Top Prediction Markets in 2026

Accurately forecasting what will happen worldwide has become harder as financial, political, and social events unfold faster than traditional analysis can keep pace. As a result, opinion polls lag behind reality, expert commentary fragments, and financial markets often react after information is already priced in. Meanwhile, as uncertainty grows, demand for clearer signals and more reliable prediction tools rises. Thus, analysts and traders increasingly […]

Accurately forecasting what will happen worldwide has become harder as financial, political, and social events unfold faster than traditional analysis can keep pace. As a result, opinion polls lag behind reality, expert commentary fragments, and financial markets often react after information is already priced in.

Meanwhile, as uncertainty grows, demand for clearer signals and more reliable prediction tools rises. Thus, analysts and traders increasingly look beyond conventional forecasting models.

In response, prediction markets have matured into data-driven forecasting systems. By allowing participants to trade contracts tied to real events, these markets convert belief and risk into transparent market price signals. Thus, forecasting improves, and outcome estimates often outperform traditional approaches.

Therefore, in this article, we present the top 5 prediction markets in 2026 you can trust, focusing on platforms that combine strong liquidity, clear rules, and credible incentives for informed traders. Thus, readers can better evaluate which platforms align with their goals and risk tolerance.

| Platform | Specifications |

|---|---|

| Kalshi | Best for: Regulated prediction market Regulated: Yes (U.S. regulated platform) Settlement: USD (cash-settled event contracts) Withdrawal methods: Bank transfer, debit card Categories: Politics, elections, economic data, weather, financial events, and others |

| Polymarket | Best for: High-liquidity global prediction markets Regulated: Partially (jurisdiction-dependent access) Settlement: Crypto (on-chain outcome tokens) Withdrawal methods: Crypto wallet (stablecoins) Categories: Politics, elections, crypto markets, geopolitics, world events, and others |

| Opinion.trade | Best for: Early users earning points for future airdrop Regulated: No (early-stage, on-chain platform) Settlement: On-chain (points → future token) Withdrawal methods: Not applicable yet (points system) Categories: Politics, crypto outcomes, social trends, opinion markets, and others |

| Probable.markets | Best for: Permissionless prediction markets and early rewards Regulated: No (decentralized protocol) Settlement: On-chain smart contracts Withdrawal methods: Crypto wallet Categories: Elections, crypto price ranges, industry trends, user-generated events, and others |

| Predict.fun | Best for: Community-driven predictions and engagement rewards Regulated: No (BNB Chain platform) Settlement: On-chain (BNB ecosystem) Withdrawal methods: Crypto wallet (BNB Chain) Categories: Sports, politics, crypto prices, entertainment, pop culture, and others |

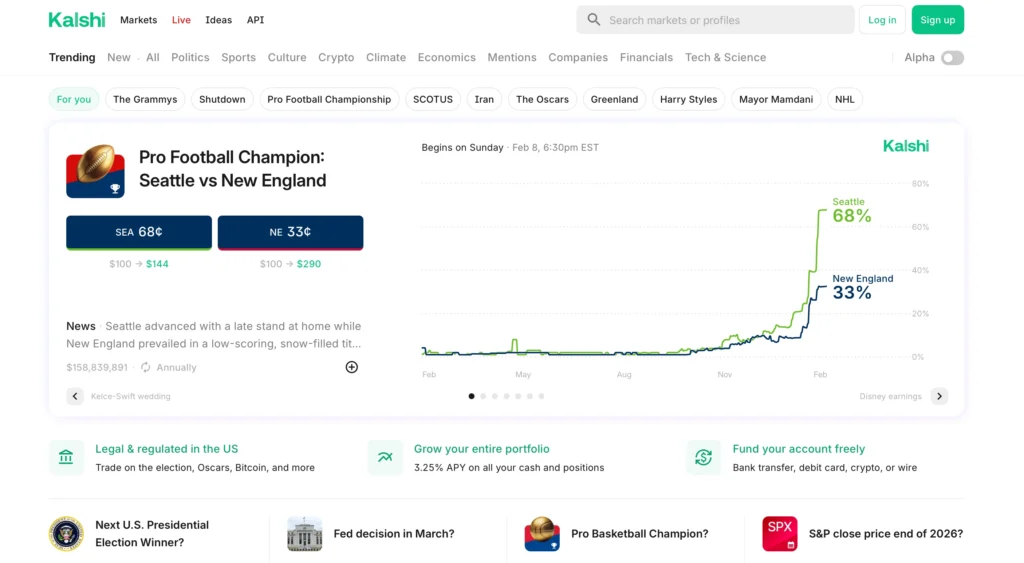

Kalshi – Best Regulated Prediction Market Overall

Kalshi stands out in 2026 as the most institutionally credible prediction market, designed for traders who prioritize regulatory clarity and capital protection when forecasting real-world events.

Founded in 2018 by Tarek Mansour and Luana Lopes Lara, Kalshi operates as a U.S.-based event contracts exchange. It operates under federal oversight, requires KYC, and uses segregated customer accounts. Because of this structure, counterparty risk is significantly lower than on unregulated betting markets.

From a technical standpoint, Kalshi lists binary event contracts priced between $0.01 and $0.99, with each price directly representing implied probability. Contracts settle at $1 or $0, and most markets close within days or weeks. Moreover, deposits and withdrawals are supported via bank transfer and debit card, with no crypto exposure required.

Prediction categories include U.S. elections, interest rate decisions, inflation releases, weather events, and other clearly measurable real-world outcomes.

On Reddit, Kalshi is consistently described as “boring but reliable.” Users appreciate accurate pricing and low risk of manipulation, though some note limited market variety and slower listing speeds.

| Pros | Cons |

|---|---|

| Regulated U.S. platform with a clear legal framework | Access restricted by geography and regulation |

| USD settlement removes crypto volatility risk | Smaller number of active markets |

| Centralized clearing reduces counterparty risk | Slower rollout of new event contracts |

| Prices closely track real economic data | Limited appeal for speculative traders |

| Strong dispute resolution rules | No token incentives or user rewards |

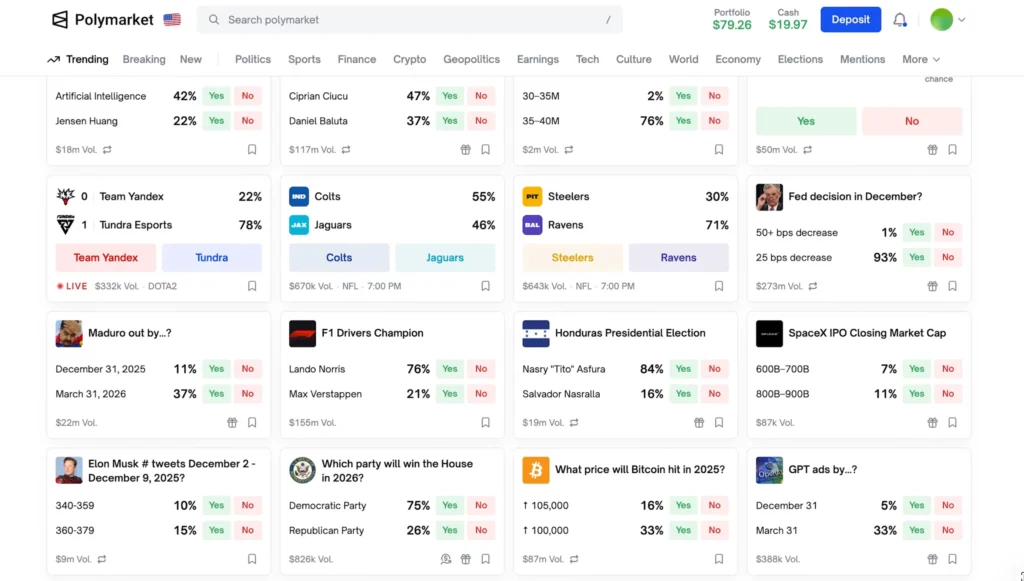

Polymarket – World’s Largest Prediction Market by Liquidity

Polymarket is the world’s largest prediction market, leading the sector by total trading volume, active users, and liquidity depth across political and financial events.

Launched by Shayne Coplan, Polymarket operates on blockchain infrastructure, with most markets settling on-chain. High-profile political markets often exceed $10–50 million in volume, making it a primary real-time signal for global events. Access varies by region, with intermediated entry in regulated areas.

Technically, users trade yes/no outcome tokens priced between $0.01 and $0.99, implying probabilities between 1% and 99%. Markets update continuously, and liquidity pools allow fast entry and exit. Settlement relies on oracle systems once outcomes are objectively resolved.

Available categories include politics and elections, crypto price outcomes, geopolitical events, macroeconomic indicators, and selected sports or entertainment markets.

Reddit sentiment views Polymarket as the fastest forecasting tool available. Traders praise liquidity and speed, while also warning that emotional markets can overshoot fair value during breaking news.

| Pros | Cons |

|---|---|

| Largest liquidity among prediction markets | Crypto-only settlement |

| Fastest price reaction to breaking news | Regulatory status varies by region |

| Wide range of political and financial events | Oracle-based resolution introduces dependency risk |

| On-chain transparency for trades and volumes | High volatility during emotional events |

| Strong signal quality for elections | Requires a wallet and crypto knowledge |

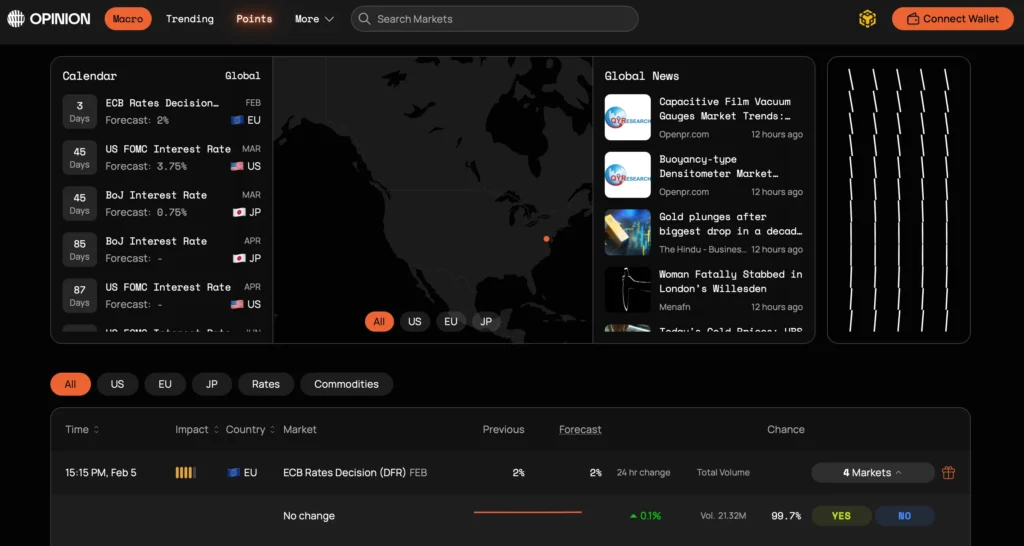

Opinion.trade – Early Prediction Market With Points-to-Airdrop Model

Opinion.trade is an early-stage prediction market that rewards participation rather than immediate financial returns, positioning itself as a long-term ecosystem play.

The platform is built by a Web3-native team operating without a traditional corporate structure. While not regulated, all activity is handled on-chain, and user balances remain in smart contracts. As a result, risk depends largely on contract security and liquidity depth.

Instead of direct payouts, Opinion.trade issues participation points. Users earn points for placing predictions, maintaining activity, and engaging consistently. These points are planned to be converted into a future token airdrop to incentivize early adoption.

Markets currently cover politics, crypto outcomes, technology adoption, social trends, and opinion-based forecasting topics.

On Reddit, users describe Opinion.trade as “low-risk to try, high-risk to size up.” Most recommend participating with small amounts to farm points rather than deploying serious capital.

| Pros | Cons |

|---|---|

| Points system rewards early participation | Points have no immediate monetary value |

| Low capital requirement to participate | Very low liquidity in most markets |

| On-chain settlement improves transparency | No regulatory oversight |

| Broad coverage of opinion-based events | Token launch timeline not fixed |

| Attractive for airdrop-focused users | Not suitable for large positions |

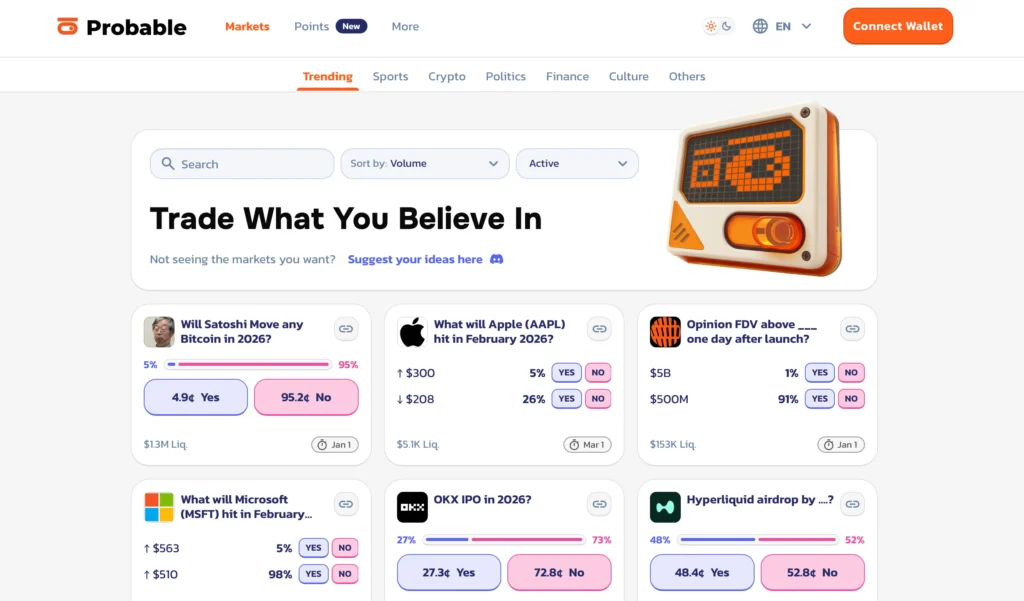

Probable.markets – Permissionless Prediction Markets With Early Rewards

Probable.markets focuses on permissionless market creation, allowing users to launch and trade markets without centralized approval.

Built by a decentralized development group, the platform relies entirely on smart contracts and oracle-based resolution. While this increases openness, it also introduces greater technical and liquidity risks than regulated platforms.

Users earn points for trading, creating markets, and providing liquidity. These points are intended to convert into a future airdrop allocation once the token launches. Market sizes vary widely, from a few hundred dollars to larger community-driven pools.

Prediction categories include elections, crypto price ranges, industry adoption, entertainment, and user-generated events.

Reddit discussions frame Probable.markets as experimental but promising. Users like the flexibility but frequently note shallow order books and uneven pricing.

| Pros | Cons |

|---|---|

| Permissionless market creation | Liquidity varies widely between markets |

| Points are rewarded for trading and creation | Smart contract risk remains |

| Transparent on-chain resolution | No fiat or bank withdrawal options |

| Supports niche and long-tail events | Early governance model |

| Strong incentive for early contributors | Airdrop details may change |

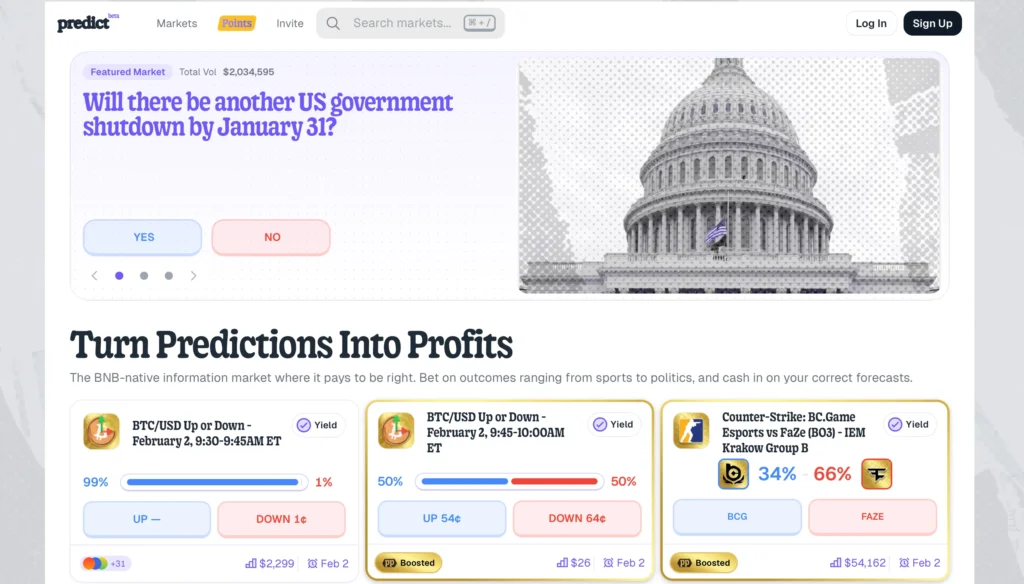

Predict.fun – BNB Chain Prediction Market Focused on Engagement

Predict.fun is a BNB Chain-based prediction market designed for accessibility, frequent participation, and community rewards rather than institutional forecasting.

A small crypto-focused team develops the platform and operates without regulatory oversight. All markets settle on-chain, and users earn points tied to activity and accuracy, which are expected to influence future airdrop distribution.

Markets emphasize high engagement and smaller position sizes, covering sports, politics, crypto price movements, entertainment, and pop culture events.

Reddit users generally describe Predict.fun as easy to use and entertaining, though many caution that liquidity is inconsistent and the platform is best suited for casual participation.

| Pros | Cons |

|---|---|

| Simple interface suitable for beginners | Not regulated |

| Community-driven engagement rewards | BNB Chain dependency |

| The points system encourages activity | Liquidity is inconsistent across markets |

| Covers casual and popular event types | No fiat settlement options |

| Low entry barriers | Airdrop not guaranteed |

Methodology: How We Selected the Top 5 Prediction Markets in 2026

To choose the top 5 prediction markets in 2026, we followed a simple, practical approach focused on how these platforms actually perform:

- Clear event contracts – We included only platforms that clearly offer event contracts linked to verifiable real-world events, with objective resolution rules.

- Liquidity and pricing quality – We prioritized markets with strong liquidity, active participants, and reliable market price signals that support accurate forecast outcomes.

- Regulation and risk control – We favored regulated platforms when available, and carefully evaluated unregulated platforms for transparency, fund handling, and overall risk.

- Ease of trading and withdrawals – We reviewed how easily retail traders can trade, manage positions, and withdraw money via bank transfer, debit card, or virtual currency.

- User feedback and real-world performance – We validated each platform using Reddit discussions, usage data, and economics research to ensure real forecasting value beyond opinion polls.

This process ensures our selections reflect practical reliability, clear incentives, and real usefulness for forecasting future events.

FAQ

Prediction markets are platforms where participants trade contracts linked to future events. Each contract represents a possible outcome, and its market price reflects traders’ collective prediction. In 2026, most prediction markets use event contracts priced between $0 and $1, turning trading activity into real-time forecasting data.

Prediction markets sit between financial markets and betting markets. Structurally, they resemble financial derivatives, since users trade contracts and manage risk based on prices and probability. However, depending on jurisdiction, some regulators still classify them under gambling rules rather than traditional finance.

Unlike opinion polls, prediction markets use financial incentives. Traders risk money or rewards, forcing them to update beliefs quickly when new data or news appears. Because poor predictions lead to losses, markets tend to generate more accurate forecasts, especially for elections and major financial events.

Most prediction markets focus on political events, elections, financial events, and major world developments. Common examples include the presidential election, central bank decisions, geopolitical outcomes, sports championships, and pop culture moments. These are real-world events with clear resolution criteria.

The market price of an event contract represents the implied probability of an outcome. For example, a price of $0.65 suggests a 65% chance the event will happen. Traders constantly adjust positions, so prices update faster than traditional forecasting models.

Some platforms operate as regulated platforms, especially in the U.S., where oversight may involve the Commodity Futures Trading Commission and formal CFTC approval. Others remain decentralized and unregulated.

Yes, retail traders make up the majority of users on most prediction markets. Minimum position sizes are often low, allowing small bets while still contributing to price discovery. This broad participation improves liquidity and makes outcomes harder to manipulate.

Platforms vary. Some use real money, others rely on virtual currency, and a few still experiment with play money models. Real-money markets generally produce better forecast outcomes because financial risk discourages careless predictions.

Key risks include low liquidity, regulatory uncertainty, smart contract vulnerabilities, and price manipulation in thin markets. Because prediction markets involve uncertainty, traders should manage positions, avoid emotional bets, and never risk more money than they can afford to lose.

In some regions, yes. Regulators may still classify prediction markets as gambling, especially political markets. However, many economists argue they function as financial markets, since they aggregate information and generate probability estimates rather than offering fixed odds.

Growth is expected as platforms expand coverage, improve liquidity, and gain regulatory clarity. As long as global events remain unpredictable, interest in prediction markets as tools for tracking, exploring, and profiting from future outcomes is likely to remain strong.

Closing Remarks

Prediction markets have matured into powerful forecasting tools that turn belief, money, and trade activity into real-time market price signals. Researchers estimate that global trading volume in prediction markets surpassed $40 billion in 2026, driven by politics, finance, and major world events.

Still, these systems carry risk. Markets vary in regulation, liquidity, and structure, and not every outcome will match expectations. Some platforms operate outside formal oversight, so retail traders should understand local laws and tax implications before placing bets or building positions. Capital protection and disciplined risk management remain essential.

While prediction markets increasingly complement traditional forecasting and even influence how some analysts track financial, political, and economic uncertainty, they should be used as one input among many, not as a sole decision mechanism. As these tools evolve, informed engagement and risk awareness will remain key to navigating future events.