Bitcoin vs. Bitcoin ETF: Which One is Right for You?

Since January 2024, we have discussed a new concept in the crypto space: spot Bitcoin ETFs (Exchange Traded Funds). These new investment options help us diversify our portfolios, but it’s extremely important to understand how they work and what they represent. And what could be better than comparing them to Bitcoin, the crypto that lays […]

Since January 2024, we have discussed a new concept in the crypto space: spot Bitcoin ETFs (Exchange Traded Funds). These new investment options help us diversify our portfolios, but it’s extremely important to understand how they work and what they represent.

And what could be better than comparing them to Bitcoin, the crypto that lays at the very foundation of Bitcoin ETFs, especially if wondering “should I buy Bitcoin or Bitcoin ETF”.

So, let’s learn more about Bitcoin ETFs vs. Bitcoin to understand better which is right for you.

Bitcoin ETF vs. Bitcoin: A Brief Overview

| Factor | Bitcoin ETF | Bitcoin (BTC) |

| Ownership | Ownership of ETF shares linked to Bitcoin | Direct ownership |

| Regulations | Heavily regulated by financial authorities | Operates outside traditional financial systems |

| Trading and Liquidity | Trades only during stock market hours | Available 24/7 on crypto exchanges |

| Taxes | Typically follows standard capital gain rules | Tax rules vary depending on the country |

| Fees | Management fees for ETF providers | Lower transaction fees but may require storage costs. Also depends on the market activity |

| Custody | Custody managed by ETF providers | Requires personal wallet and safety measurements |

The Genesis of Bitcoin ETF vs. Bitcoin

Launched in 2009, Bitcoin was the first cryptocurrency to introduce blockchain technology. It provided an alternative to traditional (fiat) currencies and a way to transfer value without intermediaries. Over time, Bitcoin became an investment asset, attracting both retail and institutional investors.

Bitcoin ETFs were launched in response to direct Bitcoin ownership challenges. The first Bitcoin ETFs were approved on January 10, 2024. They primarily track the price of Bitcoin, which comes in various forms, such as spot ETFs (holding Bitcoin directly) and future ETFs (based on contracts predicting future Bitcoin prices).

There was also another attempt to launch a Bitcoin futures ETF in 2021. The trading product was called ProShares Bitcoin Strategy ETF (BITO).

Technical Comparison

Regarding the technical comparison of Bitcoin vs. Bitcoin ETF, there isn’t too much to say, as both instruments contain… well, Bitcoin. One is the original, individual cryptocurrency, while the other is wrapped into an exchange-traded fund (ETF) that brings the same coin but adds some unique features.

So, Bitcoin ETFs are designed to follow Bitcoin’s price movement, so the main differences come down to how you buy, hold, and trade them. While Bitcoin gives you direct ownership of the digital currency, a Bitcoin ETF lets you own shares tied to Bitcoin, managed by a financial company.

With Bitcoin, you’re dealing with a digital asset that runs on blockchain—a decentralized system where miners or stakers verify transactions. It trades 24/7 on cryptocurrency platforms, meaning you can buy or sell Bitcoin anytime. You’ll need a digital wallet to store Bitcoin, and keeping it safe is your responsibility. This could involve protecting private keys or using special offline storage.

On the other hand, Bitcoin ETFs work like traditional stocks and are regulated by financial authorities. You can only trade them during regular stock market hours, so no weekend or late-night trading. Professional firms manage ETFs, so they handle custody and security for you, making them more user-friendly for people used to regular investments like stocks.

When it comes to costs, Bitcoin ETFs often charge management fees, while owning Bitcoin directly doesn’t come with those fees but may involve costs like transaction fees for buying and selling or setting up a secure wallet.

Tax rules also differ—Bitcoin ETFs follow the standard rules for stocks, while Bitcoin’s taxes depend on local regulations and may require extra reporting.

Bitcoin ETF vs. Bitcoin: Market Performance

The year 2024 marked a significant milestone for the cryptocurrency industry, with the U.S. Securities and Exchange Commission (SEC) approving spot Bitcoin and Ethereum Exchange-Traded Funds (ETFs) in January and July, respectively.

This move injected institutional legitimacy into the sector and boosted its mainstream appeal, attracting major players like BlackRock and Fidelity to launch their products.

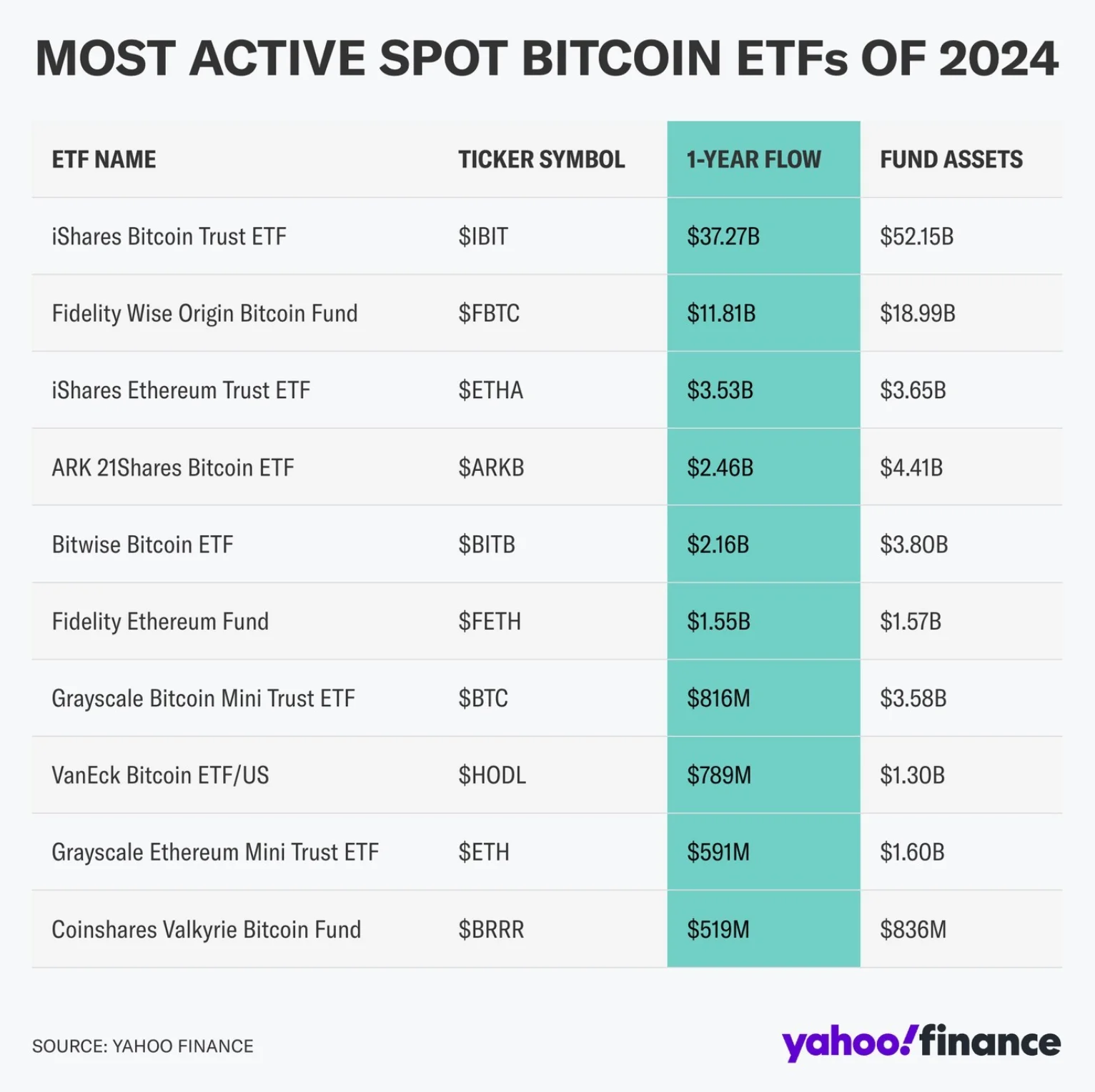

The crypto ETF sector has proven highly profitable up to this point, making its impact on the market in 2024 unmistakable. By the end of the year, Bitcoin ETFs saw remarkable growth. Let’s explore some of the key players:

- iShares Bitcoin Trust ETF (IBIT): This behemoth saw a staggering $37.27 billion inflows, boosting its AUM to a massive $52.15 billion YoY growth of over 200%.

- Fidelity Wise Origin Bitcoin Fund (FBTC): This ETF quickly gained traction, attracting $11.81 billion in inflows and a YoY AUM growth of over 150%.

- ARK 21Shares Bitcoin ETF (ARKB): This actively managed ETF saw $2.46 billion in inflows, showcasing the growing appetite for actively managed crypto strategies.

- Bitwise Bitcoin ETF (BITW): This ETF, known for its focus on data and analytics, attracted $2.16 billion in inflows, contributing to a healthy YoY growth in AUM.

- ProShares Bitcoin Strategy ETF (BITO): As one of the first Bitcoin futures ETFs to launch, BITO continued to see consistent inflows, adding another $1.5 billion to its AUM.

These are just a few examples of the many Bitcoin ETFs that experienced significant growth in 2024. The overall trend was clear: investor interest in Bitcoin ETFs surged, driven by SEC approvals and the influx of institutional capital. However, if the hype begins to fade, we might see a slight slowdown in 2025.

Focusing solely on cryptocurrency and not ETFs, Bitcoin (BTC) continues to dominate as the largest cryptocurrency by market value, boasting a market cap of approximately $1.81 trillion at the close of 2024. Bitcoin’s leading status is attributed to its position as the first and most well-known cryptocurrency. Its limited supply, decentralized nature, and reputation as “digital gold” have made it a favorite among long-term investors and institutions, which helps sustain its significant value.

Bitcoin’s fixed supply of 21 million coins classifies it as a deflationary asset. About 94% of this total is already in circulation, and this capped supply underpins its value as fewer coins become available.

However, Bitcoin’s price behavior is also shaped by how it is perceived and utilized. Its scarcity has been a critical factor in establishing it as a store of value. Macroeconomic factors, institutional interest, and broader adoption significantly influence its price dynamics.

Historically, Bitcoin has exhibited sharp volatility, yet it follows an overall long-term upward trajectory. By the end of 2024, Bitcoin will be trading at around $95,526, slightly below its all-time high of $108,268, which was reached in December of the same year.

In terms of daily trading volume, Bitcoin showcases its immense popularity and trust, with an astonishing $28 billion traded daily as of late 2024. Major events, such as political shifts, often increase trading volumes.

Bitcoin is generating significant excitement, particularly with increasing investment from large-scale investors. Many view it as a reliable hedge against economic uncertainty. This growing confidence has created substantial momentum, with retail investors and financial institutions optimistic about Bitcoin’s future.

Bitcoin: Pros and Cons

The Pros of Investing Directly in Bitcoin

- Ownership and Control – You fully own your Bitcoin, meaning you can trade, sell, or hold it as you see fit without relying on intermediaries.

- 24/7 Trading – Bitcoin markets never close, so you can trade anytime, even on weekends and holidays.

- High Liquidity – Major crypto exchanges like Binance and Coinbase make it easy to find buyers and sellers, ensuring quick transactions.

- Low Ongoing Fees – Investors save on fund management fees by directly owning Bitcoin, but trading costs remain.

The Cons of Investing Directly in Bitcoin

- Security Risks – You’re responsible for protecting your Bitcoin. Losing your private keys or getting hacked means losing your funds.

- Price Volatility – Bitcoin’s value can swing dramatically, leading to potential losses.

- Limited Regulation – Cryptocurrencies operate largely unregulated, offering little protection if something goes wrong.

- Technical Knowledge Required – Managing wallets, private keys, and transactions requires a learning curve that might overwhelm beginners.

Bitcoin ETFs: Pros and Cons

The Pros of Investing in Bitcoin ETFs

- Ease of Access – ETFs can be traded through regular brokerage accounts, making them more approachable for traditional investors.

- Regulatory Oversight – Bitcoin ETFs are regulated, offering better protection and oversight than direct cryptocurrency investments.

- No Custody Worries – The fund manager handles Bitcoin storage and security (as most Spot Bitcoin ETFs rely on a third-party custodian), eliminating the need for investors to manage private keys.

The Cons of Investing in Bitcoin ETFs

- Limited Trading Hours – Unlike Bitcoin, which trades 24/7, ETFs follow traditional stock market hours.

- Management Fees – Investors pay fees to the fund manager, which can eat into profits over time.

- Indirect Ownership – You don’t own actual Bitcoin; you just share it in a fund tracking its price. This can lead to slight mismatches in performance.

Short and Long-Term Perspectives

Bitcoin continues to dominate the market and shows strong potential for growth, driven by several key factors. These include the recent halving event, increasing interest in Bitcoin Spot ETFs, the involvement of Bitcoin whales, and external influences like Trump’s victory in the U.S. presidency.

Despite these positive trends, Bitcoin still faces market volatility, stricter global regulations, and competition from other investment options. If demand stays robust and major financial players keep backing it, Bitcoin’s price could reach around $120,000 by 2025.

Looking further into the future, by 2030 and beyond, Bitcoin could solidify its status as “digital gold,” valued for its scarcity and independence from central banks. If more individuals and businesses view it as a haven against inflation and unstable currencies, its price could soar to $500,000.

However, Bitcoin’s future success will depend on how well it navigates these challenges and maintains its position as the leading cryptocurrency.

Regarding ETFs, the iShares Bitcoin Trust ETF is one of the most talked-about options, so we’ll examine it in this article.

In the short term, the iShares Bitcoin Trust ETF looks promising because Bitcoin is becoming more widely accepted, and Spot Bitcoin ETFs are gaining popularity. This ETF makes it easy for investors to get involved with Bitcoin without buying and storing the cryptocurrency themselves.

However, there are still some challenges, like the market’s ups and downs, changing regulations, and competition from other funds. If things go well and more people keep investing in Bitcoin, this ETF’s price could be around $101.34 by the end of 2025.

By 2030, the iShares Bitcoin Trust ETF could become a top choice for investors who see Bitcoin as a digital version of gold. As more people recognize Bitcoin’s potential to protect against inflation and its limited supply, the value of the ETF could climb significantly, possibly reaching $324.75. This prediction is based on the idea that Bitcoin could be worth around $500,000 by then.

The success of this ETF will depend on how well it handles regulation changes, stays ahead of its competition, and continues to attract investors.

Please note that this isn’t financial advice, so due your due dilligence to perform yur own research. All financial investments come with risks, and these predictions might not come true.

Bitcoin vs. Bitcoin ETF: Where Are They Heading?

In the future, Bitcoin ETFs are likely to become more popular as they’re relatively “new” in the industry (regulators approve crypto ETFs) and make investing in Bitcoin easier and more accessible for regular and traditional investors.

Just like ETFs in the stock market, they could attract more people by being simple to trade through regular brokerage accounts without needing to deal with the complexities of cryptocurrency wallets or exchanges. Moreover, the Securities and Exchange Commission (SEC) approved Bitcoin ETFs, which can set a precedent for approving other crypto ETFs in the future.

Over time, we might see lower fees, more types of Bitcoin ETFs, and even their inclusion in retirement plans like 401(k)s. As more big institutions and everyday investors join the movement, Bitcoin ETFs could help stabilize Bitcoin’s price and make it a more accepted and mainstream investment.

However, challenges like regulations and Bitcoin’s volatility will still need to be addressed for the cryptocurrency to reach its full potential. Thus, Bitcoin will solidify its position as “digital gold,” a secure and decentralized store of value.

Moreover, advancements like the Lightning Network enhance scalability while maintaining its decentralized ethos, appealing to long-term investors seeking a hedge against inflation and global economic instability. Its resilience and independence make it a favored choice for those who prioritize control and the foundational principles of cryptocurrency.

Even so, as institutional interest continues to grow, Bitcoin ETFs are likely to capture more attention from traditional markets, positioning them as the preferred choice for institutional portfolios. Meanwhile, Bitcoin retains its unique appeal as a decentralized financial haven, highlighting a complementary yet divergent path for these two facets of the Bitcoin ecosystem.

FAQ

How Many Types of Bitcoin ETFs Are There?

There are two main types of Bitcoin ETFs: spot Bitcoin ETFs and futures Bitcoin ETFs. Spot Bitcoin ETFs hold actual Bitcoin and follow its current price, while futures Bitcoin ETFs are based on Bitcoin futures contracts, which speculate on the future price of Bitcoin. These options allow investors to choose how they want to gain exposure to Bitcoin without directly owning the cryptocurrency.

What Is the Largest Crypto ETF?

As of the end of 2024, the largest crypto ETF and, simultaneously, the biggest Bitcoin ETF is the iShares Bitcoin Trust ETF (IBIT). According to Yahoo Finance, this Spot Bitcoin ETF manages assets worth over $52.15 billion.

Which Bitcoin ETFs Are The Most Popular?

The most popular Bitcoin ETFs include the iShares Bitcoin Trust ETF (IBIT), the Fidelity Wise Origin Bitcoin Fund (FBTC), the ARK 21Shares Bitcoin ETF (ARKB), the Bitwise Bitcoin ETF (BITW), Invesco Galaxy Bitcoin ETF (BTCO), Grayscale Bitcoin Trust ETF (GBTC), and the ProShares Bitcoin Strategy ETF (BITO). These new Bitcoin ETFs saw significant inflows of new money, indicating that they were popular for investors seeking exposure to Bitcoin through the ETF market.

Which is the Best Bitcoin ETF?

It’s tough to say which Bitcoin ETF is the absolute best, but the iShares Bitcoin Trust ETF is a strong contender. With over $52 billion in assets and impressive growth, it’s one of the most popular choices for investors who want to invest in Bitcoin without buying it directly.

Should I Buy Bitcoin or a Bitcoin ETF?

It depends on what you’re looking for. If you want to own Bitcoin directly and have more control, buying Bitcoin might be the way to go. You can trade it anytime, but you must handle the security yourself. On the other hand, if you prefer a simpler, more traditional investment managed for you, a Bitcoin ETF could be a better fit. It’s easier to trade, but you won’t own the Bitcoin directly.

Are Bitcoin ETFs a Good Investment?

Bitcoin ETFs can be a good choice if you want an easier way to invest in Bitcoin without dealing with digital wallets or security risks. They’re regulated and can be traded like regular stocks. However, they come with management fees, and Bitcoin’s ups and downs can still affect the price. If you’re looking for a more straightforward way to invest in Bitcoin, an ETF could be worth considering.

Final Thoughts

When deciding whether to invest in Bitcoin directly or through a Bitcoin ETF, it’s important to know the benefits and drawbacks of each option. Bitcoin gives you full control and ownership, with the ability to buy or sell anytime. But it also comes with the responsibility of keeping it safe, and you need to be familiar with how it works to avoid risks like losing your private keys or being hacked.

Bitcoin ETFs, on the other hand, are a simpler way to invest. They are managed by professionals, meaning you don’t have to worry about security or handling Bitcoin yourself. Plus, they’re regulated, which gives investors a sense of safety.

However, you can’t trade them 24/7 like Bitcoin; they come with management fees. Also, you don’t own Bitcoin; you just share it in a fund that tracks its price.

Which one is better depends on what you want from your investment. If you want control and don’t mind the extra work, Bitcoin might be the right choice. If you prefer a more hands-off approach and a simpler way to invest, Bitcoin ETFs could be a better fit. Both options offer good opportunities, so it’s all about what suits your goals and comfort level.