How Long Does It Take to Mine 1 Bitcoin?

Many people getting into crypto wonder: how long does it take to mine 1 Bitcoin? The answer isn’t simple. Since the latest Bitcoin halving, mining has become slower and more competitive. The time it takes now depends on your mining hardware, hash rate, electricity cost, and whether you mine alone or in a pool. This […]

Many people getting into crypto wonder: how long does it take to mine 1 Bitcoin? The answer isn’t simple. Since the latest Bitcoin halving, mining has become slower and more competitive. The time it takes now depends on your mining hardware, hash rate, electricity cost, and whether you mine alone or in a pool.

This guide explains what “mining 1 BTC” really means in 2025, what affects mining speed and profitability, and how long it actually takes to earn one full Bitcoin under normal conditions.

Understanding Bitcoin Mining Duration

First, what do we mean by “mine 1 BTC”? In the Bitcoin mining process, blocks are mined roughly every 10 minutes, and each block currently yields a reward of 3.125 BTC (following the April 2024 Bitcoin halving event).

Because rewards are shared (especially in bitcoin mining pools), you don’t “mine 1 BTC” in one block unless you supply a significant fraction of the hash power. Instead, you accumulate BTC over time based on your contribution.

Today, the network automatically adjusts the Bitcoin mining difficulty to maintain a block time of approximately 10 minutes.

So, effectively, the time it takes to accumulate 1 BTC depends on your portion of the total computing power and the current difficulty, two fundamental variables in the process called Bitcoin mining that every miner must understand.

How Long Does It Take to Mine 1 Bitcoin (2025 Data)

Let’s look at real-world 2025 numbers to get a sense of how long it takes to mine 1 BTC. Please note that these estimates are not guarantees.

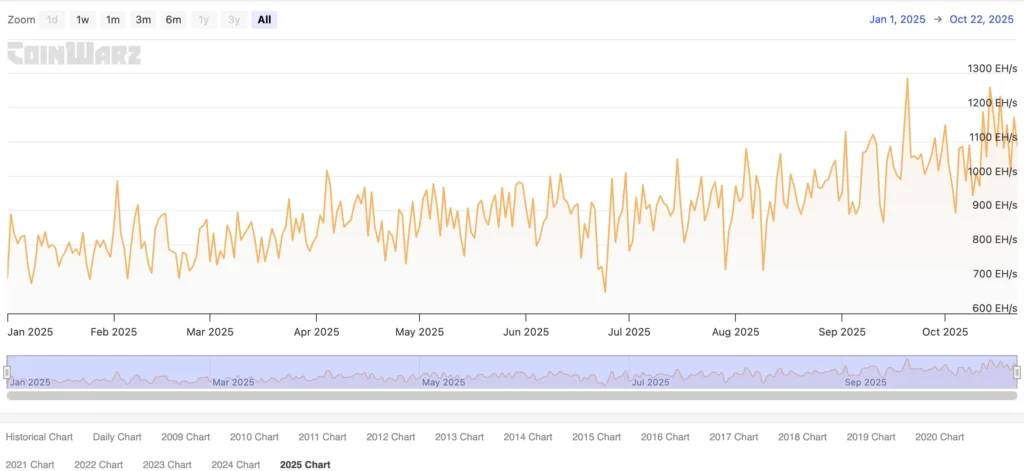

- As of late 2025, the global Bitcoin network hash rate (the total mining power competing for blocks) is roughly 1,081 EH/s (exa-hashes per second).

- Mining difficulty (a measure of how hard it is to find a new block) has reached values above ~136 trillion (T) and is trending higher.

- Modern ASIC mining systems in 2025 can achieve efficiencies of around 16.5–17 J/TH (joules per terahash).

What does this mean practically?

If you solo-mine with one mid-sized ASIC (say ~200 TH/s hash-rate), given the enormous network hash-rate and high difficulty, your share of the block reward is so small that reaching 1 BTC would likely take many decades, effectively placing a solo miner at a disadvantage compared to pooled mining setups.

If you join a mining pool (which combines your hash power with many other miners), your earnings come in small fractions but much more regularly. With a 200 TH/s contribution, you can accumulate approximately 1 BTC in 30-40 days, depending on electricity costs, pool fees, hardware efficiency, and network conditions.

Electricity costs matter a lot: network reports show that, due to the high hash rate and difficulty, the energy required per BTC increased in 2025. (e.g., one study estimates ~854,400 kWh per BTC at 2025 equipment/conditions).

Key Takeaways

For a modern miner:

- Solo mining one bitcoin is no longer realistic unless you operate at a massive scale.

- Pool mining with efficient hardware and low power costs is the viable path. It offers a realistic timeframe of approximately one month to accumulate 1 BTC under favorable conditions.

- Your actual time will vary widely based on the number of terahashes you contribute, your electricity cost, the pool you join, and how the network hash rate and difficulty evolve.

Factors Affecting Bitcoin Mining Time

When you ask “how long does it take to mine 1 BTC?”, the answer hinges on several key factors. Below are the main drivers you should understand:

1. Mining Hardware & Efficiency

- Mining with ASIC (Application‑Specific Integrated Circuit) miner devices is the only practical route in 2026. General-purpose hardware (like GPUs) simply cannot compete. For mining algorithms that still benefit from processor-based setups, we’ve also reviewed the best CPUs for mining, including high-efficiency EPYC and Threadripper models used in 2026 mining operations.

- Hasrate (how many hashes/second your hardware performs) directly affects how much of the network work you contribute. More hashrate means a larger share of block rewards.

- Energy efficiency (measured in joules per terahash, J/TH) is critical; the lower the J/TH, the less electricity you pay for the same hashrate.

Recent research shows that in 2025, only ASICs with very low J/TH (e.g., < 22 J/TH) can reliably generate returns. Upgrading to newer, more efficient hardware reduces the time to accumulate 1 BTC by lowering overhead and increasing effective contribution.

2. Mining Difficulty

The network automatically adjusts its difficulty roughly every 2,016 blocks (≈ approximately every 2 weeks) to maintain an average block time of around 10 minutes.

Difficulty rises as many miners (and more powerful hardware) join the network. Greater difficulty means that your hashrate represents a smaller share of total network effort, so it takes longer to mine a given amount of BTC.

3. Electricity Costs

Your electricity cost (typically in USD or local currency per kWh) is one of the highest variable costs in mining.

Even a high-hashrate machine may take far longer (in practical net earnings) to effectively “produce” 1 BTC when electricity is expensive. Miners pay for every kilowatt-hour (kWh), so power efficiency directly affects their profitability.

4. Pool vs. Solo Mining

Whether you mine solo (on your own) or as part of a mining pool changes how quickly you realistically accumulate 1 BTC:

- Solo mining

You attempt to mine whole blocks by yourself. Given the current global hashrate and difficulty, your odds of solving a block (and collecting the reward) are minimal unless you contribute a massive share of hash power. Time to 1 BTC can stretch into decades or longer for smaller rigs.

- Mining pool

You join many other miners, combine hash power, and share rewards proportionally based on your contribution. This smooths out variance and dramatically shortens the time it takes to accumulate 1 BTC equivalent, even though you’ll earn a fraction of a BTC at a time.

In 2025, nearly all active bitcoin miners join mining pools for consistent returns.

5. Market Price & Reward Structure

Even though “time to mine 1 BTC” is mostly about hardware, difficulty, and pool/solo strategy, the value of what you mine depends on the market price of BTC and the Bitcoin mining rewards. (currently 3.125 BTC per block after the 2024 halving).

If the BTC price is high, your bitcoin mining revenue is greater; if it’s low, you’ll need more time or a lower cost to reach profitability. Additionally, upcoming halvings will reduce the rewards, making it harder to mine each BTC over time.

If you want to explore lighter alternatives, here’s a list of free crypto mining apps for Android that allow beginners to experiment without needing expensive ASIC hardware.

Is Bitcoin Mining Still Profitable?

Bitcoin mining in 2025 can still be profitable, but only under the right conditions. Profit margins have tightened considerably after the April 2024 halving, which reduced the block reward to 3.125 BTC. Let’s look at the main factors that determine profitability today.

Current Conditions

Overall, Bitcoin mining profitability has declined by more than 7% compared to the previous month, as the difficulty reached record highs and the hash rate continued to decline.

The average global network hash rate is approximately 1,081 EH/s, and the difficulty exceeds 136 trillion, making it more challenging to earn block rewards.

Studies estimate that the energy required to mine one Bitcoin in 2025 is roughly 850,000 kWh, depending on hardware efficiency and location. These figures indicate that the blockchain’s mining process consumes a substantial amount of energy, rendering mining a highly competitive industry.

What This Means for Miners

Miners with access to cheap electricity and modern ASIC equipment can still generate a profit. However, those with older hardware or higher energy costs often struggle to cover expenses.

- With electricity costs around $0.05 per kWh or less, efficient mining rigs can remain profitable.

- At $0.10 per kWh or higher, most small-scale miners break even or operate at a loss.

Professional operations in regions with surplus renewable energy or government-subsidized power tend to perform best.

Example Profitability Estimate

Let’s take a basic example:

- Mining output: 0.01 BTC per month;

- Bitcoin price: $70,000;

- Revenue: $700;

- Power usage: 3 kW (72 kWh/day);

- Electricity cost: $0.10/kWh → $216 per month;

- Hardware cost: $3,000 (amortized over 24 months → $125 per month).

Profit = (BTC mined × BTC price) − (electricity cost + hardware amortization)

Profit = $700 − ($216 + $125) = $359/month

In this case, mining is a profitable endeavor. Yet, profits disappear quickly if energy prices rise or Bitcoin’s market value falls.

How to Estimate Your Own Mining Time

Using a Bitcoin mining calculator such as NiceHash, WhatToMine, or Minerstat, you can easily estimate how long it takes to mine one Bitcoin.

Follow these simple steps:

Check your mining speed (hashrate)

Find your miner’s hashrate in its specs. For example, an Antminer S21 runs at about 200 TH/s.

Enter your electricity cost

Type in how much you pay per kilowatt-hour (kWh), for example $0.10/kWh.

Add your power use

Write down how much power your miner uses, usually 2,500–3,000 watts for modern ASICs.

Include pool fees

Most mining pools take a small fee, usually 1–3%. Add this to your calculation.

See your daily Bitcoin output.

The calculator will show how much BTC your setup can mine daily (for example, 0.033 BTC/day).

Calculate your time to 1 BTC.

Divide 1 BTC by your daily amount:

- If you mine 0.033 BTC/day, it takes about 30 days to reach 1 BTC.

- If you mine 0.01 BTC/day, it takes about 100 days.

Update regularly

Mining conditions change every few weeks as difficulty and Bitcoin’s price fluctuate. Recheck your estimates often for accuracy.

In summary: A mining calculator gives a realistic picture of how fast miners mine one Bitcoin under specific conditions. The more powerful and efficient your hardware, and the cheaper your electricity, the faster you’ll reach that 1 BTC mark.

Future Outlook: Bitcoin Mining Beyond 2025

Bitcoin mining will continue to evolve as bitcoin mining operations expand and technology advances.

1. Rising Difficulty and Competition

As more efficient hardware emerges, a single miner’s share of the network decreases.

This means miners will need to upgrade their equipment regularly to stay competitive. Smaller or less efficient miners may struggle to remain profitable as large-scale operations continue to dominate.

2. The 2028 Halving

The next Bitcoin halving is projected for April 2028, when the block reward will drop from 3.125 BTC to 1.5625 BTC, pushing miners to adapt or upgrade to continue earning new Bitcoin.

Historically, halvings have pushed older, inefficient miners out of the market and rewarded those with low operating costs and modern hardware.

3. Shift Toward Renewable Energy

Environmental regulations and rising power costs are prompting miners to shift toward renewable energy sources, including hydro, wind, and solar. Miners utilizing inexpensive, clean power will have a clear advantage in the coming years, reducing costs and their carbon footprint while ensuring long-term sustainability.

FAQ

No, mining 1 Bitcoin in a single day is practically impossible in 2025. Even industrial setups can’t mine a whole coin that fast due to Bitcoin mining speed limits. Yet, by joining large pools, you can earn small, steady fractions of BTC daily.

You can’t mine Bitcoin for free because hardware and electricity cost money. Beware of Bitcoin mining scams promising “free BTC”; they’re often unreliable or fraudulent.

If you have access to cheap power and efficient hardware, mining can be a profitable endeavor. But for most, buying Bitcoin is easier and faster. It all depends on your setup and why you mine Bitcoin.

No, Bitcoin depends entirely on electricity. Without it, mining and transactions would stop, but decentralization ensures that some regions can continue to run the Bitcoin protocol.

Technically, yes, but it’s not practical. Laptops can’t compete with ASIC miners and would overheat quickly. To begin mining efficiently, you need specialized hardware and a good pool setup.

Final Thoughts

So, how long does it take to mine 1 Bitcoin in 2025? With modern ASICs and low electricity costs, it typically takes around 30–40 days in a mining pool. Solo mining is no longer realistic for most miners due to high difficulty and competition. To stay profitable, focus on efficient hardware, low power consumption, and innovative pool strategies, because in 2025, every watt and hash count.