+15 Best Crypto-Friendly Banks in 2026

As cryptocurrencies become increasingly mainstream, many traditional banks continue to block or limit transactions related to cryptocurrencies. This makes it challenging for investors, businesses, and crypto enthusiasts to find trusted banking partners that fully support digital assets across the global financial landscape. These restrictions slow down transfers, raise costs, and create uncertainty. Users who need fast […]

As cryptocurrencies become increasingly mainstream, many traditional banks continue to block or limit transactions related to cryptocurrencies. This makes it challenging for investors, businesses, and crypto enthusiasts to find trusted banking partners that fully support digital assets across the global financial landscape.

These restrictions slow down transfers, raise costs, and create uncertainty. Users who need fast and secure access to both cryptocurrency and fiat funds often face unnecessary hurdles when trying to transfer funds between their exchange and their customer’s bank.

To bridge this gap, we’ve compiled a list of the 17 best crypto-friendly banks in 2026. These institutions combine solid regulatory compliance with modern digital asset banking services.

Top 17 Crypto-Compatible Banks: Quick Overview

| Crypto Bank | Specifications |

|---|---|

| Custodia Bank (formerly Avanti Bank) | Available in: USA; Access: Online (business banking); Crypto Features: – Wyoming SPDI-chartered bank focused on digital-asset businesses; – Fiat cash management for crypto companies; – Regulated under Wyoming’s SPDI framework. |

| Anchorage Digital Bank | Available in: USA (federally chartered), Singapore (institutional); Access: Online (institutional platform); Crypto Features: – Qualified custody, trading, staking, settlement for institutions; – Only US crypto-native bank with an OCC charter. |

| Juno | Available in: USA; Access: App & Web; Crypto Features: – On-ramp to 20+ chains, buy/send BTC, ETH, SOL, etc.; – 2FA and “1:1 custody with a US-regulated partner.” |

| Quontic Bank | Available in: USA; Access: Online & App; Crypto Features: – Bitcoin Rewards Checking (earn BTC on purchases). |

| Ally Bank | Available in: USA; Access: Online & App; Crypto Features: – Ally Invest offers crypto trading/education; – Banking supports funding to compliant exchanges (crypto not bought directly in the core bank). |

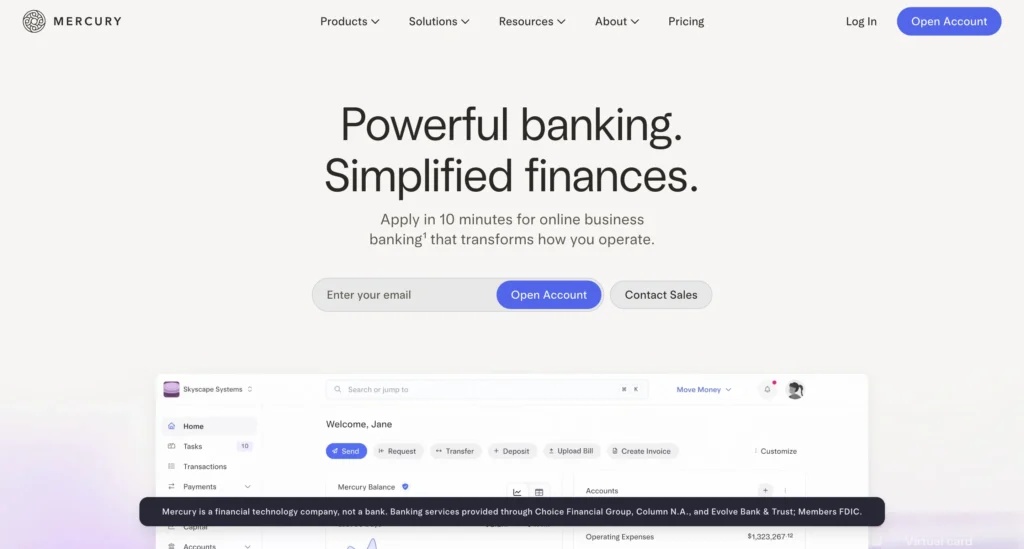

| Mercury | Available in: USA; Access: Online & App; Crypto Features: – Business banking for blockchain/crypto/NFT/Web3 companies; – Fiat operations for crypto companies via partner banks (Members FDIC). |

| Revolut | Available in: UK & many global markets; Access: App & Web; Crypto Features: – Buy/hold/exchange crypto in-app; – Card spending with auto crypto-to-fiat conversion; – Custodians with cold storage; – Koinly tax reports. |

| Wirex | Available in: UK & multiple countries; Access: App & Card; Crypto Features: – Multi-currency (fiat and crypto) accounts; – A debit card that spends crypto via automatic conversion; – Premium card tiers. |

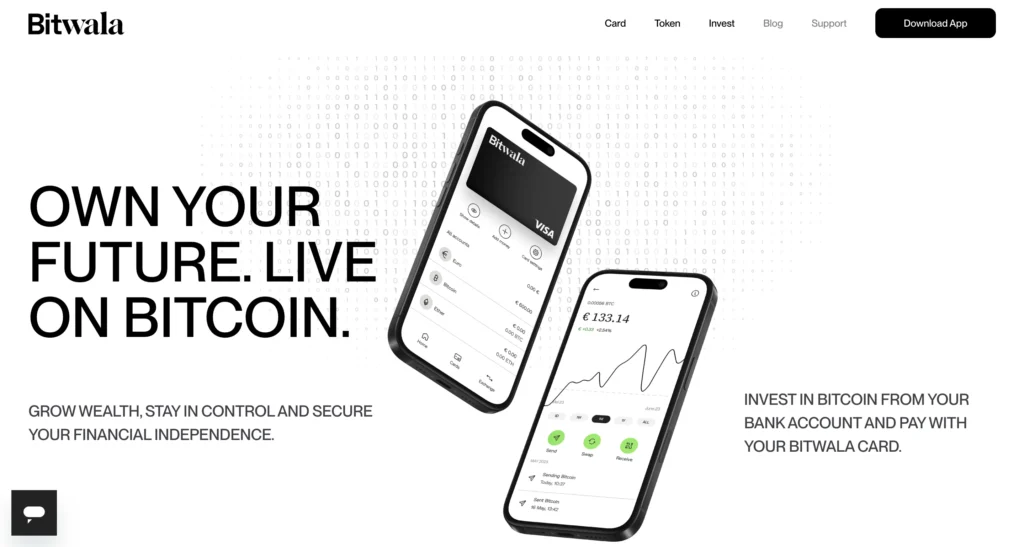

| Bitwala | Available in: EU (Germany HQ); Access: App & Web + Visa card Crypto Features: – Instant buy/store bitcoin; – Euro transfers, card payments, successor to Nuri. |

| BBVA | Available in: Spain & broader EU; Access: Online & Mobile App; Crypto Features: – A regulated European bank offering integrated Bitcoin and Ethereum trading within its mobile app. – Users can buy, sell, and hold crypto 24/7, with secure custody and seamless fiat-to-crypto conversions. |

| Bank Frick | Available in: Liechtenstein / Europe; Access: Online & Relationship banking; Crypto Features: Regulated trading & custody, tokenization, blockchain banking solutions for institutions. |

| AMINA (SEBA Bank) | Available in: Switzerland (with hubs in Abu Dhabi, Hong Kong, Singapore); Access: Online & App (private/institutional focus); Crypto Features: – Swiss-licensed bank offering custody, trading, staking, and tokenized investments; rebrand from SEBA. |

| Sygnum Bank | Available in: Switzerland & Singapore (institutional/qualified clients); Access: Online (institutional platform); Crypto Features: Regulated trading, custody, staking, tokenization, and lending. |

| SBI VC Trade | Available in: Japan; Access: Online & App; Crypto Features: – Licensed exchange under SBI Group, spot trading, lending, low-fee accounts; – Expanding ecosystem. |

| DBS Bank | Available in: Singapore (accredited & institutional investors); Access: Relationship + Online (DDEx); Crypto Features: – Tokenization, trading, and custody via DBS Digital Exchange; – Access via DBS Vickers for eligible clients. |

| Standard Chartered | Available in: Hong Kong; Access: Institutional platforms; Crypto Features: – Institutional digital-asset custody; – Broader digital-asset services (tokenization insights). |

| ZA Bank | Available in: Hong Kong; Access: App (retail); Crypto Features: – Direct retail crypto trading in-app (BTC/ETH) with HKD/USD; – 0% intro trading commission promo; – Previously supported exchange off-ramps. |

Top 6 Crypto-Friendly Banks in the USA (2026)

1. Custodia Bank (formerly Avanti Bank)

Custodia Bank (formerly Avanti) is a Wyoming-chartered Special Purpose Depository Institution (SPDI) designed to bridge blockchain finance and the U.S. banking system. It operates on a 100 % reserve model, providing institutional cash management and Bitcoin custody for digital-asset companies.

Crypto-Friendly Statement

“We broke ground on the legal/regulatory front, proving that U.S. banks can collaborate to tokenize demand deposits on a permissionless blockchain in a regulatorily-compliant manner,” said Caitlin Long, CEO of Custodia Bank.

Key Features

- SPDI Charter: Regulated under Wyoming’s SPDI framework for crypto banking.

- Full-Reserve Model: Holds client funds 1:1; no fractional lending.

- Bitcoin Custody: Institutional-grade custody for businesses.

- Stablecoin Initiative: Partnered with Vantage Bank to issue tokenized USD deposits (“Avit”).

- Regulatory Oversight: Supervised by the Wyoming Division of Banking; AML/KYC compliant.

2. Anchorage Digital Bank

Anchorage Digital is the first federally chartered crypto bank in the United States, authorized by the OCC. It serves institutional clients seeking secure custody, staking, settlement, and governance infrastructure under strict regulatory oversight.

Crypto-Friendly Statement

“Our clients can safely participate in digital asset markets from custody to trading, staking, and governance—all from within the most advanced and proven security architecture.”

Key Features

- Federal Charter: Granted by the Office of the Comptroller of the Currency (OCC).

- Qualified Custody: Regulated digital-asset custody for institutional investors.

- Staking & Settlement: Offers staking, trading, and governance participation.

- Institutional Clients: Serves firms like Visa and Franklin Templeton.

- SOC 2 Compliance: Certified for operational and data security.

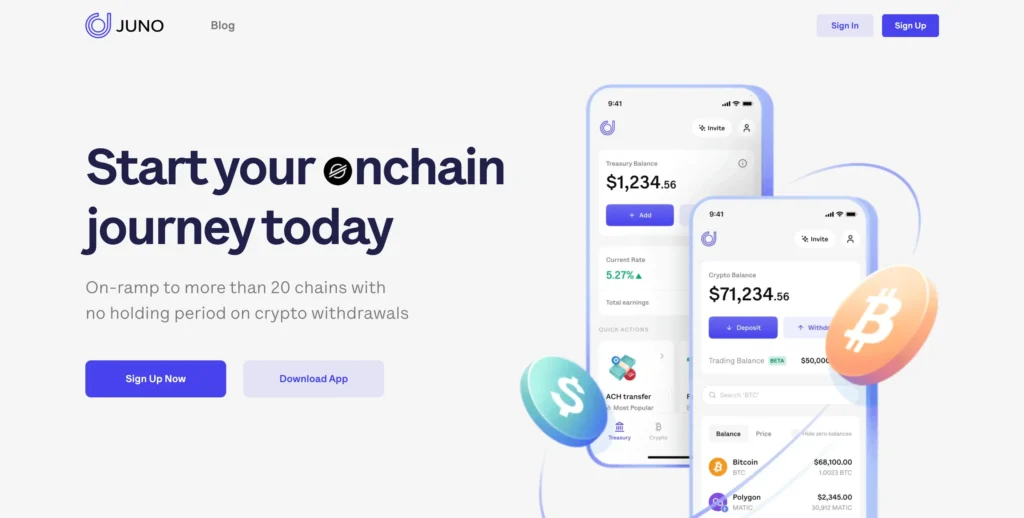

3. Juno

Juno combines traditional banking with cryptocurrency access through a single app. Users can earn, spend, and transfer both fiat and crypto assets across 20+ supported blockchains, maintaining regulatory compliance via U.S. custodial partners.

Crypto-Friendly Statement

“Digital custody and exchange services are provided through third parties. By applying for or opening a digital currency wallet on Juno, you agree to the custody and exchange agreements set forth by the third-party cryptocurrency service provider Zero Hash.”

Key Features

- Multi-Chain Access: Buy, send, and receive over 20 cryptocurrencies.

- Unified Banking: One account for USD and crypto.

- 1:1 Custody: Assets held with regulated U.S. partners.

- App & Web Access: Cross-platform with 2FA security.

- Regulatory Status: Registered with FinCEN; partnered with Evolve Bank & Trust.

4. Quontic Bank

Quontic is an FDIC-insured digital bank recognized as the first in the U.S. to offer Bitcoin Rewards Checking. It integrates crypto incentives into everyday spending while maintaining complete banking security and compliance.

Crypto-Friendly Statement

“Quontic is excited to be able to offer our customers the opportunity to earn Bitcoin as a reward and build wealth simply by swiping a debit card,” said Steven Schnall, CEO & Founder of Quontic.

Key Features

- Bitcoin Rewards: Earn BTC on debit card purchases.

- FDIC-Insured: Traditional protection for fiat funds.

- Online-Only: Fully digital operations.

- Crypto Cashback: BTC deposited automatically in the linked wallet.

- U.S. Regulated: Licensed and supervised by the FDIC.

5. Ally Bank

Ally Bank provides a reliable on-ramp to crypto by supporting transfers to compliant digital-asset exchanges. Through Ally Invest, users can access educational resources and crypto-related investment funds.

Crypto-Friendly Statement

“We don’t currently offer cryptocurrency spot trading. However, we do offer crypto-specific funds and stocks to indirectly expose your portfolio, no coins or wallet needed.”

Key Features

- Exchange Funding: Enables deposits/withdrawals to trusted exchanges.

- Crypto Education: Guides and resources via Ally Invest.

- Regulated Operations: FDIC member; adheres to U.S. financial law.

- Digital Platform: Integrated banking and investment dashboards.

- No Direct Trading: Focused on compliant third-party integrations.

6. Mercury

Mercury offers modern business banking tailored for startups, fintechs, and Web3 firms. Through FDIC-insured partner banks, it enables compliant fiat operations for crypto-related companies.

Crypto-Friendly Statement

“Banking loved by crypto companies.”

Key Features

- Startup-Focused: Supports fintech and crypto founders.

- Web3 Banking: Built for blockchain and NFT projects.

- FDIC Coverage: Partnered with Evolve and Choice banks.

- API Access: Programmatic treasury management.

- Transparent Fees: No hidden transaction costs.

Top 7 Crypto-Friendly Banks in Europe (2026)

1. Revolut (UK)

Revolut is a global app that unites traditional banking with crypto. Users can buy, sell, and hold over 80 assets, swap between fiat and digital currencies, and generate automated tax reports.

Crypto-Friendly Statement

“Everything you need for getting confident with crypto is all in one place — from fast trades to easy transfers, with fees from 0% (depending on your plan and trade volume).”

Revolut also makes it simple to download your Cryptocurrency Statement directly from the app. This downloadable report provides a comprehensive record of all your crypto activity (including purchases, sales, and transfers), helping you stay organized and compliant for tax or accounting purposes.

Key Features

- Crypto in-App: Trade 80+ cryptocurrencies.

- Instant Conversion: Real-time crypto-to-fiat at card spend.

- Koinly Tax Link: Integrated crypto tax reporting.

- Global Access: Operates in 30+ countries.

- Regulated: Registered under the UK FCA as a crypto asset firm.

2. Wirex (UK)

Wirex combines crypto and fiat in a single multicurrency account with a Visa-enabled debit card. It pioneered seamless crypto spending with instant conversion at the point of sale.

Crypto-Friendly Statement

“The ultimate solution for spending crypto and stablecoins. With Wirex, you can enjoy seamless transactions, earn up to 8% Cryptoback™ every time you spend, and stay in control of your card’s security.”

Wirex doesn’t provide a single, standardized Crypto-Friendly Statement, but it does offer comprehensive financial statements for all accounts, including crypto, fiat, and stablecoins. These tamper-evident PDF reports can be easily downloaded to track balances, transactions, and asset movements, making reconciliation and tax reporting simple.

Key Features

- Crypto Debit Card: Auto-converts crypto to fiat at checkout.

- Multi-Currency Wallet: Supports 30+ fiat and digital currencies.

- Cashback (Cryptoback): Earn up to 8 % back in WXT tokens.

- Global Reach: Available across the EU, UK, and APAC.

- Regulated: FCA-licensed; compliant with AML rules.

3. Bitwala (Germany)

Bitwala, reborn in 2023 after Nuri’s wind-down, offers an integrated platform that combines euro banking, crypto trading, and Visa payments. Its partnership with Striga enables smooth crypto-fiat operations across the EU.

Crypto-Friendly Statement

According to Bitwala’s official blog, the company is focused on expanding Bitcoin accessibility across Europe by offering a simple, secure, and compliant platform for everyday crypto use.

Through its partnership with Striga, Bitwala offers instant Bitcoin trading, euro deposits via SEPA, and Visa debit payments, all within a single, regulated app. The team emphasizes its mission to make Bitcoin banking intuitive and accessible for users across the European Economic Area.

Key Features

- Relaunch & Card: Revived the Bitwala app with Visa debit functionality for everyday spending.

- EU Focus: German-based, compliant with EU financial standards.

- Crypto Access: 24/7 Bitcoin and Ethereum trading with instant euro transfers.

- Future Roadmap: Integration with Lightning Network and improved multi-asset support.

4. BBVA (Spain)

BBVA has moved from pilots to a full, MiCA-compliant crypto rollout in Spain, integrating Bitcoin and Ether trading and custody directly inside its mobile banking app. That means retail users can buy, sell, and safeguard BTC/ETH without leaving BBVA’s ecosystem or wiring funds to third-party exchanges.

Crypto-Friendly Statement

According to Yahoo Finance, BBVA’s crypto service launch marks a significant shift in traditional banking, positioning the institution as a bridge between regulated finance and the digital asset economy.

The bank stated that the rollout was driven by strong customer demand and reflects its strategy to integrate blockchain-based products into mainstream financial services.

Key Features

- Availability: Spain (retail), with earlier crypto services in Switzerland/Turkey via affiliates

- Assets: Bitcoin (BTC), Ether (ETH) at launch

- In-App Integration: Buy/sell/custody in the BBVA mobile & web

- Compliance: MiCA authorization in Spain

- Roadmap: Exploring a BBVA stablecoin (euro-referenced)

5. Bank Frick (Liechtenstein)

Bank Frick is a pioneer of regulated “blockchain banking” in the EEA micro-hub of Liechtenstein, serving professional and institutional clients. It provides trading, custody, and tokenization under a clear regulatory framework, with due diligence processes that vet the origin of tokens and AML/KYC status.

Crypto-Friendly Statement

“Bank Frick enables professional market participants to have regulated access to crypto assets such as cryptocurrencies or tokenised assets. With us as your partner, you will receive easy access to a newly developing asset class.”

Key Features

- Focus: Institutional/professional clients (Europe)

- Services: Trading, secure custody, tokenization

- Compliance: Strong AML/KYC; documented custody policy

- Track Record: Among the earliest regulated European banks in crypto

- Supported Assets: Expanded lineup incl. ADA, DOT, XTZ

6. AMINA (SEBA Bank) (Switzerland)

AMINA is a FINMA-licensed Swiss digital asset bank offering custody, trading, staking, and tokenized investments to private and institutional clients.

The 2023 rebrand didn’t alter its regulatory core; it continues to operate as a Swiss bank and securities dealer specializing in crypto banking. AMINA has continued to add networks and staking options (most recently, institutional staking for Polygon’s POL), reflecting an expanding institutional toolkit.

Crypto-Friendly Statement

Franz Bergmueller, CEO of AMINA, said:

“Our brand signifies a new era in the company’s growth and strategy; we are a key player in crypto banking and are here to define the future of finance. With our client-focused approach, our years of traversing traditional and crypto finance, we offer a platform for investors to build wealth safely and under the highest regulatory standards.”

Key Features

- License: Swiss banking & securities dealer (FINMA)

- Services: Custody, trading, staking, tokenised investments

- Clients: Private & institutional (multi-regional reach)

- Recent Additions: Institutional staking support (e.g., POL)

- Hubs: Switzerland + presence in ADGM, HK, Singapore

7. Sygnum Bank (Switzerland)

Sygnum positions itself as the “world’s first regulated digital asset bank,” holding a Swiss banking license and Singapore MAS licenses. It serves qualified and institutional clients with custody, spot/derivatives trading, staking, tokenization, and Lombard lending against crypto collateral.

Sygnum frequently expands network support (e.g., recent SUI custody/trading/staking) while keeping client assets bankruptcy-remote and off-balance-sheet.

Crypto-Friendly Statement

Stefan Linder, Sygnum industry advisor and Co-Founder of the Swiss Economic Forum, noted that: “Sygnum has the potential to usher in a new age in banking with blockchain technology and to redefine trade of traditional and digital assets.”

Key Features

- Licenses: FINMA (CH), MAS (SG) permissions.

- Services: Custody, trading (spot/derivs), staking, tokenization.

- Institutional: Off-balance-sheet, bankruptcy-remote setup.

- New Support: SUI: custody, trading, staking, lending.

- Geography: Switzerland, Singapore, and expanding to the EU/ME.

Top 4 Crypto-Friendly Banks in Asia (2026)

1. SBI VC Trade (Japan)

SBI VC Trade is SBI Group’s regulated crypto arm in Japan, providing spot trading, lending, and, most recently, stablecoin capabilities.

In 2025, it became the first registered Japanese firm authorized to handle USDC payments under Japan’s updated stablecoin framework, evidence of both regulatory progress and SBI’s leadership.

The exchange’s services are framed within the country’s strict licensing regime, making it a popular fiat on- and off-ramp for domestic users and institutions.

Crypto-Friendly Statement

According to SBI Holdings’ official press release, SBI VC Trade received regulatory approval to issue and manage the U.S. dollar–denominated stablecoin USDC in Japan under the revised Payment Services Act.

Key Features

- Jurisdiction: Japan (licensed).

- Services: Part of SBI Group (a large financial conglomerate).

- Milestone: First JP approval for USDC-related services (2025).

- Group Backing: Part of SBI Group (a large financial conglomerate).

- Target Users: Retail & institutional (regulated environment).

2. DBS Bank (Singapore)

DBS runs DDEx, a bank-operated platform for digital currencies and security tokens, available to accredited and institutional investors. Access is integrated via DBS Digibank for eligible wealth clients, with custody and fiat debits linked inside DBS’s environment.

Crypto-Friendly Statement

As stated on DBS’s official site, the DBS Digital Exchange (DDEx) enables accredited investors to trade cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash, and XRP, alongside security tokens, within a fully regulated and bank-backed environment.

DDEx operates under the oversight of the Monetary Authority of Singapore (MAS), ensuring that all activities adhere to Singapore’s financial and anti-money laundering regulations.

Key Features

- Access: Accredited investors & institutions only.

- Platform: DBS Digital Exchange (DDEx).

- Integration: DBS digibank app for eligible clients.

- Assets: BTC, ETH, plus selected tokens/STOs.

- Regime: Operates under MAS rules/compliance.

3. Standard Chartered (Hong Kong & Singapore)

Standard Chartered serves the institutional segment through digital asset custody and market infrastructure, primarily via subsidiaries such as Zodia. In 2025, it expanded custody into Hong Kong and set up a new EU entity in Luxembourg to serve MiCA markets; it also joined ventures around stablecoins in HK.

Crypto-Friendly Statement

As reported by CNBC, Standard Chartered’s Zodia Custody has expanded into Hong Kong to meet the growing demand for regulated crypto services from institutions. The move aligns with Hong Kong’s pro-digital asset policies, strengthening Standard Chartered’s position as a global leader in compliant crypto custody.

Key Features

- Focus: Institutional custody & infrastructure.

- Footprint: HK expansion; EU entity in Luxembourg.

- Services: Digital-asset custody; banking/FX rails for crypto firms.

- Partnerships: FalconX settlement & services.

- Roadmap: HK stablecoin JV (Anchorpoint Financial).

4. ZA Bank (Hong Kong)

ZA Bank is Hong Kong’s largest virtual bank and the first in Asia to introduce direct, in-app retail crypto trading (BTC/ETH) with on-ramps for HKD/USD. The workflow is located within the ZA app, featuring clear fee schedules and promotions (e.g., 0% introductory commission) that are published at launch.

Crypto-Friendly Statement

According to ZA Bank’s official announcement, the bank launched its virtual-asset trading services in partnership with HashKey and OSL, two of Hong Kong’s licensed crypto exchanges, to ensure a secure and fully compliant trading environment.

Key Features

- Users: Retail (HK) via ZA app.

- Assets: BTC, ETH (at launch).

- Currencies: HKD, USD support.

- Fees: Clear entry/platform fees; 0% promo at launch.

- Positioning: First retail crypto trading by a bank in Asia.

Key Considerations When Choosing a Crypto-Friendly Bank

1. Regulatory Compliance

Always verify that the bank operates under an official license and follows Anti-Money Laundering (AML) and Know Your Customer (KYC) standards. A regulated institution ensures that your crypto and fiat transactions comply with international financial laws, reducing the risk of frozen funds or account closures.

2. Fees & Transaction Limits

Compare deposit, withdrawal, and conversion fees. Crypto-compatible banks often charge dynamic spreads or service fees that can vary by asset and region.

Be sure to check:

- Daily withdrawal and transfer limits;

- Conversion fees between crypto and fiat;

- Hidden costs, such as inactivity or custody fees, as well as any transaction fees or recurring monthly fees.

3. Security & Insurance

Security should be non-negotiable. Look for banks offering cold storage, multi-signature wallets, and insurance coverage for both fiat and digital assets. Institutions like Anchorage Digital Bank and Sygnum Bank provide insured custody and audited reserves, adding a strong layer of protection against breaches and enhancing fraud protection.

4. Supported Regions & Currencies

Check whether the bank operates in your region and supports your preferred fiat currencies and crypto assets. Some institutions serve only specific markets: for example, DBS Bank mainly operates in Asia, while Quontic Bank focuses on U.S. customers.

5. Reputation & Transparency

Before committing, research the bank’s history, audits, and client reviews to ensure a secure investment. Reputable digital-asset-friendly banks regularly publish proof-of-reserves reports, transparency statements, or obtain certifications from trusted financial regulators.

Why Banks Are Adopting Crypto Services?

1. Meeting Customer Demand and Staying Competitive

Customers (especially younger generations) want banks that support digital assets and crypto payments. Traditional banks risk falling behind if they don’t adapt to this growing trend.

According to a 2025 report by Elliptic, 44% of financial institutions say they are ready to start offering accounts to crypto businesses, while 21% are already active in digital asset services.

2. Creating New Revenue Streams Through Innovation

Crypto services enable banks to expand beyond traditional products, such as savings accounts and loans. They now earn revenue from custody fees, trading, staking, tokenization, and blockchain-based payments.

These services help banks diversify their income and increase profit margins, especially in today’s low-interest-rate environment. Institutions that embrace digital assets are positioning themselves as leaders in the new era of financial innovation.

3. Gaining Confidence Through Regulatory Clarity

Stronger regulations have made it easier for banks to enter the crypto market with confidence.

In the U.S., the GENIUS Act has created clearer compliance standards for digital assets, while Europe’s MiCA (Markets in Crypto-Assets Regulation) is building a unified legal framework for crypto operations.

With better guidance and oversight, banks can now offer regulated, transparent, and customer-friendly crypto services that build long-term trust.

Banking Failures and Risks in the Crypto Market

The connection between traditional banking and cryptocurrency is growing rapidly, but it still presents challenges. In recent years, several well-known banks have collapsed after becoming overly exposed to crypto volatility, illustrating the fragility of this relationship when not adequately managed.

1. Liquidity and Volatility

Cryptocurrency prices can fluctuate significantly in a short period. When this happens, banks that hold or process crypto-related assets may face sudden liquidity issues, making it harder for them to meet client withdrawals or maintain adequate balance reserves.

2. Regulatory Uncertainty

Each country has its own rules for crypto assets. The lack of global regulation makes compliance particularly challenging, especially for banks that operate across multiple regions.

3. Operational and Cybersecurity Risks

Because crypto transactions happen online, digital banks are frequent targets for hacking, fraud, or system failures. A single security breach can cause significant financial and reputational damage.

FAQ

A crypto-friendly bank is a financial institution that supports transactions related to cryptocurrencies. It allows users to buy, sell, or transfer digital assets between exchanges and traditional accounts without restrictions, often enabling them to trade crypto with integrated tools. These banks often integrate blockchain technology and offer additional banking services.

Yes, but only through banks that support crypto-fiat conversions. You’ll need to sell your crypto on an exchange or through the bank’s integrated platform, then withdraw the funds in your local currency. Always check the bank’s supported exchanges, cryptocurrency transactions policies, and withdrawal limits before making a transfer.

The best account depends on your trading habits and location. For U.S. users, Anchorage Digital and Vast Bank offer regulated crypto custody and fiat integration. In Europe, Revolut and Wirex are highly reliable for seamless crypto-fiat transfers. Select a bank that offers swift deposits, transparent fees, and robust exchange partnerships across reputable crypto platforms.

Banks like Wirex, Revolut, and Quontic Bank offer debit cards that allow you to spend cryptocurrency at any location where Visa or Mastercard is accepted. These cards automatically convert your digital assets into fiat at the point of sale, combining flexibility with global usability for everyday cryptocurrency payments.

Final Thoughts

In 2026, banks that support digital assets will give you a safe and regulated way to manage both traditional and digital assets in one place.

They combine compliance, security, and convenience, making it easier to buy, sell, store, and account for crypto responsibly, whether you transfer funds, hold assets in a crypto wallet, or diversify into regulated crypto investments.

Still, not all banks offer the same level of protection or features. Before opening an account, take the time to research each bank’s license, supported assets, and fees to find the one that best fits your needs, especially in terms of transaction fees and service tiers.

As regulations continue to evolve, crypto-friendly banks will continue to expand their services, helping you access the digital economy with greater trust and confidence.