Understanding Trading Volume in Crypto: A Complete Guide

Ever feel lost trying to decode the language of crypto, especially when wondering what is volume in crypto? You’re not alone. Crypto trading volume might seem puzzling initially, but understanding it could make a big difference in looking at potential price movements and market trends. Simply put, trading volume shows the level of buying and […]

Ever feel lost trying to decode the language of crypto, especially when wondering what is volume in crypto? You’re not alone. Crypto trading volume might seem puzzling initially, but understanding it could make a big difference in looking at potential price movements and market trends.

Simply put, trading volume shows the level of buying and selling pressure in the market, like a pulse check for crypto. By grasping how daily volume and market sentiment work together, you’ll be equipped to spot opportunities and risks.

So, today, we break down trading volume and how to use it to make smarter choices in crypto. Let’s uncover the insights behind those volume bars and price shifts.

What is Trading Volume Crypto?

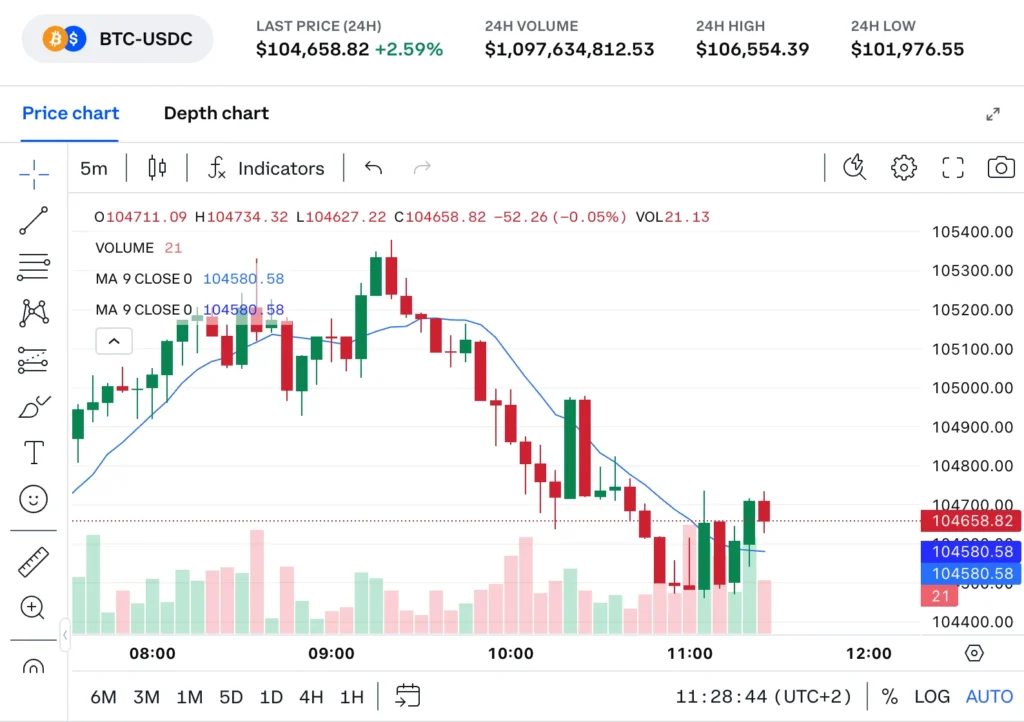

In its simplest form, trading volume is the total number of times a cryptocurrency is traded within a specific period. It counts how often a coin is bought and sold, helping investors see how active the market is for that particular asset. This measure is often tracked over 24 hours to provide a snapshot of recent activity.

Trading volume is displayed on price charts as bars or lines, visually representing the flow of buying and selling. Higher bars generally indicate more transactions and can hint at rising interest, while lower bars suggest a quieter market. Volume can be observed on different levels, from individual exchanges to the entire market, giving traders an idea of the coin’s popularity and the current level of interest from other market participants.

In crypto, trading volume isn’t just a number; it reflects the overall demand for a coin at any moment. Understanding this basic concept provides a foundation for analyzing market trends and observing how active a coin is, setting the stage for a more in-depth look at factors like liquidity, volatility, and market sentiment.

Who doesn’t love free tokens?

Find legit airdrops that reward you with real crypto just for participating check the latest airdrops

The Importance of Trading Volume in Crypto

Trading volume helps traders understand the overall health and movement of the crypto market. But have you wondered why trading volume matters?

- Liquidity: High trading volume means more active buying and selling, which creates a liquid market where trades can happen quickly without prominent price changes. As a result, it helps traders buy and sell quickly at fair prices, while low volume can make trades harder to execute and may cause price gaps.

- Price Discovery: Volume helps set the fair value of a cryptocurrency. With more trading activity, the market price better reflects what buyers and sellers think the asset is worth based on supply and demand.

- Market Sentiment: Volume levels also tell how traders feel about an asset. A spike in volume might show growing interest or excitement, while low volume might suggest hesitation or a wait-and-see approach.

- Market Stability: Higher volume tends to stabilize the market, making it harder for any single trade to cause sudden price shifts. In contrast, low-volume markets are more vulnerable to manipulation, where an extensive trade could lead to unexpected price movements.

- Trading Strategies: Traders use data from daily trading volume and indicators like the volume-weighted average price (VWAP) to refine their strategies. By watching buying and selling pressure, they can make more informed decisions about when to enter or exit trades.

Want free crypto to get started?

Claim signup bonuses from top platforms with zero upfront cost see what you can grab today

Common Volume Indicators in Crypto

To understand and interpret trading volume data, traders use specific indicators that reveal patterns and trends. Here are some of the most commonly used volume indicators in crypto:

1. On-Balance Volume (OBV)

OBV tracks the volume flow over time to show buying and selling pressure. When OBV goes up, it shows more buying, while a decrease indicates more selling. A rising OBV paired with a price increase can support an ongoing trend, while a difference between OBV and price might signal a potential reversal.

2. Volume-Weighted Average Price (VWAP)

VWAP gives the average price of a crypto asset, adjusted by its trading volume over a set period. Traders use VWAP to see if the price is above or below this average, giving insight into the asset’s trend and helping them decide if they’re buying or selling at a reasonable price.

3. Money Flow Index (MFI)

The MFI combines price and volume to measure buying and selling pressure. Higher values of MFI suggest overbought conditions (where prices may soon fall), and lower values indicate oversold conditions (where prices may rise). This indicator helps traders identify possible points to buy or sell.

4. Accumulation/Distribution (A/D) Line

The A/D line measures the overall flow of money into or out of an asset based on its price and volume. When the line rises, it shows more buying interest (accumulation), while a falling line shows more selling interest (distribution). This is useful for tracking long-term market trends.

5. Chaikin Money Flow (CMF)

CMF analyzes buying and selling activity balances. Values above zero suggest buying interest, while values below zero suggest interest in sale. CMF helps traders see the strength of a trend and identify potential turning points.

6. Moving Average of Volume (MAV)

MAV calculates the average trading volume over a specific period, smoothing out short-term fluctuations. It helps traders identify long-term volume trends, making it easier to spot consistent increases or decreases in activity that might signal a shift in market interest.

Each indicator gives traders a different perspective on market activity and sentiment, helping them better understand price movement and potential trends. By combining these indicators, traders gain valuable insights into the market and can create more precise trading strategies.

Confused by token metrics?

Learn how market cap and supply really affect a coin’s value — read the full breakdown

How to Use Volume in Crypto

Each indicator opens the door to a deeper understanding of trading volume, helping you spot trends, track market sentiment, and make sense of buying and selling activity. But knowing the tools is just the beginning; what truly matters is how you use them.

Ever wondered how trading volume can directly influence your decisions and boost your confidence as a trader? Let’s go into some practical ways to implement this knowledge and take your crypto trading to the next level.

1. Track Volume to Confirm Trends

If a coin’s price goes up and the trading volume also increases, it’s a sign that the trend is solid and many buyers are interested. On the other hand, if the price drops with a higher volume, it shows that many people are selling. Watching this helps you understand if the trend will likely continue.

2. Spotting Reversals Early

Sometimes, a coin’s price might change direction after a long trend. If the price has been falling for a while and suddenly the volume increases with a slight price rise, it could mean more people are starting to buy. This might show that the trend is about to reverse.

3. Recognizing Breakouts

Breakouts happen when the price moves above a resistance level or below a support level. If this happens with high trading volume, it will likely keep moving in the same direction. If the volume is low, the breakout might not hold, and the price could reverse.

4. Checking Market Liquidity

High trading volume usually means the market is liquid. This means you can buy or sell coins quickly without changing prices. If the volume is low, trades might be slower, and you could pay more or sell for less than you expected.

5. Understanding Market Sentiment

Trading volume can show how traders feel about a coin. If the volume suddenly increases, it might mean people are excited or confident about that coin. If the volume drops, fewer people are interested or uncertain.

6. Using Volume Indicators

There are tools like the Money Flow Index (MFI) and Volume-Weighted Average Price (VWAP) that combine price and volume data. MFI shows if a coin might be overbought or oversold, while VWAP helps you see if its price is fair compared to its recent trading volume.

By observing trading volume and combining it with price analysis, you can better understand what’s happening in the market and make smarter trading choices. Remember, volume works best with other tools to form a complete strategy.

Is volume the real market signal?

Learn how trading volume reveals buyer strength and short term momentum see how volume really works

Regulatory Changes Impacting Trading Volume

In 2024 and beyond, new cryptocurrency regulations will shape the market’s operation, focusing on safety, transparency, and stability. These rules aim to create a more reliable environment for traders and investors worldwide, directly impacting cryptocurrency trading volume across various markets.

1. European Union’s MiCA Regulation

The European Union’s Markets in Crypto-Assets (MiCA)regulation introduces a unified legal framework for cryptocurrencies across all EU member states. It establishes clear rules for crypto companies, including licensing requirements, to ensure better consumer protection and reduce fraud.

MiCA is expected to increase trust among traders and encourage more trading activity by making the market more transparent. However, some platforms could experience low trading volume as market participants adapt to the new requirements during the adjustment period.

The regulation will fully apply by December 30, 2024, and is enforced across the EU, providing a consistent approach to managing crypto-assets.

The United States Regulatory Changes

In the United States, efforts are underway to improve oversight of the cryptocurrency market while supporting innovation. Regulators like the Securities and Exchange Commission (SEC) focus on protecting investors and ensuring fair practices.

At the same time, there is growing support for policies that could benefit crypto businesses and traders, potentially boosting trading activity. These updates have been implemented gradually throughout 2024, aiming to balance market safety with innovation.

OECD’s Crypto-Asset Reporting Framework (CARF)

On a global scale, the Organisation for Economic Co-operation and Development (OECD) has introduced the Crypto-Asset Reporting Framework (CARF). This initiative requires crypto exchanges to report transaction details to tax authorities, aligning crypto-assets with traditional financial reporting systems.

CARF, which will be implemented by 2027, aims to reduce tax evasion and promote transparency. This change will influence trading behaviors as market participants adapt to the new requirements.

FAQ

More precise rules can attract more participants, improving market liquidity. Some platforms may experience reduced activity during the transition as they adjust to new compliance requirements.

MiCA applies to the EU, CARF has global ambitions, and U.S. regulatory updates mainly affect its domestic market. Together, they shape a more connected and standardized crypto ecosystem.

The regulations aim to create safer markets with reduced fraud and more transparent rules, thereby giving traders greater confidence in their investments.

High trading volume typically indicates strong interest from traders, often resulting in price increases. On the other hand, low trading volume can signal a lack of interest, which may cause prices to drop.

Trading volume represents the total number of units traded over a specific period, whereas market liquidity refers to the ease with which assets can be bought or sold without significantly affecting their price.

Final Thoughts

By now, we hope we have answered one of the most asked queries, “What is Volume in Crypto?” Now you see that it is more than just numbers; it shows how active and engaged the market is.

Thus, traders can make more informed decisions by understanding volume trends and their relationship to market behavior. As new regulations are introduced, they bring a chance for safer and more accessible crypto trading for everyone.

Staying informed and open to these changes can help traders grow alongside this market.