How to Stake Cardano (ADA) in 2026

As the Cardano network continues to mature, more users are discovering how to stake Cardano and earn consistent staking rewards while maintaining full control of their ADA tokens. Thanks to its proof-of-stake model, Cardano staking has become one of the most reliable ways to generate passive income from digital assets, eliminating the need for complex trading strategies. In this guide, you’ll learn everything about staking Cardano, including how Cardano […]

As the Cardano network continues to mature, more users are discovering how to stake Cardano and earn consistent staking rewards while maintaining full control of their ADA tokens. Thanks to its proof-of-stake model, Cardano staking has become one of the most reliable ways to generate passive income from digital assets, eliminating the need for complex trading strategies.

In this guide, you’ll learn everything about staking Cardano, including how Cardano staking works, how to choose stake pool operators, and which wallets and platforms best suit your needs. Whether you’re using a hardware wallet, custodial wallet, or crypto exchange, you’ll discover exactly how to stake ADA securely and earn rewards.

Understanding What Cardano Is and Why Staking Matters

Cardano is a proof-of-stake blockchain designed to provide scalability, interoperability, and sustainability for decentralized applications. Built on peer-reviewed research, the Cardano blockchain operates using a consensus mechanism known as Ouroboros, which enables participants who hold and stake ADA to help validate transactions, produce blocks, and secure the network.

When you participate in staking, you delegate your ADA tokens to a staking pool managed by pool operators. These stake pool operators maintain the infrastructure required to keep the Cardano network running efficiently. In return, you’ll earn staking rewards proportional to your contribution and the pool’s performance.

The Cardano network represents a decentralized future where full ownership, transparency, and security are prioritized. Staking empowers every ADA holder to participate in governance and help secure the network while earning passive income.

How Cardano Staking Works

Before diving into the staking process, it’s crucial to understand how Cardano staking functions.

The system revolves around stake pools, which are groups of users who delegate their ADA held to professional pool operators. These operators manage nodes that take turns becoming a slot leader, responsible for producing blocks in the next block round. When a slot leader successfully creates a block, rewards are distributed among all participants in proportion to their delegated stake.

Since Cardano uses a proof-of-stake model, the more ADA you delegate, the higher your potential share of the rewards earned. The staking process is flexible and user-friendly, allowing you to withdraw or re-delegate your stake at any time.

You retain full ownership of your ADA tokens throughout staking (they never leave your wallet, and you’ll never lose access to your funds). This self-custody design ensures you maintain complete control and security while still being eligible to earn staking rewards.

How to Stake Cardano (Step-by-Step)

Let’s walk through the process of staking Cardano (ADA) safely and efficiently. The steps below explain how to stake ADA, whether you’re using a cryptocurrency exchange such as Binance, Coinbase, or Kraken, or a wallet like Ledger, Yoroi, or Daedalus.

For demonstration purposes, the screenshots provided will show how to complete the process on Binance. However, keep in mind that the procedure is similar across most platforms. Remember, you must have ADA in your account before you can start staking it.

Step 1. Set Up Your ADA Wallet

To begin staking ADA, you need a wallet that supports Cardano staking. Popular options include Daedalus, Yoroi Wallet, and Ledger hardware wallet integration.

If you prefer maximum security, consider using a hardware wallet, such as the Ledger hardware wallet or Trezor. These devices store your private keys offline, protecting your assets from online risks.

Alternatively, custodial wallets and crypto exchanges can handle the staking process on your behalf, but they hold your funds in trust. For maximum control, self-custody is recommended.

Since we’ll be demonstrating how to stake Cardano using Binance, we’ll use the platform’s built-in wallet. Ensure you have a verified Binance account and that your ADA tokens are available in your Spot Wallet or Earn Wallet.

Step 2. Choose a Staking Pool

After setting up your wallet, the next step is to select a staking pool. The Cardano network offers thousands of stake pool operators, each with different fixed fees, performance levels, and rewards.

When evaluating pools, consider the following factors:

- Pool saturation: Avoid pools that are over-saturated to maximize earnings.

- Fixed fees and variable costs: Lower fees can result in more rewards.

- Reliability: Choose pool operators with consistent uptime and transparency.

- Community reputation: Supporting a trusted Cardano community pool can contribute to network growth.

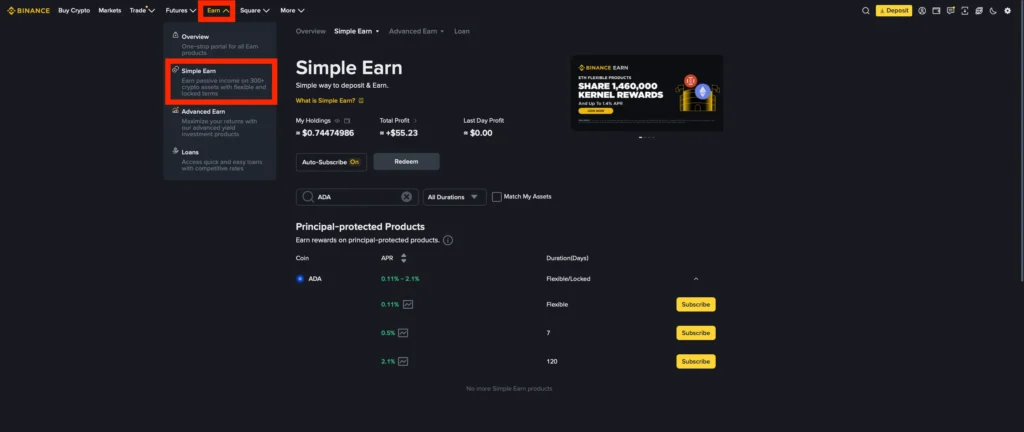

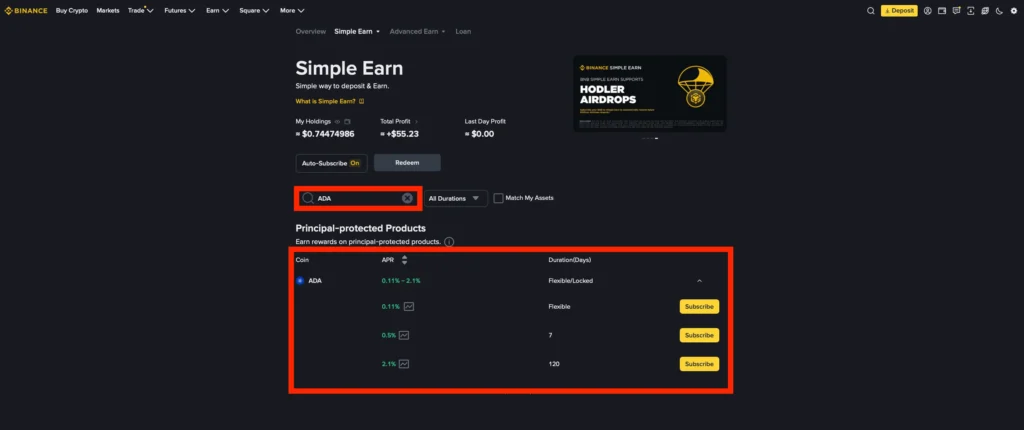

In Binance, once logged in, from the main menu, go to “Earn” → “Simple Earn.”

In the Simple Earn dashboard, search for “ADA.”

You’ll find multiple staking products with two main types of terms:

- Flexible: withdraw anytime, lower APY.

- Locked: 7–120-day periods, higher APY.

Step 3. Delegate Your ADA Tokens

Once you’ve chosen a pool, open your wallet and select the “Delegate” option. You’ll be prompted to confirm the staking pool you wish to join and specify the amount of ADA tokens you want to stake.

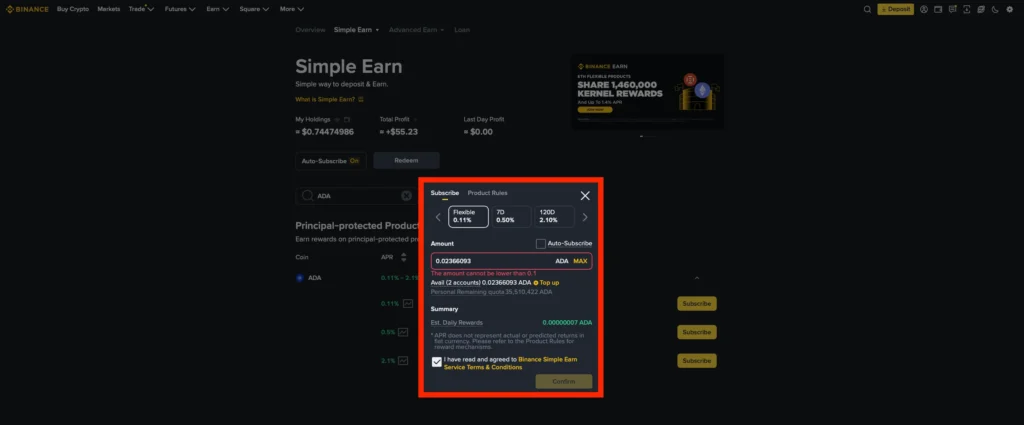

On Binance, click “Subscribe” next to your chosen staking offer. Enter the amount of ADA you’d like to stake, review the estimated APY, and check the box to confirm the terms. Finally, click “Confirm.”

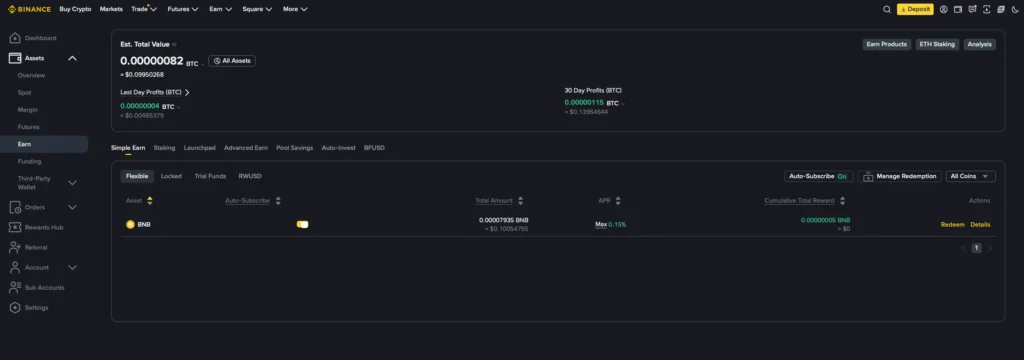

Step 4. Track and Earn Rewards

After delegation, your ADA will start generating staking rewards. These are typically distributed every epoch (around five days). You can view your rewards earned directly in your wallet interface.

The typical annual percentage yield (APY) for ADA staking ranges between 3% and 6%, depending on the pool’s performance and overall network conditions.

By consistently staking, you can earn rewards and even earn passive income while supporting the Cardano network. The Cardano staking model ensures you remain in control of your funds, with predictable rewards and minimal risk.

If you’re also staking assets on other chains, here’s a complete guide on how to stake MATIC (POL).

Best Platforms for Staking Cardano in 2026

While staking ADA through self-managed wallets offers the most control, some investors prefer centralized exchanges for their user-friendly interfaces and ease of use.

Besides Binance, which we used as an example above, here are two more popular methods to stake your ADA on trusted platforms:

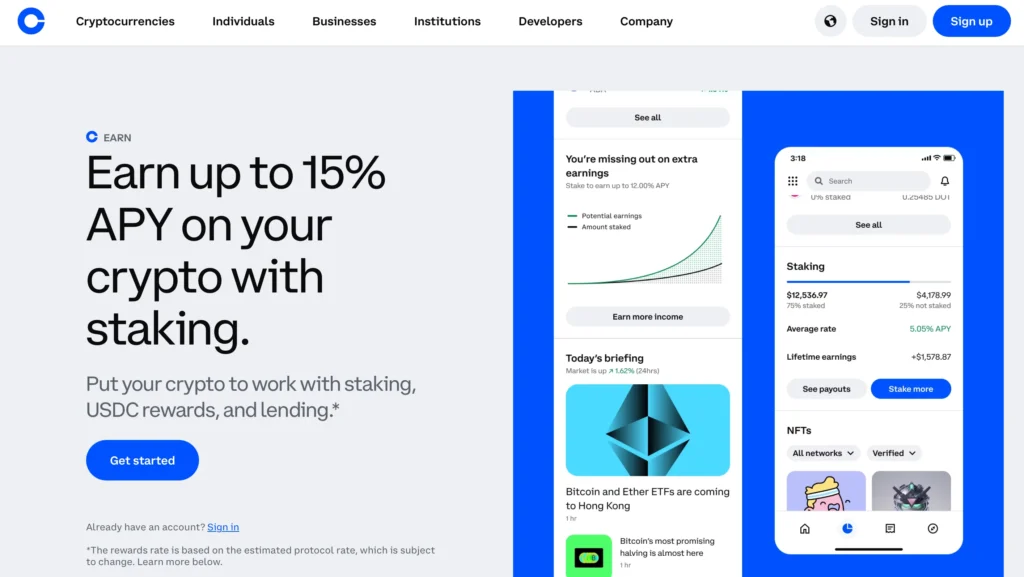

1. Staking Cardano on Coinbase

Coinbase offers a simplified experience for staking Cardano, making it ideal for beginners who want to earn rewards without having to deal with stake pool details. Once you hold ADA in your account, you can opt in to Cardano staking directly.

The exchange automatically delegates your ADA tokens to a staking pool and handles the validation process on your behalf. Rewards are added to your account every few days, allowing you to earn staking rewards effortlessly.

Though convenient, this method is custodial, meaning the crypto exchange holds your assets.

2. Staking ADA on Kraken

Kraken is another crypto exchange that supports staking ADA with competitive yields and reliable service. Users can stake ADA directly from their Spot Wallet and start earning rewards almost instantly.

Kraken offers flexible terms, allowing you to withdraw your funds at any time. With transparent fees, strong security, and an excellent user experience, it remains a popular method for investors seeking a hands-off way to earn staking rewards.

Tips to Maximize Your Staking Rewards

- Monitor Pool Performance: Regularly check the uptime and running costs of your chosen pool.

- Re-delegate When Needed: If performance drops, reassign to a more suitable pool.

- Diversify: You can delegate portions of your ADA held to multiple stake pools.

- Use a Hardware Wallet: Enhance security with a hardware wallet, such as Ledger, for long-term staking.

- Stay Updated: The Cardano network evolves rapidly; keeping informed ensures you get the most rewards and incentives.

By following these practices, you’ll consistently earn staking rewards and enjoy greater future rewards as the network expands.

Advantages of Staking ADA

Staking Cardano provides multiple benefits for both investors and the network:

- Passive income: Generate steady earnings through predictable rewards.

- Security: By delegating ADA tokens, you help secure the Cardano network.

- Self-custody: Maintain ownership and control over your funds.

- Sustainability: Support the ecosystem’s developer community and governance.

Additionally, because staking ADA involves minimal risk, it’s ideal for long-term holders who want to grow their assets while supporting a proof-of-stake blockchain.

Risks and Considerations of Staking Cardano

Although staking Cardano is generally low-risk, it’s essential to stay cautious. You could lose access to your funds if you use untrusted custodial wallets or fall victim to phishing. Always double-check the authenticity of pool operators and wallets.

Also, remember that rewards are variable, influenced by network factors, fees, and pool performance. There’s no guarantee of returns, but historically, Cardano staking has provided stable yields for consistent participants.

FAQ

You cannot obtain free ADA because every reward is derived from staking Cardano, which requires holding and delegating your ADA tokens. You earn rewards by supporting a staking pool, so while it’s low-cost, it’s not entirely free.

Yes, staking Cardano is a great way to earn passive income and support the Cardano network.

Yes, most regions treat ADA rewards from Cardano staking as taxable income once received. Tax obligations are subject to your local laws, so track your rewards earned carefully.

No, you must manually delegate to a staking pool through a wallet or crypto exchange. After that, your ADA held will automatically generate staking rewards each epoch.

In general, there’s no minimum lock-up period for staking ADA. You only wait one epoch before earning ADA rewards, and you can withdraw or redelegate at any time.

Cardano staking allows you to stake ADA directly from your wallet without locking funds in smart contracts. Ethereum requires deposits, whereas Cardano staking works to maintain full ownership and flexibility.

Yes, staking Cardano uses less energy and is more user-friendly. Instead of mining rigs, you join a staking pool to earn passive income through the proof-of-stake consensus mechanism.

Conclusion

Learning how to stake Cardano is one of the smartest strategies for generating passive income while supporting the Cardano network. Whether you use a hardware wallet, a crypto exchange, or a self-custody option, you’ll maintain ownership, help secure the ecosystem, and continually earn rewards.

The staking process is simple, transparent, and user-friendly, making staking ADA an attractive choice for both beginners and advanced crypto holders.

In the long run, participating in Cardano staking ensures that you earn staking rewards, contribute to a sustainable proof-of-stake blockchain, and enjoy steady future rewards as part of the growing Cardano community.