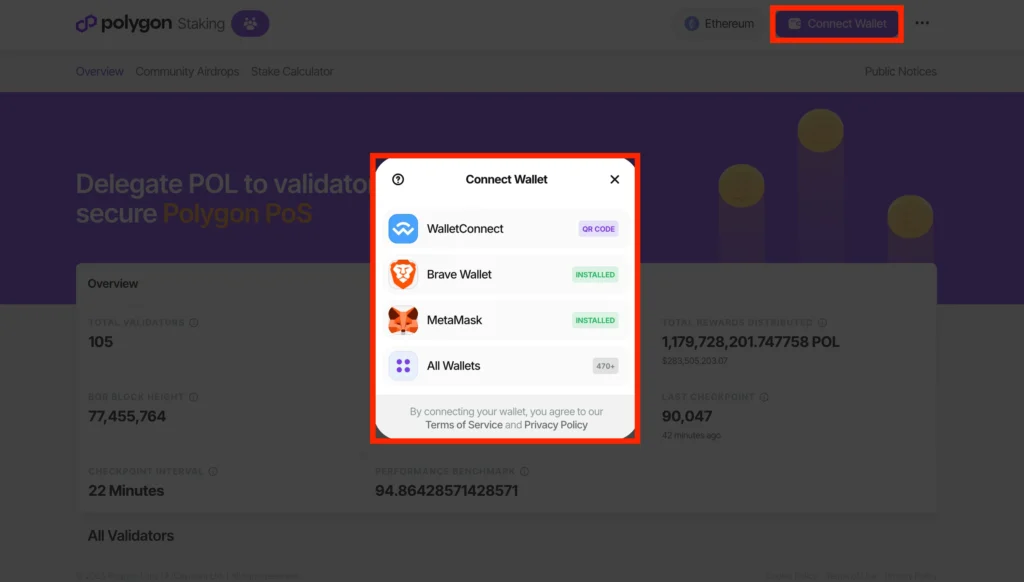

Step 1. Go to the Polygon Staking Dashboard and Connect Your Wallet

Visit the official Polygon staking platform and connect your wallet (MetaMask, Brave Wallet, Coinbase Wallet, Ledger, or other) by pressing the proper button in the top-right corner.

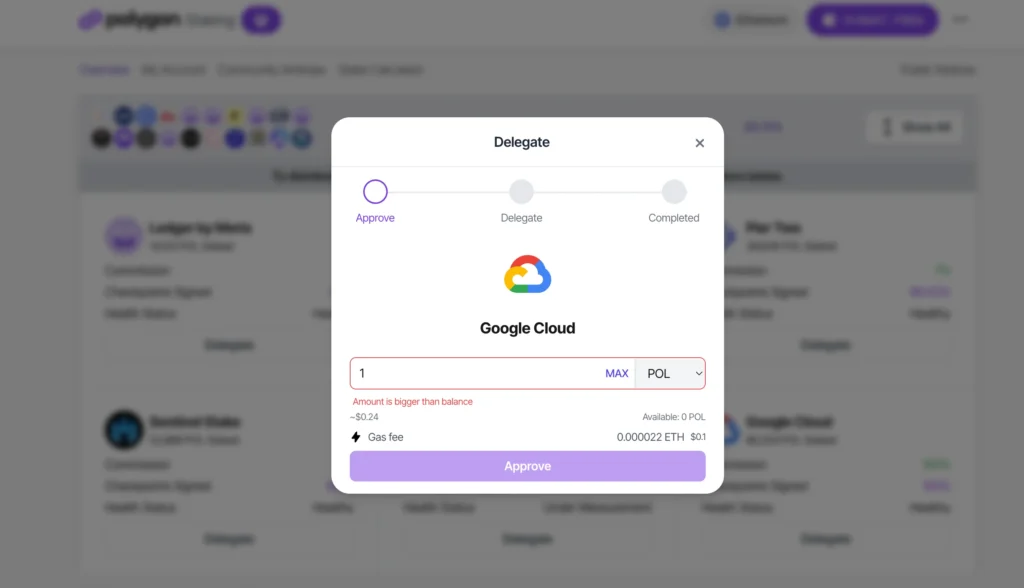

Step 2. Select a Validator and Enter the Amount

Browse the list of available validators, check their commission rates and performance, and click “Delegate”. Specify the number of MATIC (POL) tokens you wish to stake and confirm the transaction.

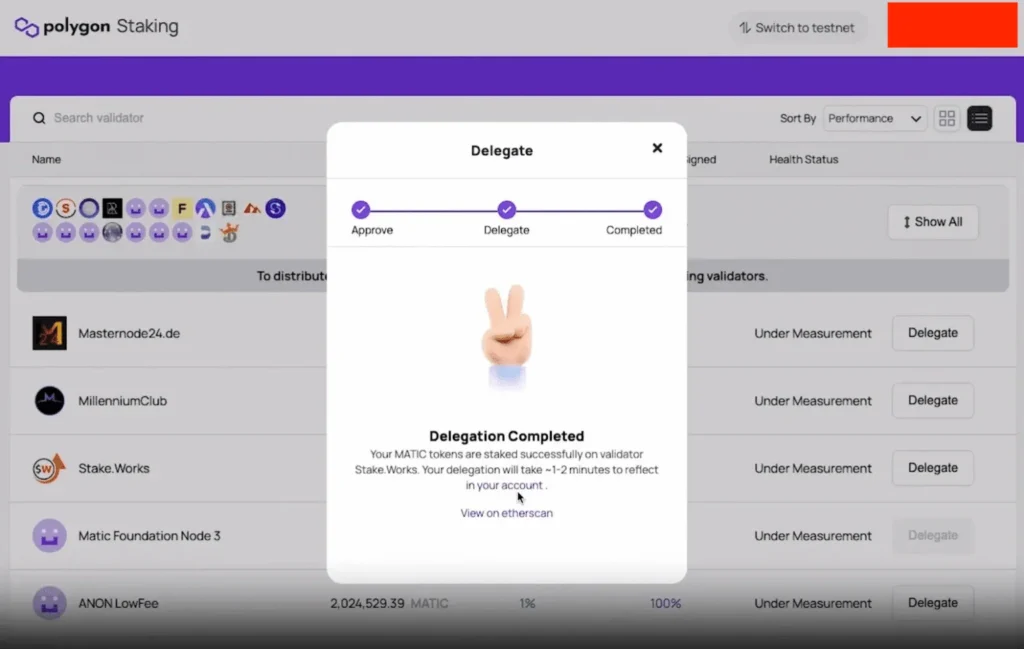

Step 3. Approve the Transaction and Track Rewards

Confirm the approval request in your wallet. You’ll need a small amount of ETH to cover gas fees.

After delegation, you can monitor your staked tokens, rewards, and validator status directly from the dashboard. Remember that even if you stake MATIC, you’ll receive rewards in POL.

Note: Polygon staking is non-custodial, meaning your tokens remain in your wallet throughout the process.

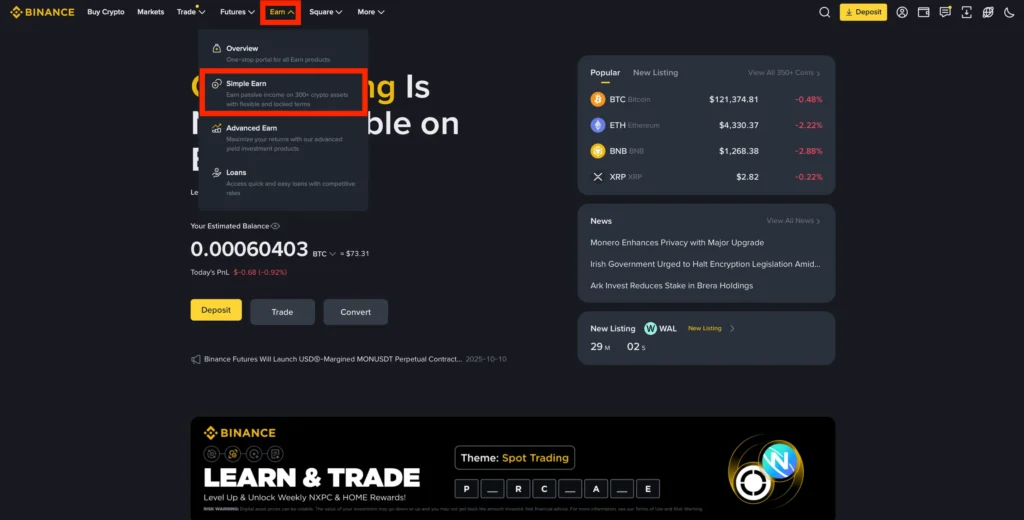

How to Stake MATIC (POL) on Binance

Among all centralized exchanges, Binance remains one of the best places to stake MATIC (POL) in 2026 and beyond, offering competitive APYs, flexible terms, and a beginner-friendly interface.

Through Binance Simple Earn, users can choose between flexible and locked staking, depending on their goals.

Even if you prefer using another major exchange such as Coinbase, Crypto.com, or KuCoin, the staking process is very similar.

Here’s how to do it in just four simple steps:

Step 1. Log In and Prepare Your Account

Make sure you have a verified Binance account and that your MATIC (or POL) tokens are available in your Spot Wallet or Earn Wallet.

Then, log in to the official website of the Binance Exchange or open the Binance app.

From the main menu, go to “Earn” → “Simple Earn.”

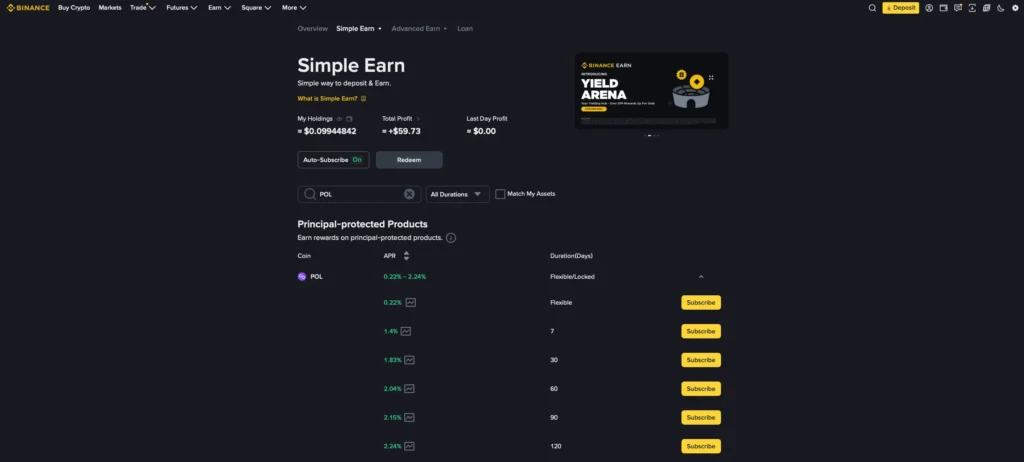

Step 2. Find Polygon (MATIC or POL)

In the Simple Earn dashboard, search for “MATIC” or “POL.”

You’ll find multiple staking products with two main types of terms:

- Flexible: withdraw anytime, lower APY.

- Locked: 7–120 day periods, higher APY (up to 2.24%).

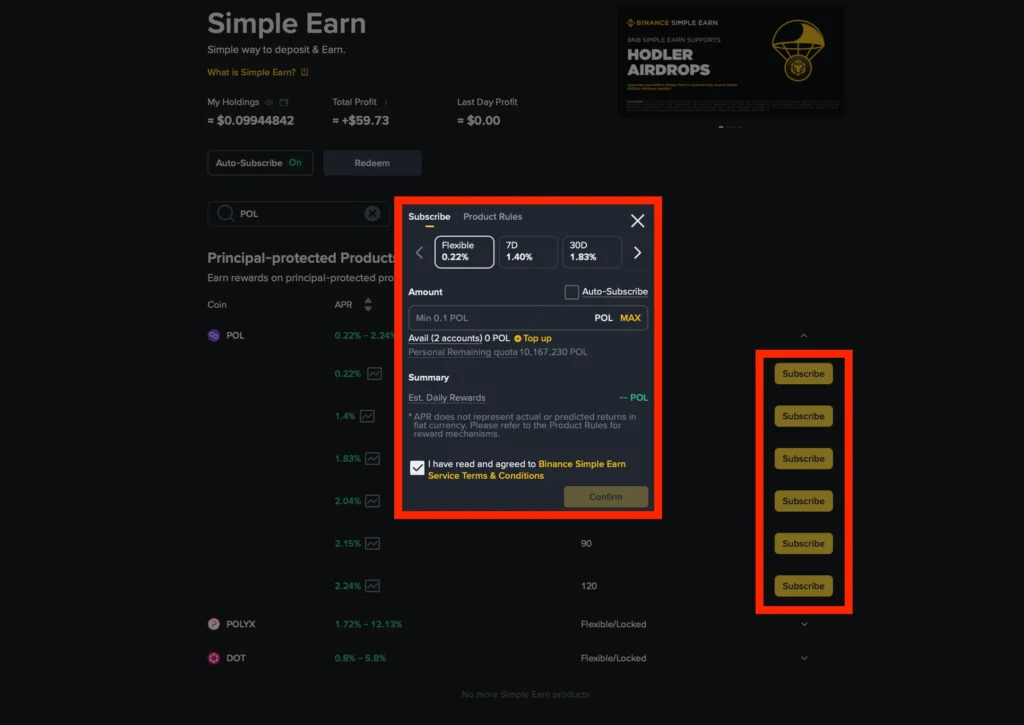

Step 3. Choose a Plan and Subscribe

Click “Subscribe” next to your chosen staking offer.

Enter the amount of MATIC or POL you’d like to stake, review the estimated APY, and check the box to confirm the terms.

Finally, click “Confirm.”

Your tokens are now locked into the staking program and will start earning rewards automatically.

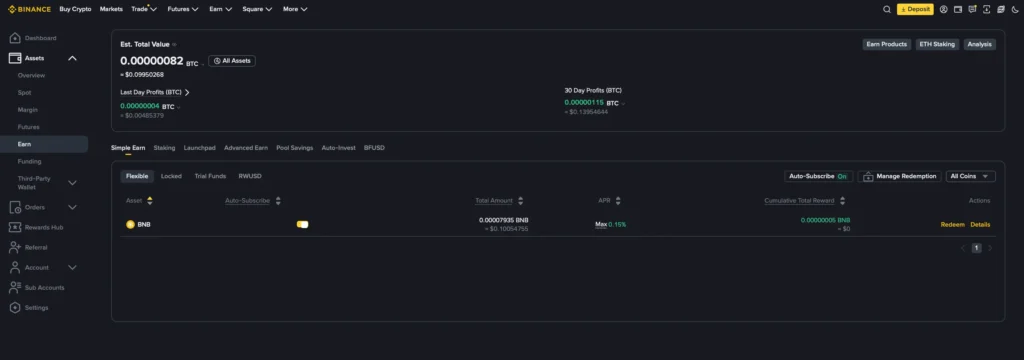

Step 4. Monitor Rewards and Redeem

You can track your rewards at any time under Wallet → Assets → Earn → Simple Earn.

There, you’ll see your staked balance, daily rewards, and lock period details.

When your staking term ends:

- Redeem your tokens back to your Spot Wallet, or

- Auto-renew/Re-stake to continue compounding your rewards.

If you’re using Flexible Staking, you can withdraw at any time, but you’ll forfeit rewards for the current day.

Note: Staking via Binance is custodial, meaning Binance holds your tokens on your behalf.

How to Stake MATIC (POL) on Stader (via MaticX)

Since Lido on Polygon officially sunset in June 2025, Stader Labs has become one of the top platforms for staking MATIC (POL) through Polygon liquid staking.

Stader allows you to stake Polygon (MATIC or POL) and receive MaticX tokens, giving you full liquidity and the ability to use your staked tokens across the Polygon network’s DeFi ecosystem while still earning staking rewards.

Even if you prefer other liquid staking dApps, the staking process on Polygon is similar.

Here’s how to do it:

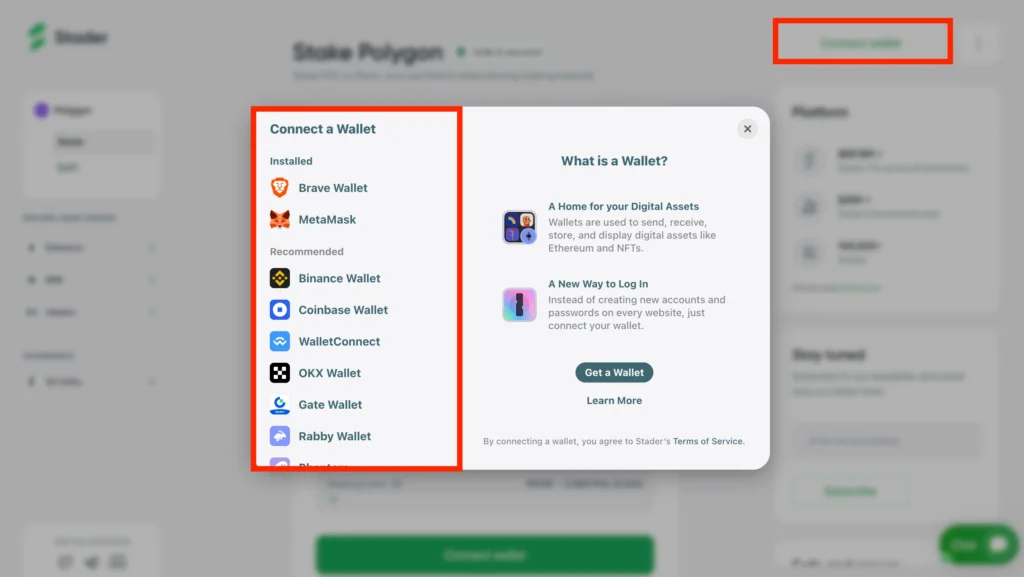

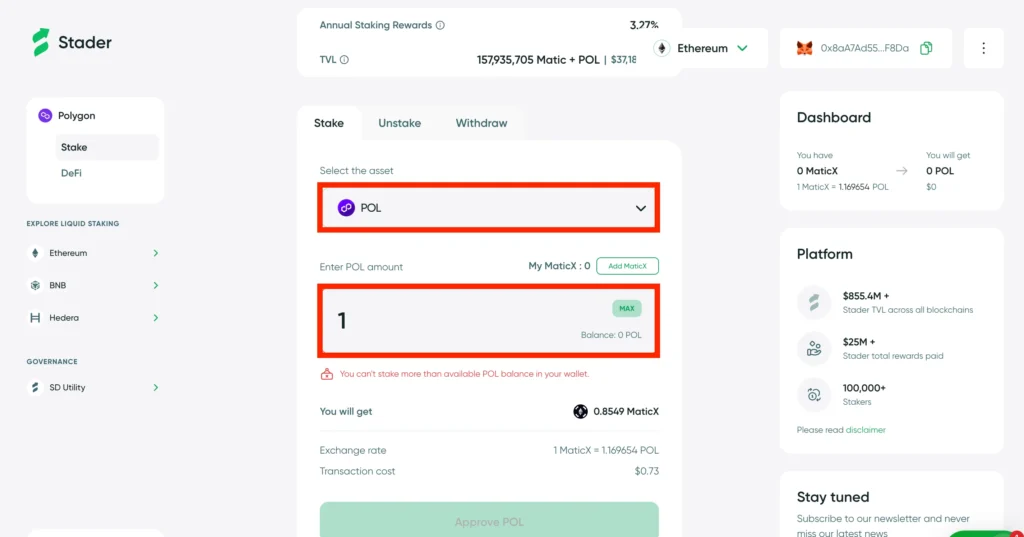

Step 1. Visit Stader’s Polygon Liquid Staking Page and Connect Your Wallet

Go to the official Stader Polygon liquid staking page or navigate through the “Stake Polygon” section on the Stader’s website or the Stader App.

Click “Stake Now” or “Connect Wallet” and select your preferred wallet, such as MetaMask, Ledger device, or another compatible Polygon wallet.

Before you start staking, ensure your MATIC (or POL) tokens are available in your wallet and that you have a sufficient balance for gas fees on the Polygon network.

Step 2. Enter the Amount of MATIC to Stake

After your wallet is connected, enter the amount of MATIC or POL you want to delegate to the staking pool.

Stader will automatically display your expected reward rate (APY) and the amount of MaticX tokens you will receive in return.

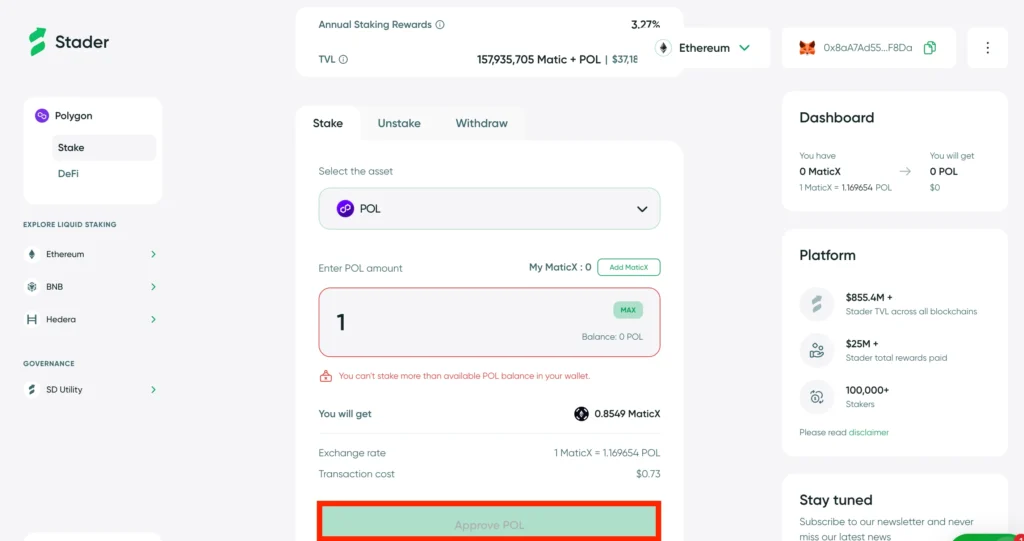

Step 3. Confirm the Transaction and Delegate

Click “Approve POL/MATIC” or “Stake” to proceed.

Your wallet will open a pop-up window asking you to approve the transaction.

Carefully verify the details, validator selection, and network information, then confirm the transaction.

Once approved, your MATIC tokens are automatically delegated to Stader’s validator network, and MaticX will appear in your Polygon wallet almost instantly.

This process ensures that your MATIC staked tokens continue to support network security while generating rewards within the Polygon network.

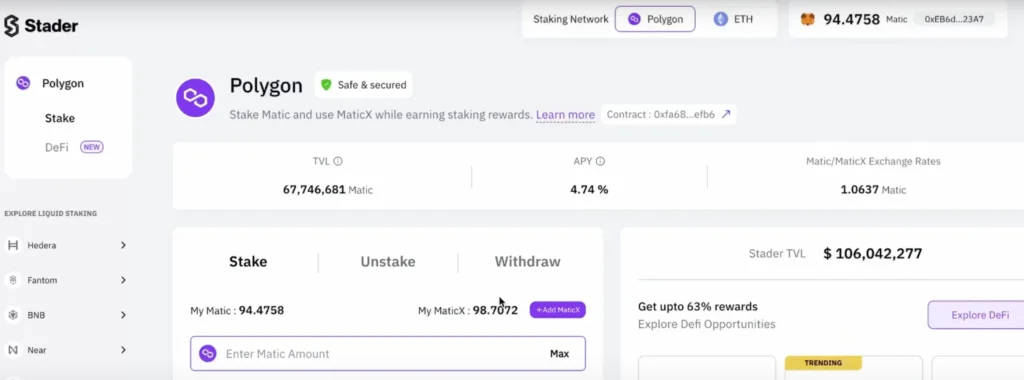

Step 4. Track Your Rewards and Use MaticX

Your staking Polygon rewards will accumulate automatically, increasing your MaticX balance over time. You can track your earned rewards, validator performance, and staked balance through the Stader dashboard or directly in your wallet interface.

Because this is liquid staking, you can use your MaticX tokens in DeFi applications like Aave, Balancer, or Curve to start earning rewards on top of your staking yield. You can also redeem MaticX back to MATIC (POL) at any time, according to the platform’s conversion policy, making this an ideal choice for investors who want flexibility and continuous passive income.

If you’re also staking assets on other chains, here’s a complete guide on how to stake Cardano (ADA).

FAQ

Yes, you can still stake your MATIC tokens directly, or first migrate them to POL, the upgraded Polygon token designed for the new Polygon 2.0 ecosystem. Both tokens are fully supported during the transition phase. However, as Polygon continues the migration process, staking MATIC will gradually result in receiving rewards and balances in POL, since POL is replacing MATIC as the network’s primary staking and governance token.

There’s no strict minimum amount required to stake MATIC, but most platforms suggest at least a few MATIC coins to cover gas fees and validator thresholds. Before you start staking, check the Polygon website or your chosen staking pool for updated limits and reward details.

You can’t stake MATIC (or POL) directly in MetaMask, as the wallet doesn’t support native staking. However, you can stake by connecting your MetaMask wallet to the official Polygon Staking Portal or another trusted dApp that supports Polygon staking.

The official Polygon Staking Portal remains the safest. However, platforms like Binance, Coinbase, Crypto.com, and Stader offer excellent alternatives for higher flexibility or yield.

Typical annual yields range from 4% to 12%, depending on the validator’s performance and the staking platform.

Yes, you can connect your MATIC wallet or Ledger Live app to the Polygon staking dashboard or a liquid staking platform, such as the Stader app. This lets you stake Polygon tokens, track your MaticX balance, and earn rewards while keeping your crypto assets secure within your own wallets on the Ethereum network.

Wrapping Up

Learning how to stake MATIC (POL) in 2026 is one of the most innovative ways to earn passive income while supporting the growth and network security of the Polygon network. Whether you stake Polygon directly on the official Polygon website, use a centralized exchange, or prefer Polygon liquid staking through the Stader app or StaderLabs app, the process is simple and accessible for everyone.

Before staking, review the available tokens, validator performance, and your expected reward rate. Keep in mind that price volatility can impact your overall value, so approach staking as a long-term strategy rather than a short-term investment.

Ultimately, staking through Polygon’s comprehensive guide of methods provides you with full flexibility, enabling you to start earning rewards, grow your staked tokens, and maximize the value of your portfolio in the evolving cryptocurrency space.