XLM vs. XRP: A Complete Analysis to Understand Their Key Differences

Stellar and Ripple are two of the most well-known cryptocurrencies, and their place in the top rankings makes it clear they’re a big deal. Surprisingly, not many people know exactly how they differ, so in this article, we’ll discuss the similarities and, more importantly, the key differences between XLM vs. XRP. One of the biggest […]

Stellar and Ripple are two of the most well-known cryptocurrencies, and their place in the top rankings makes it clear they’re a big deal. Surprisingly, not many people know exactly how they differ, so in this article, we’ll discuss the similarities and, more importantly, the key differences between XLM vs. XRP.

One of the biggest differences people usually point out is that XRP is supported by a private company, Ripple Labs, a for-profit organization. In contrast, XLM is managed by the non-profit Stellar Development Foundation. At the same time, the non-profit Stellar Development Foundation manages XLM.

But most people don’t fully understand what sets these two coins apart. So, let’s determine which one might better suit you, whether you want to invest or learn more about them.

Disclaimer. This article is not financial advice. Instead, it’s a detailed analysis to help you better understand the differences between XRP and XLM to make a more informed decision. Always research or talk to a financial advisor before making any investment choices.

XLM vs. XRP: A Brief Overview

| Criterion | Stellar Lumens (XLM) | Ripple (XRP) |

| Price (at the time of writing) | $0.47 | $1.41 |

| Market Cap (at the time of writing) | $14.2 billion | $80.5 billion |

| Circulating Supply (at the time of writing) | 30.04 billion XLM | 57 billion XRP |

| Maximum Supply | 50 billion XLM | 100 billion XRP |

| Blockchain | Stellar | Ripple |

| Consensus Mechanism | Stellar Consensus Protocol (SCP) | Ripple Protocol Consensus Algorithm (RPCA) |

| Cryptographic Algorithm | Ed25519 + SHA-256 | SHA-256 |

| Token Utility | Facilitating cross-border payments, powering decentralized applications (dApps) | Facilitating cross-border payments, especially for financial institutions |

| Founders | Jed McCaleb | Chris Larsen, David Schwartz, Author Britto, and Jed McCaleb |

| Launch Date | 2014 | 2012 |

| Token Distribution | Initially, 100 billion XLM was created, but it was reduced to 50 billion. Gradual, community-influenced distribution. | Pre-mined 100 billion XRP. Fixed supply cannot be altered. |

| Supporting Exchanges | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. | Binance, Coinbase, OKX, Kraken, Bitget, ByBit, Bitfinex, KuCoin, Crypto.com, Gate.io, HTX, MEXC, etc. |

| Communities | Discord X (Twitter) StellarGitHub Stack Exchange | Reddit X (Twitter) GitHub |

The Genesis of XLM vs. XRP

In 2012, a project was born out of a great big idea: making money transfers faster and cheaper, especially across borders. It all started with Ripple. Chris Larsen, David Schwartz, Author Britto, and Jed McCaleb founded Ripple with one mission: to fix how money moves around the world.

They knew the existing banking system was slow and expensive for international transactions, so they created RippleNet, a network designed to help banks and financial institutions send money more quickly.

Ripple’s digital token, XRP, was the key to smoothing these transfers, acting as a bridge between different currencies. The idea was simple: make big financial institutions work better, faster, and cheaper. Ripple focused on the financial world’s big players—banks and corporations.

But then there was Stellar Lumens.

That’s because Jed McCaleb had a different vision. He wanted to create something that could help everyone, not just the big banks. He gathered a team of like-minded individuals and, in 2014, launched Stellar with a dream of connecting people who had no access to banks—especially those in developing countries.

Unlike Ripple, which focused on working with large financial institutions, Stellar aimed to create a decentralized network that anyone could use. Its mission was to make financial services accessible to all, allowing people to send money without needing a traditional bank.

While Ripple went on to focus on improving the financial system for big institutions, Stellar chose a different path, one that was more about everyone—no matter how big or small.

So, Ripple (XRP) and Stellar (XLM) were born from the same core idea, but their stories show how two different visions can grow from the same seed—each with its dream of how money should work in the future.

XRP vs. XLM: Technical Comparison

Winner: Stellar (XLM)

1. Blockchain and Consensus Mechanisms

Ripple uses the Ripple Protocol Consensus Algorithm (RPCA), a unique consensus mechanism designed for fast, scalable transactions. In the RPCA, a group of trusted validators agrees on the order and validity of transactions. Validators are selected by the Ripple network participants and do not require mining or energy-intensive operations like Proof-of-Work (PoW).

Each transaction is validated by a set of pre-selected validators, and once a consensus is reached, the transaction is added to the ledger. Using a smaller set of trusted validators allows Ripple to achieve fast transaction times and low fees. Still, critics argue that relying on trusted nodes reduces its decentralization compared to traditional blockchain systems.

On the other hand, Stellar employs the Stellar Consensus Protocol (SCP) based on the Federated Byzantine Agreement (FBA).

Thus, Stellar aims to provide greater decentralization by allowing each network participant to select its trusted validators, called quorum slices. The quorum slice is a subset of trusted nodes that each participant believes are reliable, and transactions are confirmed when there is agreement across a sufficient number of these quorum slices.

This system enables greater decentralization because anyone can become a validator, and the network is designed to avoid single points of failure. Moreso, SCP enables faster transactions than traditional blockchain mechanisms while maintaining decentralization, though the process can be more complex than Ripple’s centralized model.

2. Scalability and Network Throughput

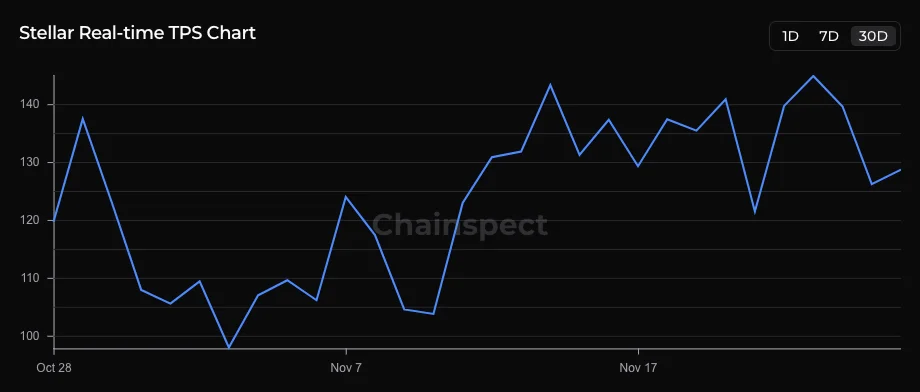

Stellar is built for scalability, making it highly efficient in handling transactions. While it can theoretically process up to 1,000 transactions per second (TPS), its current practical performance is around 136 TPS.

Thanks to its decentralized ledger and efficient design, Stellar ensures that transactions remain fast, even during high demand. This focus on scalability makes it ideal for microtransactions and remittances, where quick and low-cost transfers are essential.

Ripple’s network is theoretically faster, with a capacity of 1,500 TPS under normal conditions and up to 50,000 TPS in optimized setups. However, it currently handles about 38 TPS in practice, which is lower than Stellar’s practical performance.

3. Transaction Costs and Network Congestion

Stellar transactions are incredibly cheap, with a base fee of just 0.00001 XLM—usually just a fraction of a cent, even during busy times. This makes Stellar one of the most affordable blockchain networks to use. Whether you’re sending small or large amounts, paying transaction fees remains very low, making it a cost-effective solution for users across the globe. Thus, network congestion is rarely an issue for Stellar.

However, when discussing XRP, Ripple’s transaction fees are similarly low, ranging from 0.00001 XRP to 0.0005 XRP. While it can occasionally cost slightly more than Stellar, the difference is negligible for most real-world use cases.

Also, XRP is generally resistant to network congestion due to its efficient consensus mechanism and low transaction fees.

4. Programming Languages and Smart Contracts

XLM (Stellar) uses diverse programming languages, including C++, Go, Java, JavaScript, Python, and Ruby. Yet, the main language is C++. This broad foundation helps ensure Stellar’s performance, scalability, and adaptability.

Furthermore, Stellar offers limited support for smart contracts—it can handle basic decentralized applications and tokenization, but it doesn’t have the advanced smart contract capabilities of platforms like Ethereum.

XRP (Ripple), by contrast, is primarily written in C++. This gives the XRP Ledger a strong foundation for speed and efficiency. However, unlike Stellar, Ripple does not natively support smart contracts. Ripple Labs, the company behind XRP, is actively exploring ways to integrate smart contracts into its ecosystem, but this effort is still in the early stages of development.

XLM vs. XRP: Market Performance

Winner: Ripple (XRP)

1. Market Capitalization

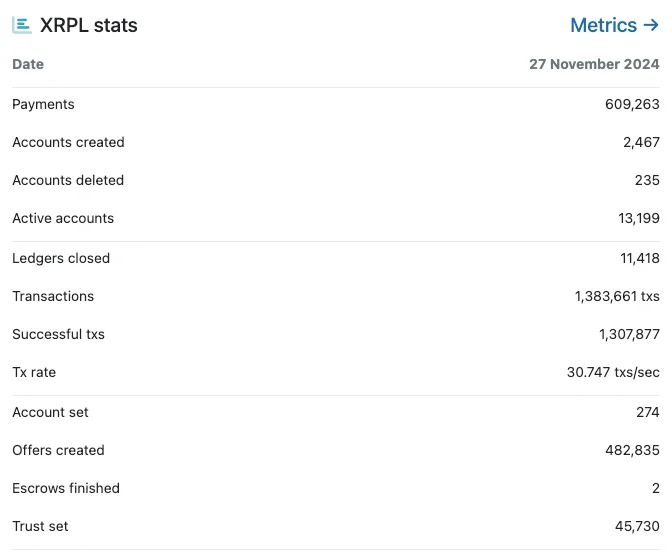

As of November 27, 2024, Ripple’s XRP has a higher market capitalization than Stellar’s XLM. XRP’s market cap is about $80.5 billion, making it the sixth-largest cryptocurrency. Meanwhile, XLM’s market capitalization is around $14.2 billion, making it 14th in the rankings.

The big difference in their market sizes reflects their focus. XRP’s high value comes from being widely used by banks and businesses to facilitate cross-border payments. On the other hand, XLM focuses on smaller-scale use, helping individuals and small projects with affordable and accessible financial solutions.

2. Supply and Price Action

When Stellar was first launched, it created 100 billion XLM tokens, but in 2019, the Stellar Development Foundation (SDF) burned 55 billion of those, reducing the total supply to 50 billion XLM. This reduction in supply is an example of how supply and demand dynamics can influence price action.

Currently, around 30.04 billion XLM are in circulation, and the SDF holds the remaining 19.96 billion for future development and promotional activities.

Regarding price action, XLM tends to have more stability and less volatility than many other cryptocurrencies, including XRP. Since its main focus is on offering affordable transactions and helping improve financial inclusion, its price tends to change in line with real-world use and adoption rather than market speculation. As of November 27, 2024, XLM’s price is $0.47 per token, reflecting some growth along with the broader market.

Regarding Ripple, they launched XRP with a total supply of 100 billion tokens, and 57 billion XRP are currently in circulation. Unlike Stellar, XRP is a deflationary currency, meaning a small portion of each transaction fee is burned, which reduces the overall supply over time and makes the remaining tokens more scarce and valuable.

XRP tends to experience more volatility than XLM, mainly due to market sentiment, news about regulatory issues (especially its battle with the SEC), and partnerships with large financial institutions. At the time of writing, XRP is trading at $1.41.

3. Trading Volume and Market Sentiment

XRP has a significantly higher trading volume than XLM. As of November 27, 2024, XRP’s 24-hour trading volume is approximately $9.1 billion, reflecting its popularity among traders and institutional use cases.

Market sentiment is currently positive, but around XRP, it generally tends to be volatile, driven by legal updates, announcements of new institutional partnerships, or broader crypto market trends. When positive news emerges, XRP often experiences sharp price increases, creating excitement and attracting retail and institutional investors. However, its sentiment can also swing negatively during periods of regulatory uncertainty.

XLM, in contrast, sees a lower trading volume, averaging about $3.3 billion per day, highlighting its smaller market presence and focus on grassroots adoption.

Market sentiment around XLM is also positive right now, but compared to XRP, it is generally more stable, as it is less affected by regulatory drama or big institutional moves. Its reputation as a tool for affordable and accessible transactions gives it steady support among smaller investors and developers. However, it lacks the hype and trading excitement often seen with XRP.

XRP vs. XLM: Practical Uses

Winner: Stellar (XLM)

There’s not much difference between the two regarding practical uses, but XLM offers more versatility. It’s better suited for individuals and smaller-scale projects, while XRP focuses primarily on enterprise solutions, making it less practical for everyday users. Both serve similar purposes, but they target different audiences.

1. Peer-to-Peer Payments

XLM is great for fast, affordable transactions, especially for individuals and small businesses. It’s ideal for peer-to-peer payments and remittances, and it strongly focuses on financial inclusion, particularly in areas with limited access to banking.

However, XRP is built for institutional use, which makes it less relevant for personal or small-scale transactions.

2. Asset Creation and Exchanges

Stellar allows custom asset creation and directly supports decentralized exchanges on its network. This is useful for businesses and developers who want to tokenize assets or facilitate currency swaps—something XRP doesn’t offer natively.

3. Institutional Liquidity Solutions

XRP is the leader in liquidity solutions for banks and financial institutions. It’s a bridge currency within RippleNet, helping banks settle international payments quickly and efficiently. This makes XRP essential for large-scale, enterprise-level applications.

4. Decentralization and Accessibility

XLM’s decentralized approach makes it more suitable for grassroots financial systems and smaller-scale uses. XRP, on the other hand, is more centralized, with Ripple Labs controlling its token distribution, which could limit its adoption for broader, independent use.

XLM vs. XRP: Short and Long-Term Perspectives

Both cryptocurrencies show promising potential when compared to XLM (Stellar) and XRP (Ripple) in terms of their short-term outlook. XLM benefits from strong technical indicators and positive market sentiment, which will continue into 2024.

Analysts predict that by the end of 2024, XLM could trade between $0.14 and $0.44, with an average price of $0.29. Its growth trajectory appears optimistic through 2025, where it might reach as high as $0.86, averaging around $0.51.

XRP, on the other hand, is also experiencing bullish momentum, supported by similar technical indicators and sentiment. Experts foresee XRP trading between $0.78 and $1.50 by the end of 2024, with an average price of $1.10. Looking into 2025, XRP is expected to see even more significant growth, with a potential range of $0.80 to $3.28, averaging around $1.81.

While both assets show strong short-term prospects, XRP generally exhibits a higher predicted average price for 2025, suggesting a more substantial upside in the near term than XLM.

However, in terms of long-term outlook, the two cryptocurrencies diverge somewhat.

XLM faces a more cautious future, with analysts projecting a gradual decline in price through 2026 and 2027. In 2026, its price range is expected to narrow to $0.18 to $0.62, and by 2027, it may hover between $0.20 and $0.55. By 2030, XLM could retrace to between $0.53 and $1.07, averaging around $0.78, as market competition and regulatory challenges weigh on its growth.

In contrast, XRP’s long-term trajectory is more volatile, with predictions showing some decline in the coming years. However, it is expected to experience significant growth post-2027, with a peak in 2029 potentially reaching as high as $5.51.

By 2030, XRP might trade between $1.76 and $3.17, averaging around $2.26, indicating that its long-term prospects could include a larger upside than XLM’s, though it also faces a higher degree of risk due to its volatility.

Disclaimer. This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risks due to high volatility. Always perform thorough research or consult a financial advisor before investing.

Where Are They Heading?

The future of Stellar depends on its ability to keep improving and growing its ecosystem. Unlike XRP, Stellar hasn’t faced as much regulatory pressure, but its success still relies on several key factors.

The growth of Soroban, Stellar’s smart contract platform, will be crucial. Soroban is designed to attract developers and help create new applications on the Stellar network. The more developers use it and create useful apps, the more demand there could be for XLM, boosting its value. If these new applications are widely adopted, it could directly impact the coin’s growth.

Also, the overall sentiment in the cryptocurrency market and the state of the global economy will affect XLM’s price. If the market is positive and more investors show interest, the price of XLM could rise. On the other hand, if the market is down or there’s an economic recession, it could hurt the coin’s value.

Regarding XRP, a mix of legal, technological, and market forces is expected to shape its future.

The recent partial win against the SEC has improved its position by easing worries about being labeled a security, boosting investor confidence. However, we can expect other future lawsuits, and if Ripple were to lose rulings, it could still harm XRP’s growth.

Institutional adoption is key to XRP’s growth. As more banks and payment providers see the value of Ripple’s technology for quick, low-cost transactions, demand for XRP as a bridge currency could rise. Ripple is also working on making its network faster and more versatile, which could increase its usefulness and appeal.

Another potential government challenge is FedNow, a payment system recently launched by the Federal Reserve. It uses blockchain technology to enable fast transfers of traditional fiat currencies and their conversion into stablecoins. Many see FedNow as direct competition to platforms like Stellar and Ripple. Depending on how successful this Federal Reserve initiative is, it could lead to noticeable price changes for both Ripple and Stellar.

Additionally, there is speculation that the US government may introduce clear regulations for stablecoins under Donald Trump’s leadership. Such guidelines could pave the way for Ripple to launch its anticipated stablecoin, RLUSD. Ripple has partnered with major exchanges to support RLUSD’s distribution, but the project is still awaiting regulatory approval.

FAQs

Which Token Is More Secure: Ripple or Stellar?

Stellar is generally seen as more secure than Ripple due to its use of the Stellar Consensus Protocol (SCP), allowing for faster and safer transactions than Ripple’s method.

Should I Buy Stellar or Ripple?

If you’re interested in institutional-focused transactions, Ripple might suit you, as it’s a for-profit company with a strong market presence. But if you’re more into supporting affordable services for individuals and small businesses, Stellar, a non-profit, maybe a better fit.

Final Thoughts

So, in the XLM vs. XRP battle, we must acknowledge that both share some foundational similarities, such as their creation by the same founder and their common goal of improving money transfers; they ultimately serve different purposes and target distinct audiences.

Stellar focuses on enabling financial inclusion for individuals and small businesses, particularly in underserved regions, by providing affordable and accessible financial services.

Also, XRP and XLM have a significant distinction in their target audience. XRP aims to enhance international money transfers in the banking sector and large financial institutions.

The differences between these two digital assets also extend to their governance models, scalability, and market strategies. Stellar employs a decentralized approach focusing on organic network growth, while Ripple’s more centralized model appeals to traditional financial institutions seeking efficient liquidity solutions.