7 Best Optimism DEX Platforms of 2026

Using DeFi on Ethereum can be slow and costly. High gas fees and long wait times make trading hard, especially for beginners. Optimism DEXs solve this. Built on a fast, low-cost Layer 2 network using optimistic rollups, they let you trade quickly while maintaining Ethereum’s security. Users pay over 90% less in gas fees than on the […]

Using DeFi on Ethereum can be slow and costly. High gas fees and long wait times make trading hard, especially for beginners. Optimism DEXs solve this. Built on a fast, low-cost Layer 2 network using optimistic rollups, they let you trade quickly while maintaining Ethereum’s security. Users pay over 90% less in gas fees than on the mainnet.

In this guide, we’ll show you the seven best Optimism DEX platforms of 2026 and how to use them efficiently within the Optimism ecosystem.

Top 7 DEXs on Optimism

| Platform | Features |

|---|---|

| 1. Velodrome Finance V2 (Optimism) | Best For: Yield Farming & Governance 24-Hour; Trading Volume: $668,487; Unique Feature: Dual-token ve-model system, No-KYC; |

| 2. Uniswap V3 (Optimism) | Best For: Advanced Traders & Liquidity Providers 24-Hour; Trading Volume: $7,107,585; Unique Feature: Concentrated liquidity, No-KYC; |

| 3. Velora, previously ParaSwap | Best For: Aggregated Swaps 24-Hour; Trading Volume: $299,197; Unique Feature: Best-rate routing across DEXs, No-KYC; |

| 4. Rubicon (Optimism) | Best For: Order Book Trading 24-Hour; Trading Volume: $178.12; Unique Feature: CEX-style UX on L2, No-KYC; |

| 5. Curve (Optimism) | Best For: Stablecoin Swaps 24-Hour; Trading Volume: $1,116,114; Unique Feature: Low slippage for stable assets, No-KYC; |

| 6. 1inch | Best For: DEX Aggregation 24-Hour; Trading Volume: $12,022,845; Unique Feature: Pathfinder algorithm, No-KYC; |

| 7. Matcha (Optimism) | Best For: User-Friendly DEX Access 24-Hour; Trading Volume: $0.00; Unique Feature: Clean UI with powerful search, No-KYC; |

Disclaimer: Trading volumes can be highly volatile and may change quickly. For the most accurate information, refer to the latest data on CoinGecko.

And do you want to move funds from one exchange to another? Learn how to transfer from Binance to Coinbase.

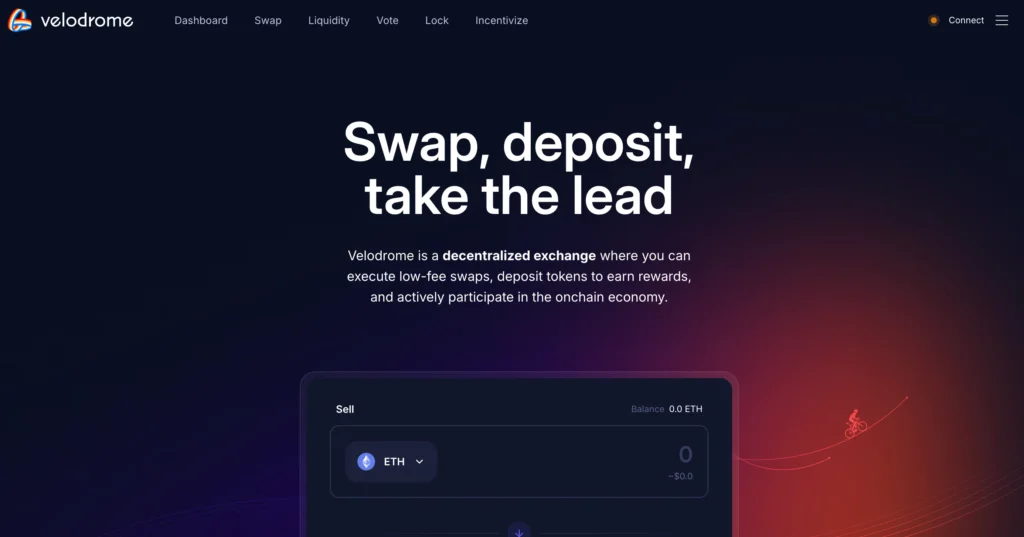

1. Velodrome Finance V2 (Optimism)

Velodrome is a full-stack AMM platform that goes beyond simple swaps and yield farming. It acts as the core liquidity hub of Optimism’s Superchain and aligns with the broader vision of the ecosystem fund to incentivize growth.

Its governance runs on veVELO. By locking VELO tokens, members can vote on key decisions and earn a share of emissions through bribes. Velodrome also offers users airdrops with OP token rewards to boost participation, making it even more connected to Optimism’s broader governance system.

Currently, the platform supports 59 coins and 163 trading pairs, showing a strong supply of assets.

Key Features

- Dual-Token ve-Model: Lock VELO tokens for veVELO to earn trading fees and governance rights.

- Flywheel Economics: Protocols bribe voters to direct emissions to their pools.

- Optimized for Partnerships: Explicitly built for protocol-to-protocol collaborations.

- Weekly Epoch System: Rewards are distributed every Thursday.

| Pros | Cons |

|---|---|

| Yield incentives through bribes and emissions. | The complexity of the ve-model may deter beginners. |

| Strong system integration across Optimism. | Token emissions could cause dilution. |

| Weekly rewards create predictable incentives. | Lower trading volume than top decentralized exchanges. |

2. Uniswap V3 (Optimism)

Uniswap V3 on Optimism works like it does on the mainnet, but faster and cheaper. It offers concentrated liquidity, multiple fee levels, and built-in price oracles (TWAP), making it easy to trade a wide range of ERC-20 tokens on Layer 2.

UNI token holders make governance decisions, like setting fee tiers or adjusting trading limits. Uniswap is also testing new governance models, such as futarchy, in partnership with the Optimism Foundation. This reflects Uniswap’s ongoing project evolution within the optimism ecosystem.

Currently, the platform supports 64 coins and 181 trading pairs.

Key Features

- Concentrated Liquidity: Provide liquidity within specific price ranges for higher returns.

- Multiple Fee Tiers: Choose from 0.01%, 0.05%, 0.3%, and 1% fee structures.

- Advanced Analytics: Current data on pool performance and impermanent loss.

- Cross-Chain Support: Seamless integration with the Ethereum mainnet positions.

| Pros | Cons |

|---|---|

| High liquidity and deep market presence. | UI can feel advanced for casual users. |

| Multiple fee tiers benefit traders and LPs. | Manual liquidity management is required. |

| Real-time analytics for performance tracking. | Impermanent loss still applies. |

3. Velora, previously ParaSwap

Velora is a next-generation trading aggregator built for intent-based orders. It simplifies complex cross-chain trades by automatically optimizing key settings like slippage, timing, and limit prices while supporting basic token swaps.

The platform works natively on OP Mainnet and other blockchains and aims to streamline multi-DEX access while reducing friction for everyday users.

Key Features

- Multi-DEX Routing: Automatically finds the best prices across platforms.

- Gas Estimation: Transparent fee calculations before trading.

- Slippage Protection: Automatic adjustments to prevent failed transactions.

- Mobile Optimized: Smooth experience across all devices.

| Pros | Cons |

|---|---|

| Best-rate swaps from multiple DEXs. | Limited liquidity on less popular tokens. |

| Mobile app optimization improves accessibility. | Not ideal for advanced trading strategies. |

| Slippage protection reduces failed trades. | Lower visibility than 1inch or Matcha. |

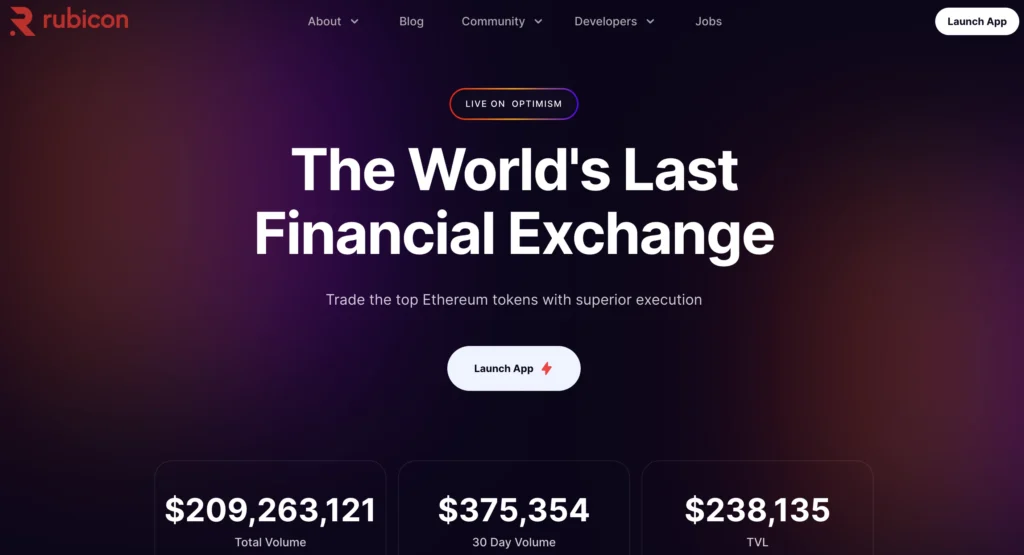

4. Rubicon (Optimism)

Rubicon brings a full order book trading experience to Layer 2. Designed for active traders, Rubicon gives members precise control over their trades while keeping everything transparent and on-chain.

The platform has received Retroactive Public Goods funding and is closely tied to Optimism’s governance efforts to grow the use of on-chain order books.

The platform maintains a detailed log of orders and transactions to enhance transparency.

Key Features

- Central Limit Order Book (CLOB): A Familiar trading interface like centralized exchanges.

- Maker-Taker Model: Earn rebates for providing liquidity as a maker.

- Advanced Order Types: Stop-loss, take-profit, and conditional orders.

- Professional Tools: Charts, order management, and portfolio tracking.

| Pros | Cons |

|---|---|

| CEX-style experience with full order book. | Very low daily trading volume. |

| Rebate incentives for liquidity providers. | Smaller user base and visibility. |

| Supports advanced order strategies. | Limited token pairs compared to peers. |

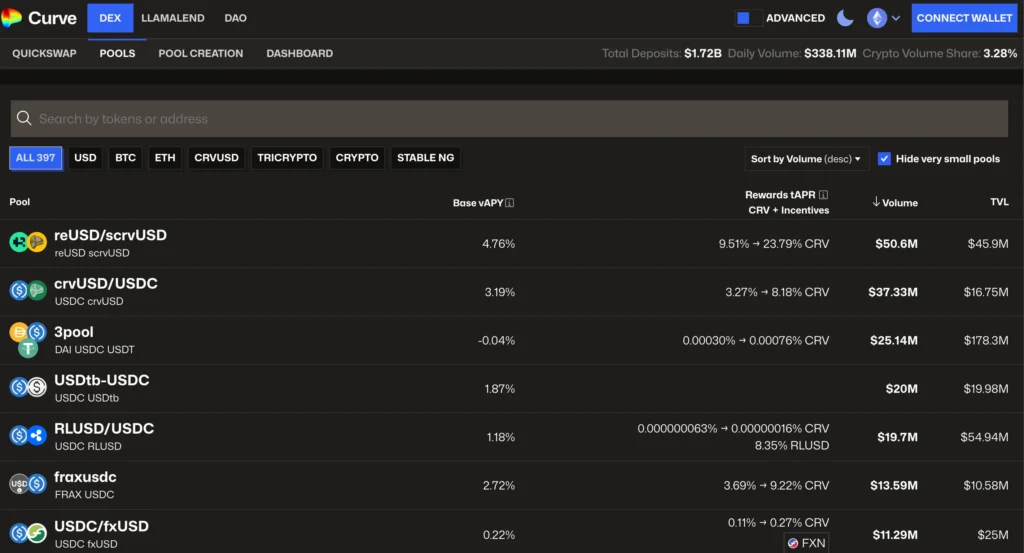

5. Curve (Optimism)

Curve on Optimism is designed for high-volume stablecoin trading and is ideal for swaps between DAI, USDC, and USDT.

As part of the Optimism Collective, Curve has received OP-funded grants to enhance its user interface and expand its cross-chain capabilities, thereby strengthening Optimism’s stablecoin ecosystem.

Currently, the exchange supports 11 coins and 26 trading pairs.

Key Features

- Stable Asset Optimization: Purpose-built for stablecoin and similar-asset swaps.

- Minimal Slippage: Advanced bonding curves reduce price impact.

- Yield Farming Rewards: Earn CRV tokens and boost rewards through veCRV.

- Multi-Asset Pools: Trade between multiple stablecoins in a single swap.

| Pros | Cons |

|---|---|

| Minimal slippage for stablecoin trades. | Not suitable for volatile token swaps. |

| Yield farming options via CRV and veCRV. | UI can be unintuitive for newcomers. |

| Strong capital efficiency in stable pools. | Concentrated use case (stable assets only). |

6. 1inch

1inch on Optimism enables faster and cheaper token swapping using smart routing (Pathfinder), gas-saving features, and on-chain limit orders.

The latest Pathfinder upgrade boosts swap efficiency by up to 6.5% on average, making a big difference for gas-sensitive trades on Layer 2.

The platform is governed by the 1INCH DAO, which oversees rewards and incentive programs. Some of this funding comes from OP tokens through Optimism’s Governance Fund.

Key Features

- Pathfinder Algorithm: Automatically finds the most efficient trading routes.

- Multi-DEX Aggregation: Compares prices across all Optimism decentralized exchanges simultaneously.

- Gas Optimization: Minimizes processing costs even further.

- Limit Orders: Set buy/sell orders at specific prices.

| Pros | Cons |

|---|---|

| Best-in-class trade routing and gas optimization. | The interface might overwhelm basic users. |

| Aggregates liquidity from all major Optimism DEXs. | Requires signing multiple transactions. |

| Support for limit orders on-chain. | Some tokens may show low liquidity routing. |

7. Matcha (Optimism)

Matcha offers a simple, easy-to-use trading interface with smart limit orders and cross-chain swaps. It pulls liquidity from over 130 sources to help participants get the best prices.

A recent upgrade introduced Matcha Auto on Optimism, allowing gasless trades on Layer 2 with much lower failure rates, around 5.4%.

You don’t need to take part in governance to use Matcha. Yet, decisions about the protocol are made by the open-source 0x DAO. Participants also benefit from the shared governance and funding provided by the Optimism Superchain.

Currently, the exchange supports five coins and seven trading pairs.

Key Features

- Clean, Intuitive UI: Minimalist design focuses on ease of use.

- Powerful Token Search: Find any token quickly with smart search.

- Educational Resources: Built-in guides and explanations.

- 0x Protocol Integration: Access to professional market-making.

| Pros | Cons |

|---|---|

| Intuitive UI is ideal for beginners. | Lowest trading volume among listed DEXs. |

| Strong search and discovery tools. | Lacks pro trading features. |

| Educational resources built in. | Fewer tokens than larger aggregators. |

How to Use Decentralized Exchanges on Optimism

Getting started with Optimism DEXs requires a few essential steps to ensure smooth and secure trading:

1. Wallet Setup and Network Configuration

Add the network details to configure your wallet to connect to the Optimism network. Most popular wallets, such as MetaMask, WalletConnect, and Coinbase Wallet, support Optimism natively.

2. Bridge Assets to Optimism

Transfer your assets from the Ethereum mainnet using official bridges, such as the Optimism Gateway, or third-party solutions like Hop Protocol and Synapse.

3. Acquire ETH for Transaction Fees

Ensure your wallet contains sufficient ETH to cover network fees on Optimism. While fees are significantly lower than on mainnet, you’ll still need ETH for gas.

4. Connect to Your Chosen Decentralized Exchange

Navigate to your preferred decentralized exchange platform and connect your wallet. To avoid phishing attacks, always verify that you’re using the official website or visiting links from trusted sources.

5. Execute Your Trade

Select your trading pair, enter the desired amount, review the trade details, including fees and slippage, and confirm the trade.

6. Monitor and Manage Positions

For liquidity providers, regularly monitor your positions for optimal performance and consider rebalancing strategies based on market conditions.

Pros and Cons of Using Optimism Decentralized Exchanges

| Upsides | Downsides |

|---|---|

| Low Gas Fees: Optimism reduces gas costs by over 90% vs Ethereum. | Requires Bridging: Assets must be bridged from Ethereum/mainnet. |

| Withdrawal Delays: Transferring funds back to Ethereum can be a slow process. | Limited Token Support: Not all tokens or decentralized applications (dApps) are currently available. |

| Ethereum-Level Security: Built on Ethereum’s Layer 2 rollup tech. | User Experience Can Be Complex: Wallet setup and bridging can be confusing for beginners. |

| No KYC: Trade directly from your wallet; no sign-up is needed. | User Experience Can Be Complex: Wallet setup and bridging may confuse beginners. |

| Access to Top DeFi Protocols: Uniswap, Synthetix, Velodrome & more. | Smaller Liquidity on Some DEXs: Compared to Ethereum L1 or CEXs. |

| Ideal for Small Traders: Low fees make it accessible to everyone. | Still an Evolving Ecosystem: Some tools and integrations are new. |

FAQ

A Decentralized Exchange (DEX) enables participants to trade cryptocurrency assets peer-to-peer without intermediaries, utilizing smart contracts on blockchain networks.

Optimism significantly reduces gas costs and speeds up transactions, while leveraging Ethereum’s security and existing developer base.

Using a decentralized exchange on Optimism combines the security of Ethereum with the speed and affordability of a Layer 2 solution, making it ideal for traders of all levels.

Yes. Optimism inherits Ethereum’s base-layer security and has been audited and battle-tested through major DeFi protocols like Uniswap and Synthetix.

Both are strong Layer 2 solutions. Optimism emphasizes simplicity and ecosystem collaboration (e.g., the OP Stack), while Arbitrum offers features like Arbitrum Nitro. Your choice depends on specific protocol support and personal preferences.

Final Thoughts

Optimism DEXs are redefining the DeFi trading experience in 2026. With faster speeds and lower fees, the Optimism decentralized exchange offers a compelling alternative to the Ethereum mainnet and other Layer 2 solutions.

Whether you’re a beginner or an experienced trader, exploring the best Optimism DEX platforms could be a smart move in your crypto journey. Always do your own research and consult multiple sources before interacting with any project.

Moreover, for users diversifying across L2s, here’s the complete guide on how to stake MATIC (POL).