The Best Crypto Bridges of 2026

Are you seeking the best crypto bridge to move assets across blockchains? We’ve got you! Indeed, high gas fees, long wait times, and confusing interfaces make transferring tokens from one chain to another frustrating, especially for new users. Without the right tools, you risk delays, losses, or even bridging to the wrong network. But here’s […]

Are you seeking the best crypto bridge to move assets across blockchains? We’ve got you!

Indeed, high gas fees, long wait times, and confusing interfaces make transferring tokens from one chain to another frustrating, especially for new users. Without the right tools, you risk delays, losses, or even bridging to the wrong network.

But here’s the good news: we’ve gathered the top crypto bridges of 2026, reviewed them, asked for feedback on community websites, and compiled the list based on key factors, such as security, fees, and ease of use.

Read until the end, pick your tool, and bridge assets faster, cheaper, and smarter, no matter what chain you’re on!

9 Best Cross-Chain Bridges in 2026

| Across.to Bridge | Best for: Overall cross-chain transfers; Supported Blockchains: 20+; Security Model: UMA Optimistic Oracle & Dataworker; Real Assets Only: Yes; Notable Cons: Limited chain support & relayer dependency; |

| Stargate Finance | Best for: Native token transfers at scale; Supported Blockchains: 80+; Security Model: LayerZero DVN & unified pools; Real Assets Only: Yes; Notable Cons: Variable fees & gas overhead; |

| Rhino.fi | Best for: Self-custody & security-minded users; Supported Blockchains: 32+; Security Model: StarkEx Validium & Data Availability Committee; Real Assets Only: Yes; Notable Cons: Variable transfer fees & low fees for high volume |

| Rubic Exchange | Best for: One-click cross-chain swaps; Supported Blockchains: 50+; Security Model: Fully decentralized & audited; Real Assets Only: Yes; Notable Cons: Fixed fees add up & gas applies |

| deBridge | Best for: Devs & power users who need more than just swaps; Supported Blockchains: 20+; Security Model: Decentralized validators & Arweave; Real Assets Only: Yes; Notable Cons: Flat fees add up & not beginner-friendly |

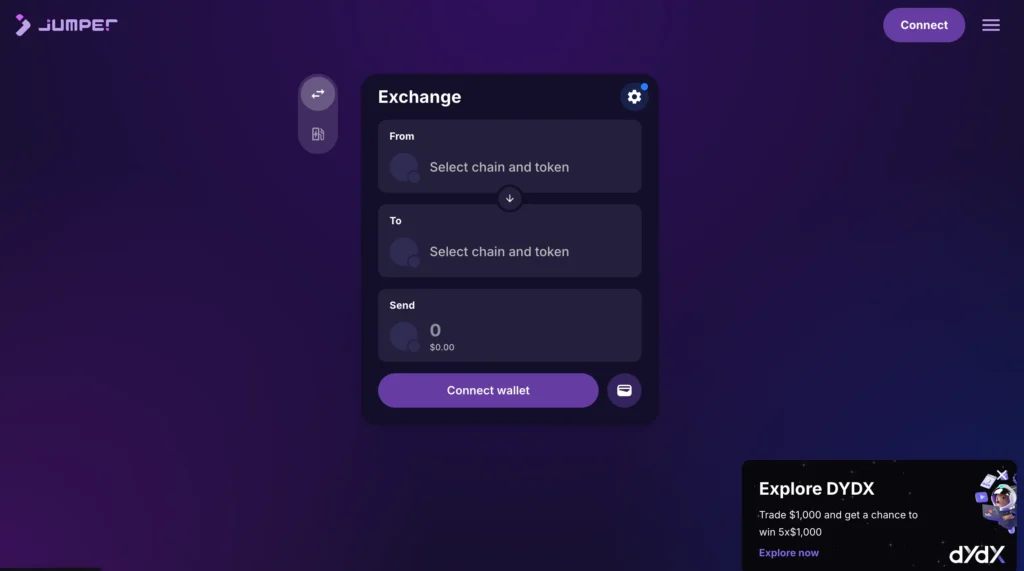

| Jumper Exchange | Best For: Aggregator for cross-chain swaps Supported Blockchains: 51+; Security Model: Audited contracts & bridge insurance; Real Assets Only: Yes; Notable Cons: Complex for beginners & variable provider fees; |

| MemeBridge | Best for: Cheap L2 transfers and first-time bridgers Supported Blockchains: ~40; Security Model: Efficient, gamified & community; Real Assets Only: Yes; Notable Cons: Newer, less proven & limited info |

| Relay | Best for: Lightning-fast intent-based transfers Supported Blockchains: 15+; Security Model: Multi-sig, audited contracts & real asset bridging; Real Assets Only: Yes; Notable Cons: Fewer chains than some aggregators & no cross-chain swaps |

| Squid Router | Best for: One-click cross-chain swaps without wrapped tokens; Supported Blockchains: 60+; Security Model: Powered by Axelar network, audited, supports both tokens & contract calls; Real Assets Only: Yes; Notable Cons: Fees can add up for complex routes & Axelar dependency. |

Layer 1 Blockchain List

Explore the top Layer 1 blockchains and their unique features, use cases, and growth potential.

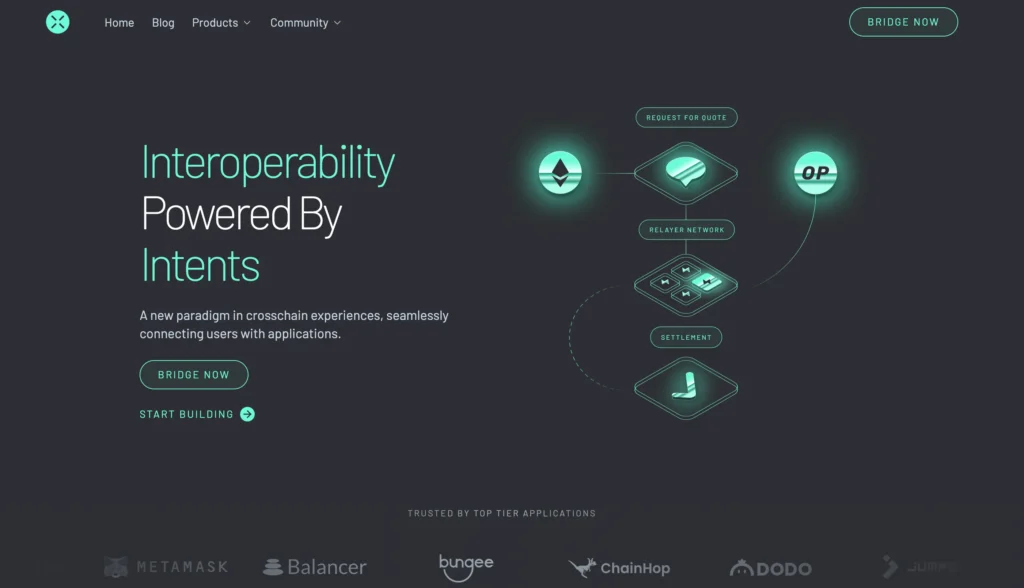

Read More1. Across.to Bridge, Top Pick for Cross-Chain Transfers Overall

Launched in 2021, Across gained a solid reputation for reliability, efficiency, and security among the year’s top crypto bridges. Thus, it has become the go-to bridge thanks to its speed, low fees, and no-nonsense approach to asset transfers.

Built on an intent-based framework, Across lets users declare what they want to do, and the protocol figures out how. That often leads to faster and cheaper transactions, and Across consistently ranks as one of the most cost-effective bridges in the market.

Supported Blockchains

It supports over 20 chains, including Ethereum, Arbitrum, Optimism, Polygon, Base, zkSync, Linea, Scroll, Blast, Zora, Soneium, Lisk, Ink, World Chain, and others.

Security Architecture

- UMA’s Optimistic Oracle: Across relies on UMA’s single-round dispute oracle. Anyone can submit a proposed outcome (like a price or state update); it gets confirmed if nobody disputes it within a short timeframe.

- Dataworker System: The Dataworker component proposes capital reallocations and refund decisions to the Oracle, helping optimize LP fund use without compromising safety.

- Canonical Asset Transfers: No synthetic tokens, ever. That eliminates an entire category of smart contracts and liquidity risks.

Fee Structure

- Liquidity Provider Fees: Users pay no fee if relayers get repaid on the origin chain. If repayment is handled on the destination chain, a fee applies based on liquidity usage.

- Relayer Fees: These are customizable and set by users to make relaying worth the cost (gas fees, capital risk, opportunity cost). They’re built directly into the transaction spread (input vs. output).

Pros of Across

- Fast Transfers: The relayer model enables almost instant bridging across supported chains.

- Low Fees: Thanks to smart liquidity incentives and competition among relayers.

- High Security: Backed by UMA’s battle-tested optimistic oracle and canonical token model.

- Easy to Use: Clean UI, beginner-friendly experience.

- Real Assets Only: No wrapped tokens, no added trust assumptions.

Cons of Across

- Limited Chain Support: Not as widespread as some aggregators or multi-bridge platforms.

- Relayer Dependency: Speed and cost efficiency depend on active relayer participation.

Avalanche vs. Solana

Compare bridging options and blockchain features between Avalanche and Solana.

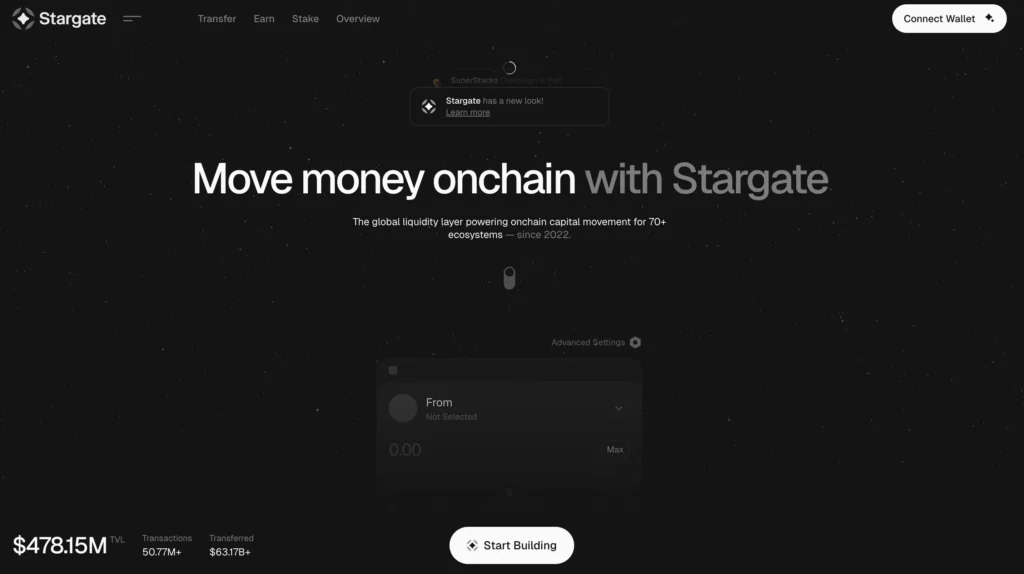

Read More2. Stargate, Best Crypto Bridge for Native Token Transfers

Stargate is our second top pick for cross-chain bridging. It’s earned serious credibility for handling direct native asset transfers. Moreover, Reddit users often highlight Stargate for its simplicity, deep liquidity, and transparent fee model.

Stargate uses shared liquidity pools to route real assets across chains, unlike traditional bridges that mint synthetic tokens. That means you don’t need to trust third-party wrappers or worry about redemption issues. Just plug in the chain you’re on, the one you want to bridge to, and you’re done in one step.

Supported Chains

Stargate supports a wide range of EVM-compatible Layer 1 and 2 networks, with more rolling in over time. Currently, the protocol supports over 80 chains, including Ethereum, Arbitrum, Optimism, Polygon, Avalanche, BNB Chain, Base, Fantom, Metis, Linea, Mantle, and others.

Security Architecture

- Unified Liquidity Pools: Stargate pools assets together across chains, avoiding the common issue of fragmented liquidity. This helps keep transactions smooth and avoids failures from empty destination pools.

- Instant Finality: Once your transfer goes through, it’s final: no rollbacks, reorgs, or stress. That’s a huge win over bridges that rely on synthetic token mechanics.

- ∆ (Delta) Algorithm: This in-house balancing mechanism optimizes liquidity, especially during heavy transaction spikes. It automatically rebalances capital between pools to prevent outages.

- LayerZero’s DVN & Oracle Layer: Stargate uses LayerZero’s Decentralized Validation Network (DVN) and messaging layer to guarantee delivery and state verification between chains.

- Audited Smart Contracts: The codebase is regularly audited and battle-tested for vulnerabilities. You’re not flying blind here.

Fee Structure

- Flat Fee: Each transaction carries a 6 bps fee (0.06%). Five bps go to the treasury, and one bps is reserved for veSTG token holders.

- Gas Costs: Since Stargate runs on LayerZero, users also pay gas fees using the destination chain’s native token. These cover execution and message verification through DVN.

- V2 Dynamic Fees (AIPM): Stargate v2 introduced the AI Planning Module, which adjusts fees based on liquidity pressure. If a pool runs low, Stargate offers rebates to incentivize users to help rebalance it. It’s smart, but might surprise folks who are used to flat pricing.

Pros of Stargate

- Native Transfers: No wrapped tokens, just real assets, end-to-end.

- Wide Chain Support: Compatible with a long list of EVM chains.

- High Liquidity: Large TVL means more efficient bridging and lower slippage.

- Transparent Pricing: See slippage and fees before you confirm.

- Liquidity Rewards: Provide liquidity and earn tokens.

- Simple Interface: Designed with usability in mind, excellent for all levels.

Cons of Stargate

- Variable Fees: The AI-managed dynamic fees might throw off users expecting consistency.

- Liquidity Pressure: Pools can still run low during peak demand.

- Gas Overhead: LayerZero execution adds a bit of gas cost.

Crypto Market Cap Explained

Understand how market capitalization impacts token prices and bridge utilization.

Read More3. Rhino.fi, Best for Self-Custody and Security-Minded Users

Rhino.fi is one of the most innovative tools out there. It’s our third top pick overall, and for a good reason: it combines multi-chain access, low fees, and rock-solid self-custody through StarkEx Validium Layer 2 tech.

Rhino.fi gives you all the perks of Layer 2 scaling while staying self-custodial. No one can touch your funds, even if the platform vanishes; your tokens are safe and retrievable via Ethereum’s Data Availability Committee.

Supported Chains

You can bridge to over 32 major networks, including Ethereum, Arbitrum, Optimism, Polygon, zkSync, Avalanche, Base, Linea, BNB Chain, Tron, TON, and many more.

Security Architecture

- Self-Custody by Default: You own your funds, period. Not even Rhino.fi has access to them.

- StarkEx Validium Layer 2: Built by StarkWare, this tech posts data off-chain for better performance while anchoring proof security to Ethereum. To compromise it, someone would have to breach Ethereum, which isn’t happening.

- Data Availability Committee: If Rhino.fi disappears, users can still exit to Ethereum using this independent mechanism. You’re never locked in.

Fee Structure

- Trading Fees: The maker fees start at 0.15%, dropping to 0% for large-volume traders, and the taker fees start at 0.20%, falling to 0.14% once you cross $30M in 30-day volume.

- Swap Fees: Flat 0.30%.

- Transfer Fees: Vary by token and are updated regularly. Some tokens are nearly free; others may carry a cost depending on network congestion and liquidity.

Pros of Rhino.fi

- True Self-Custody: You’re always in control with built-in emergency withdrawals.

- Strong Security: StarkEx + Ethereum makes for a highly secure combo.

- Extensive Chain Access: One of the widest selections of supported networks.

- Fail-Safe Withdrawals: Even if Rhino.fi goes dark, your tokens are safe and retrievable.

Cons of Rhino.fi

- Transfer Fee Variability: Costs depend on the token and can change without notice.

- Volume-Based Trading Fees: Low fees are reserved for big movers.

Crypto Unlocks: Tools to Track Bridged Assets

Discover essential tools to monitor token unlocks and asset flows across bridges.

Read More4. Rubic Exchange, Best for One-Click Cross-Chain Swaps

Built as a multi-chain DEX aggregator and bridge hub, Rubic streamlines cross-chain trades by integrating swap protocols and liquidity sources into one platform. It’s a favorite among privacy-conscious users because there’s no KYC, and it’s 100% decentralized.

Even more, Reddit traders often highlight Rubic’s plug-and-play ease and broad chain support, making it one of the best crypto bridges for quick swaps without hopping across five dApps.

Supported Chains

Rubic supports over 50 blockchains, giving users great flexibility across L1 and L2 networks. Some notable names include Arbitrum, Base, Linea, TON, Tron, Polygon, Ethereum,zkSync, and many others.

Security Architecture

- Decentralized by Design: Rubic doesn’t rely on centralized infrastructure. All interactions between your wallet and the blockchain reduce the attack surface (e.g., no DDoS risk from third-party servers).

- One-Click DeFi Workflow: Rubic compresses multiple DeFi actions into one smooth UX step, simplifying the process while reducing the chance of user error.

- Audited Smart Contracts: All core contracts are fully audited, ensuring code reliability and resistance to vulnerabilities.

- dApp & Wallet Integrations: Rubic offers SDKs and white-label solutions with fee-sharing incentives, making it a trusted backend for developers and wallet providers.

Fee Structure

- $2 for cross-chain swaps;

- $1 for on-chain swaps;

- Gas fees vary based on the destination network and transaction complexity.

Pros of Rubic

- One-Click Simplicity: Consolidates multiple steps into a single interface for fast swaps.

- Multi-Chain Coverage: Works with 50+ major blockchains.

- Fully Decentralized: No central servers or KYC requirements.

- High Usage: Over $1.69 billion in lifetime transaction volume.

- Developer Friendly: SDK and white-label tools for seamless integrations.

Cons of Rubic

- Fixed Fees: $2 per cross-chain swap increases if you make frequent transfers.

- Gas Still Applies: Standard gas costs apply on top of Rubic’s flat fee.

Crypto Unlocks: 5 Tools

Track bridged and locked assets with top tools and platforms in the crypto space.

Read More5. deBridge, Best Crypto Bridge for Devs and Power Users

More than just a bridge, deBridge is a fully decentralized cross-chain messaging protocol that lets you move assets and arbitrary data between chains. Think cross-chain swaps, limit orders, and even NFT transfers, all verified by a decentralized validator network and backed by permanent data availability on Arweave.

Crypto-native communities like Reddit often recommend deBridge to users who want flexibility, deep security, and composability without relying on centralized intermediaries or wrapped tokens.

Supported Chains

deBridge currently supports 20+ chains, including EVM and non-EVM networks: Ethereum, Arbitrum, Polygon, Avalanche, BNB Chain, Solana, Optimism, Base, Gnosis, Fantom, and more.

Security Architecture

- Decentralized Validator Network: Independent validators validate all cross-chain messages.

- Arweave-Based Data Availability: Validator signatures and message metadata are stored permanently on Arweave, creating a tamper-proof audit trail and preventing loss of critical information in case of network failure.

- Delegated Staking & Slashing: Validators stake collateral and face slashing for downtime or misconduct.

- Transaction Finality: Validators wait for final confirmations on each source chain, avoiding issues with reorgs or probabilistic finality that can mess up cross-chain execution.

Fee Structure

- deBridge keeps it simple with a flat fee per cross-chain message, paid in the native gas token of the origin chain (e.g., ETH, MATIC, AVAX).

- 50% of the fee goes to validators as rewards, helping decentralize the network.

Pros of deBridge

- Fast Settlement: Near-instant finality with minimal reversion risk.

- More Than Just Swaps: Send assets and arbitrary data across chains.

- Strong Security Stack: Validator network + slashing + Arweave data storage.

- No Liquidity Pools: Eliminates pool fragmentation and locked liquidity risk.

- Wide Chain Access: Includes Solana, Arbitrum, Ethereum, Base, and more.

Cons of deBridge

- Flat Fees Can Add Up: Less ideal for small-volume users or microtransactions.

- Not Beginner-Friendly: Advanced trading features like gasless orders and staking may be overwhelming.

- Validator-Centric Design: Network performance depends on validator participation and integrity.

How to Bridge from BSC to Ethereum

Learn the safest and easiest ways to transfer crypto between Binance Smart Chain and Ethereum using reliable bridges.

View the Step-by-Step Guide6. Jumper Exchange, Best for Aggregated Bridging and DEX Routing

Jumper Exchange has rapidly emerged as a leading solution for cross-chain swaps and bridging, earning praise from the DeFi community for its broad approach. Reddit threads and DeFi users consistently shout out Jumper as the go-to platform when they want reliability without having to babysit their transfers.

Supported Chains

Jumper Exchange supports over 51 blockchains, including Ethereum, Arbitrum, Polygon, Avalanche, BNB Chain, Optimism, Base, and Solana.

Security Architecture

- Smart Contract Audits: Jumper’s underlying technology has undergone audits by reputable firms, ensuring a secure transaction environment.

- Bridge Insurance: An opt-in feature offering additional protection against bridge-related risks.

- Transparent Routing: Users receive detailed information on the bridges and DEXs involved in their transactions, promoting transparency and informed decision-making.

Fee Structure

- Standard gas fees are associated with blockchain transactions.

- Fees imposed by the integrated bridges and DEXs vary based on the chosen route. All estimated fees are displayed upfront, allowing users to assess costs before proceeding.

Pros of Jumper Exchange

- Extensive Aggregation: Combines multiple bridges and DEXs, offering users optimal transaction routes.

- User-Friendly Interface: Designed for novice and experienced users, simplifying complex cross-chain operations.

- Extensive Chain Support: Facilitates operations across a broad spectrum of blockchains.

- Security Measures: Incorporates audited smart contracts and optional bridge insurance for enhanced user protection.

Cons of Jumper Exchange

- Complexity for Beginners: Many options and routes may overwhelm new users.

- Variable Provider Fees: Fees depend on the selected route, leading to unpredictable costs.

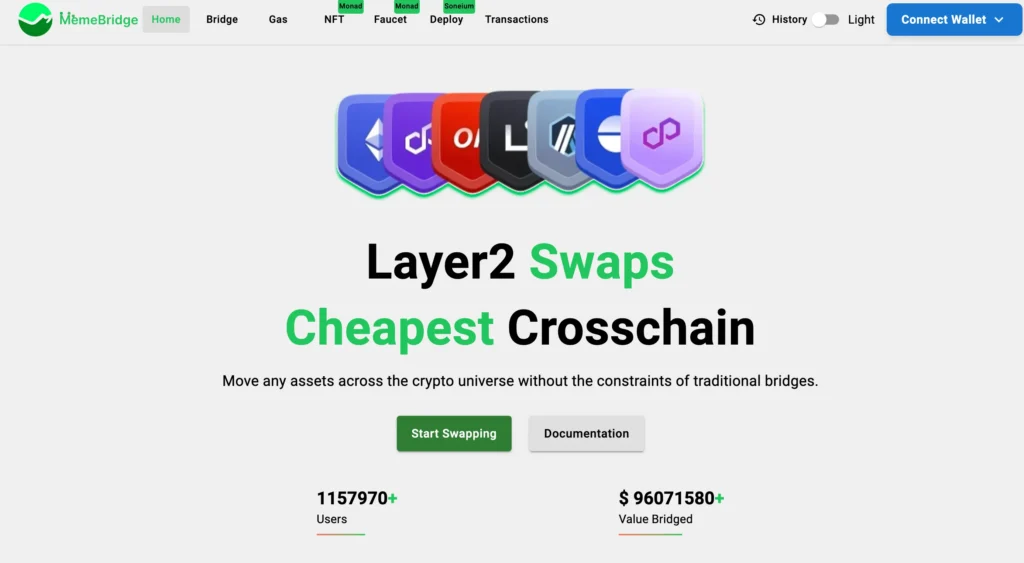

7. MemeBridge, Best for Cheap L2 Transfers and First-Time Bridgers

MemeBridge earns a solid spot on our list not just for its low costs but because it’s quietly become a go-to option for frictionless bridging across 40+ chains. Beneath the meme aesthetic is a practical tool: a lightweight, community-friendly bridge serious about cross-chain efficiency. While still relatively new, it’s building momentum thanks to its low fees, fast performance, and gamified point system that rewards users for transfers.

Supported Chains

MemeBridge supports ~40 blockchain networks, including a healthy mix of primary Layer 1s and Layer 2s: Ethereum, Arbitrum, Base, Optimism, Polygon, zkSync, BNB Chain, Avalanche, and many others.

Security Architecture

- Smart Contract Audits: Its codebase undergoes routine audits from third-party security firms to identify and mitigate vulnerabilities before deployment.

- Decentralized Oracles: The protocol avoids single points of failure in transaction validation and price feeds by integrating decentralized Oracle networks.

Fee Structure

- Transfer fees vary depending on the network load and token involved. Before bridging, all costs are shown upfront, so you’ll know what you’re paying.

- The platform often promotes itself as the “cheapest L2 bridge”, and in practice, it consistently offers lower fees than many larger competitors.

Pros of MemeBridge

- Ultra-Easy UI: Perfect for beginners and fast casual use.

- Huge Chain List: Supports ~40 networks, from L1s to rollups.

- Low-Cost Bridging: Especially efficient for L2-to-L2 transfers.

- Community Perks: A point system could reward early users.

- Great for Smaller Transfers: Avoids bloated fees on modest transactions.

Cons of MemeBridge

- Still Emerging: As a new protocol, it’s evolving fast (which can mean bugs or UX inconsistencies).

- Vague Fee Structure: Lacks fixed rates, making cost prediction more challenging for some users.

- Limited Track Record: Hasn’t been stress-tested like older platforms.

Start your crypto journey with free rewards

Grab sign up bonuses from trusted platforms and grow your wallet faster see the full bonus list

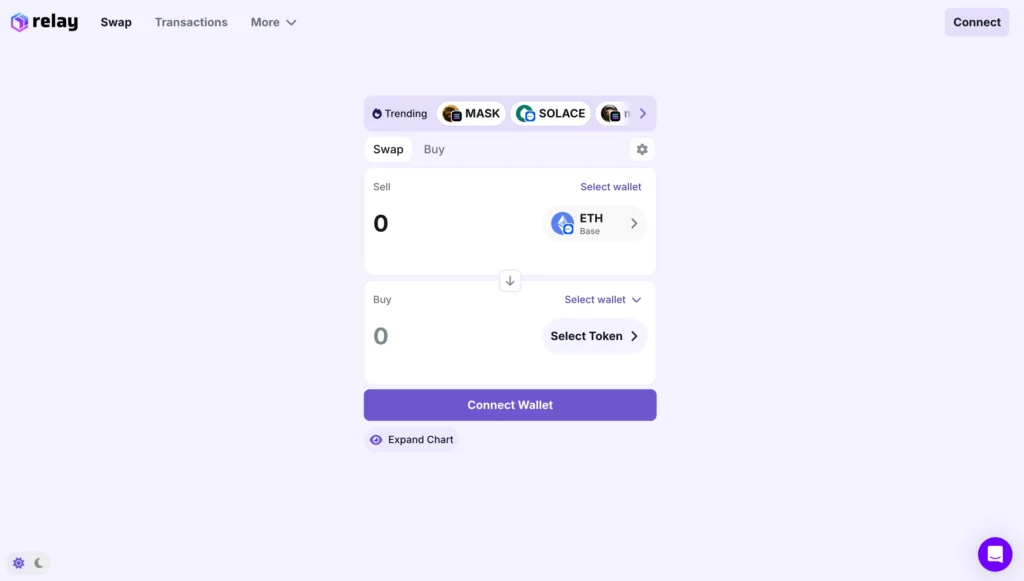

8. Relay.link, Best for Lightning-Fast Intent-Based Transfers

Relay.link also deserves your attention. It’s one of the most efficient intent-based solutions, built to move tokens or trigger transactions across chains in seconds. At its core, Relay is a cross-chain execution network. It connects Jumper’s relayers (autonomous agents who handle transactions on other chains for you). That means no wrapping, no approvals on the destination chain, and no holding your breath while waiting for settlement.

Supported Chains

Relay supports over 70 chains, including Ethereum, Arbitrum, Optimism, Base, Polygon, zkSync, Linea, Scroll, Fantom, Avalanche, BNB Chain, Celo, and others.

Security Architecture

- Decentralized Relayers: Your intent is executed by relayers, not centralized servers. No single point of failure.

- Audit Coverage: Smart contracts are regularly audited, with risk-focused reviews to catch the usual suspects.

- Fail-Safes for Users: Relay guides safe wallet usage and contract approvals and lets you track execution and relayer performance on its dashboard.

Fee Structure

- You pay gas on the origin chain only. You do not pay gas on your destination chain since the relayer covers it.

- Relayer Fee – Split into two parts: Service Fee for using the relayer and Destination Gas Fee reimbursing the relayer for completing the job.

Pros of Relay

- Blazing Fast: Cross-chain actions settle in as little as 5–10 seconds.

- No More Wrapping: You bridge the real token, not synthetic.

- One Signature UX: One click, one signature.

- Massive Chain Support: Already work with most major chains and are adding more.

- Developer-Friendly: With a full SDK, intents API, and even white-label support, it’s ideal for wallets and dApps.

Cons of Relay

- Relayer Dependency: The system leans heavily on relayer availability. If relayers are slow or unreliable, things can lag.

- Fee Variability: While costs are generally low, gas spikes on source chains can make fees unpredictable.

- Still Early: Despite being super promising, Relay is still in growth mode. Some UX polish and integrations are ongoing.

9. Squid Router, Best for One-Click Cross-Chain Swaps Without Wrapped Tokens

Based on Axelar’s cross-chain messaging protocol, Squid Router lets you swap from any token on one chain to another in a single transaction. It’s fast, non-custodial, and doesn’t involve synthetic assets. It’s one of Reddit’s most mentioned bridges for easy cross-chain swaps—no wrapping or wallet juggling. Many say it’s the smoothest DEX-router combo out there, thus making it one of the best crypto bridges of the year.

Supported Chains

Squid supports over 79 chains, including Ethereum, Arbitrum, Polygon, Optimism, Base, zkSync, BNB Chain, Avalanche, Moonbeam, and many more.

Security Architecture

- Non-Custodial: Squid doesn’t hold your tokens. You keep full control throughout the transaction.

- Powered by Axelar Validators: Transactions are verified through Axelar’s decentralized validator set.

- Audited Smart Contracts: Squid has been through multiple independent audits.

- Transaction-Level Protection: Every transfer waits for sufficient confirmations to ensure finality.

- Automatic Refunds: If there’s leftover gas from your transaction, it’s refunded.

Fee Structure

- Gas fees are paid using the native token of the origin chain.

- The cross-chain gas estimate has been rolled into the swap and is visible upfront.

Pros of Squid

- One-Click Cross-Chain Swaps: From token A on Chain X to token B on Chain Y.

- No Wrapped Tokens: You get real, native assets on the destination chain.

- No Custody Risk: You stay in control the entire time.

- It supports many chains, such as Ethereum L1 and all the major L2s.

- Reddit-Approved UX: Gets a lot of love in many subreddits.

- No Platform Fees: What you see is what you get.

Cons of Squid

- Axelar Dependency: If Axelar has issues, Squid’s cross-chain engine stalls.

- Not Ideal for Power Users Who Want Manual Control: The simplicity comes at the cost of configurability.

Methodology: How We Picked the Best Crypto Bridge

This article explains what matters when bridging crypto across multiple chains, especially with wrapped tokens, native assets, and cross-network transfers.

We evaluated each bridge based on:

- Security: Assessed smart contract audits, past exploits, transparency, and trust models.

- Fees: Compared total costs, including gas, bridge fees, and slippage.

- Speed: Measured transfer times during low and high congestion.

- Volume: Analyzed real transaction activity and daily usage, not just spikes.

- Supported Chains: Preferred bridges that connect to multiple ecosystems.

- Ease of Use: Tested wallet connection, asset selection, transfer tracking, and support.

We also considered how bridges function technically and filtered for those that excel in real-world performance.

FAQ

What is a Cross-Chain Crypto Bridge?

A cross-chain crypto bridge is a protocol for moving assets (like tokens or NFTs) across different blockchain networks. It connects ecosystems like Ethereum, BNB Chain, and Polygon, enabling cross-chain transfers without needing a centralized exchange.

Why Do People Bridge Crypto Assets?

People bridge crypto assets to access lower fees, faster networks, or tokens that only exist on a specific destination chain. It’s also common when managing funds across multiple chains for trading, staking, or farming.

How Do You Bridge Crypto Tokens?

Connect your wallet, pick the token and network you want to bridge from, and then choose your destination chain. Enter the amount, review the quote, and confirm the transaction. The bridge handles the rest, and your assets show up on the new chain in minutes.

Are Cross-Chain Bridges Safe?

Many are, but not all. Security depends on the bridge’s smart contracts, validator setup, and transparency. Look for platforms with audits, clear fee structures, and strong reputations. Redditors often flag issues early, so it’s worth checking community feedback before moving large amounts.

Conclusion

Hopefully, now you know which crypto bridges will be the most popular in 2026. Whether you want to transfer tokens more efficiently or explore new chains, these tools prove how blockchain bridges enable a truly connected Web3 experience.

Choose wisely, and bridge safely!