How to Invest in DeFi in 2026

Many people are frustrated with traditional financial systems that offer limited portfolio growth, high fees, and a lack of transparency. As global markets evolve, investors are seeking alternative ways to grow their wealth without relying on banks or intermediaries. But entering the world of decentralized finance (DeFi) can feel overwhelming at first. Newcomers want to understand how it works, which platforms to trust, and how they could begin without […]

Many people are frustrated with traditional financial systems that offer limited portfolio growth, high fees, and a lack of transparency. As global markets evolve, investors are seeking alternative ways to grow their wealth without relying on banks or intermediaries.

But entering the world of decentralized finance (DeFi) can feel overwhelming at first. Newcomers want to understand how it works, which platforms to trust, and how they could begin without risking their entire portfolio. Without clear guidance, it’s easy to feel lost, or worse, to make costly mistakes.

This guide was created for you: the curious, the cautious, and the committed. You’ll see how to make a wallet, fund it, and use DeFi applications to earn, trade, lend, or stake your crypto assets.

Whether you’re reviewing your current financial strategy or preparing for the future of money, this is your step-by-step path to investing in DeFi confidently.

What Do You Need Before Investing in DeFi

Before you can invest in decentralized finance (DeFi), you must have two essential things:

- A crypto wallet (preferably non-custodial, like MetaMask).

- Ensure some cryptocurrency (crypto) is stored in that wallet.

Here’s how to get started. Additionally, please familiarize yourself with the best DeFi projects and DeFi use cases before investing.

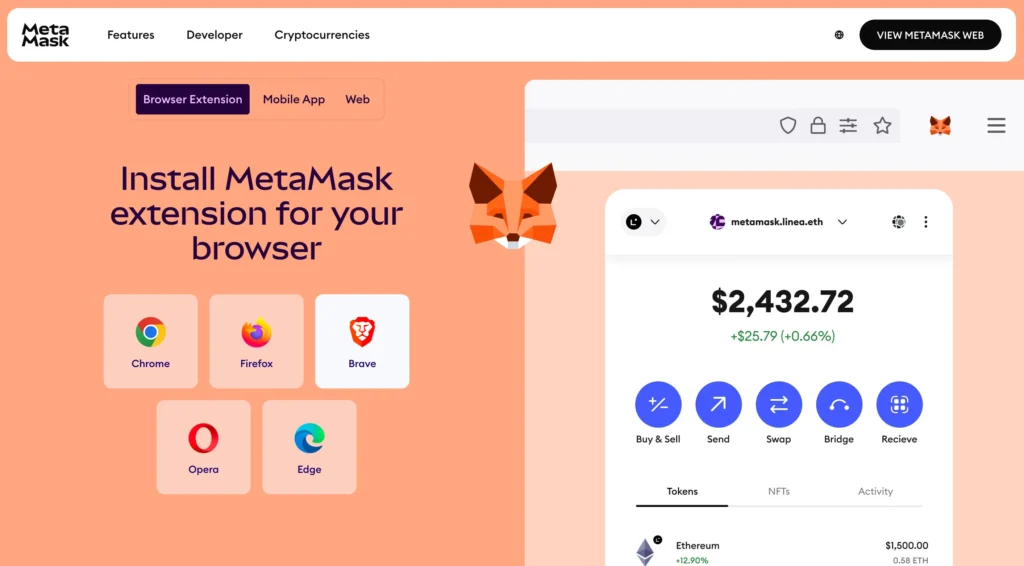

Step 1. Create a DeFi-Compatible Crypto Wallet (MetaMask)

To access DeFi applications and manage your digital assets, you’ll need a wallet like MetaMask, one of the most widely used blockchain wallets.

1.1. Download MetaMask

- Visit the official MetaMask download page.

- Select your preferred browser (E.g., Chrome, Firefox) to download the correct extension.

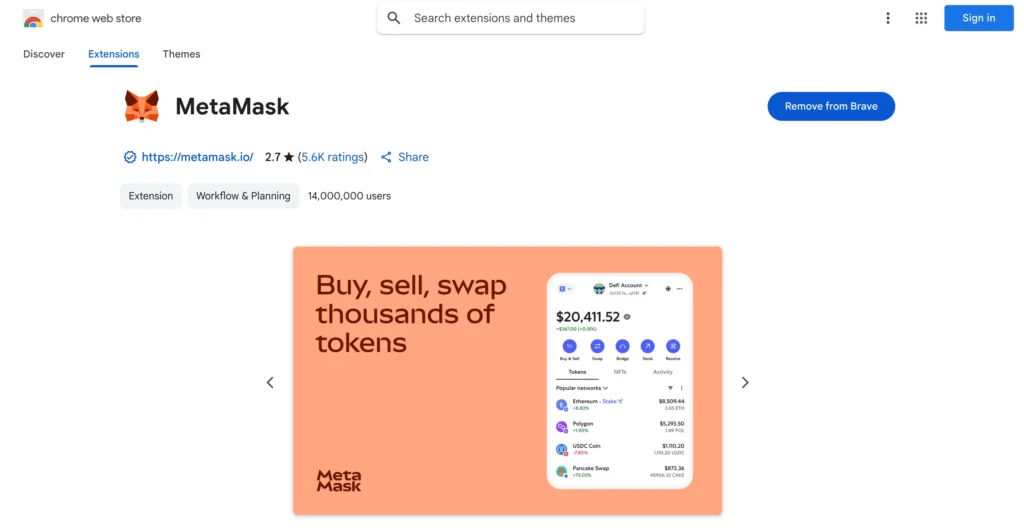

1.2. Add MetaMask to Your Browser

- Once redirected to the Google Chrome Web Store, click “Add to [Browser].”

- Confirm by selecting “Add Extension” to install it.

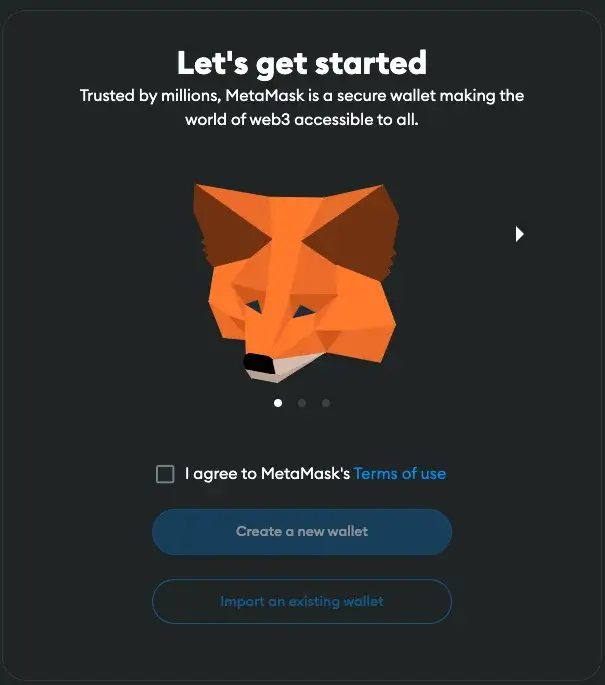

1.3. Set Up Your Wallet

- Choose “Create a New Wallet” or “Import an Existing Wallet.”

- Create a strong password.

- Securely store your Secret Recovery Phrase (this is crucial for recovering your funds if needed).

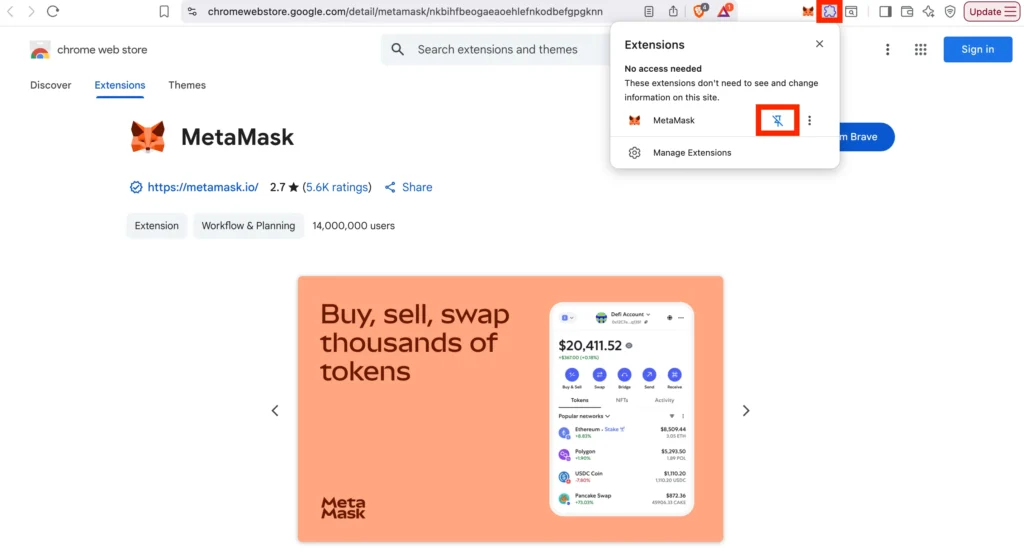

1.4. Pin MetaMask for Easy Access

- Click the puzzle icon in your browser.

- Pin the MetaMask Fox icon to your toolbar.

Now, you have a wallet ready for DeFi investment and secure transactions.

Step 2. Fund Your Wallet with Crypto

You can’t access DeFi financial services without crypto. Here’s how to transfer crypto into your MetaMask wallet:

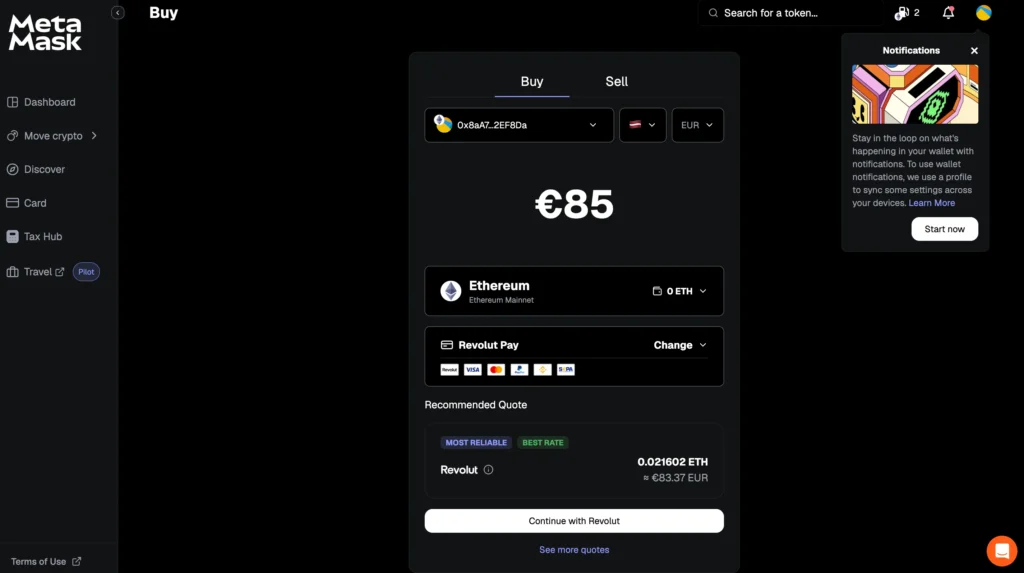

Option 1. Buy Crypto Directly in MetaMask

- Open MetaMask and click the “Buy” or “+” button

- Choose a payment provider (e.g., Revolut, Coinbase Pay, Transak, Ramp, etc.)

- Purchase ETH (Ethereum) using a bank card, Apple Pay, or Google Pay.

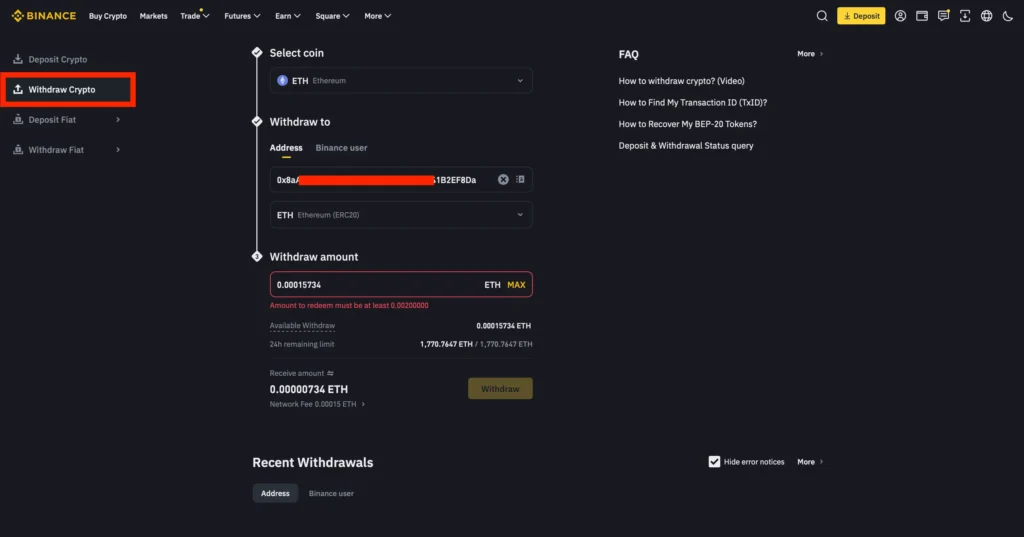

Option 2. Transfer from a Centralized Exchange

Already bought crypto like ETH on an exchange (e.g., Binance, Coinbase)?

- Go to your exchange account.

- Select Withdraw.

- Enter your MetaMask wallet address (Account 1).

- Choose the correct network (Ethereum) and amount.

- Confirm the transaction.

After confirmation, your Ethereum-based crypto assets will appear in MetaMask. This gives you the access and liquidity you need to start investing in DeFi.

Now that you have a crypto wallet and funds ready, you can explore DeFi protocols, stake assets, earn interest, or engage in blockchain-based lending without third-party intermediaries.

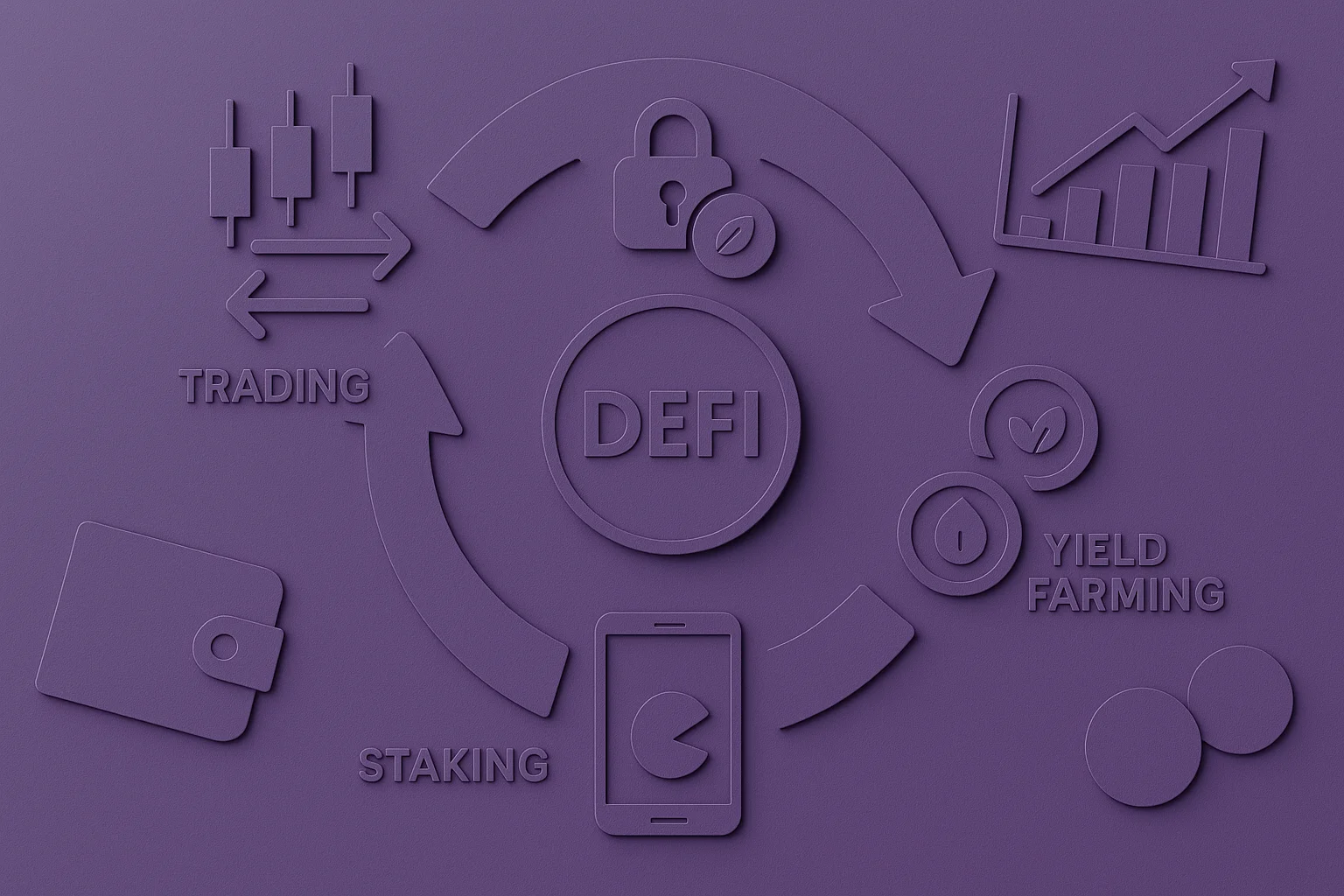

The Most Popular Ways to Invest in DeFi

Decentralized finance (DeFi) has unlocked new blockchain-based financial services that allow users to earn, invest, and transact without relying on traditional financial intermediaries.

Here are the most widely used methods for investing in DeFi, categorized by their nature, operation, supported platforms, and initial setup requirements.

1. DeFi Lending

DeFi lending is a decentralized alternative to traditional credit markets. It allows users to supply crypto assets to a liquidity pool or peer-to-peer lending protocol in exchange for interest payments.

This process is executed entirely through smart contracts without relying on banks or financial institutions. By locking digital assets into a DeFi protocol, lenders gain passive income from the interest generated by borrowers.

When you deposit tokens into a lending pool, the DeFi application automatically makes those assets available to borrowers. Borrowers must over-collateralize their loans using other crypto assets, which protects lenders against default.

Smart contracts enforce all transactions, interest rates, and loan terms, eliminating the need for a third-party or centralized decision-making process.

Interest is paid back to the pool and distributed to lenders based on their share. The performance of each lending pool depends on the supply-demand ratio, the protocol’s risk model, and on-chain governance parameters.

Some platforms that provide DeFi lending are:

- Aave (Ethereum, Polygon, Avalanche);

- Compound (Ethereum);

- Venus (BNB Chain).

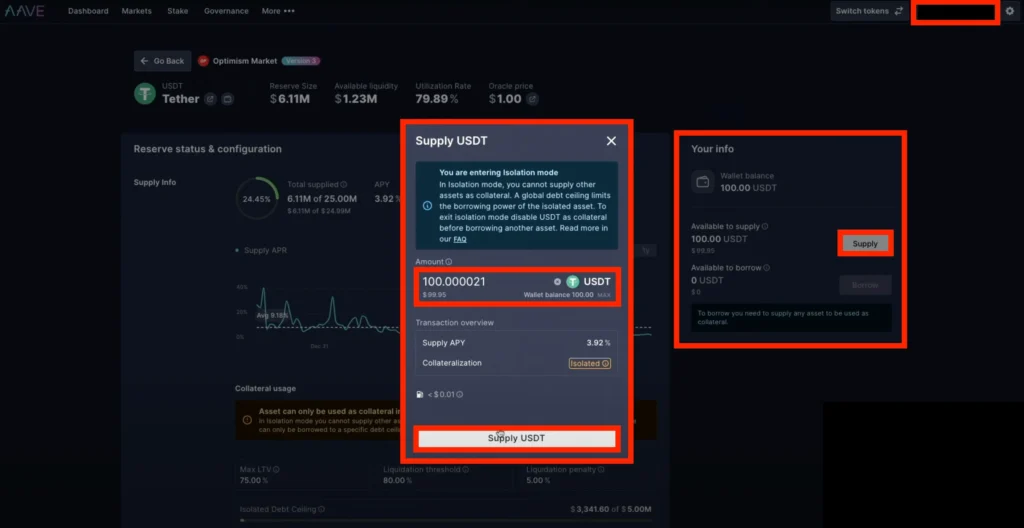

How to Invest in DeFi through Lending (Examplified Using Aave)

- Go to the official Aave website;

- Connect your MetaMask wallet;

- Select the desired blockchain network;

- Choose the crypto asset to lend (e.g., USDC, DAI, ETH);

- Click “Supply” and enter the amount;

- Confirm the transaction in MetaMask.

Your wallet now holds interest-bearing tokens, and your assets generate yield in real time.

2. DeFi Trading

DeFi trading refers to exchanging cryptocurrency or DeFi tokens through decentralized exchanges (DEXs). Unlike centralized trading platforms, DEXs operate without an order book or custody service. They utilize automated market makers (AMMs) or other smart contract-based models, allowing users to swap assets directly from their wallets while retaining full control.

DEXs, such as UniSwap or 1inch, work by connecting users to liquidity pools rather than traditional order books. When a trade is made, the smart contract calculates the price based on the pool’s asset ratio, using a constant product or curve-based formula.

The transaction is executed directly on-chain, making it transparent, immutable, and non-custodial. Fees are paid to liquidity providers, and depending on pool depth, slippage may apply.

Traders can perform swaps, provide liquidity, or use routing aggregators to get the best execution across multiple protocols.

Some platforms that provide DeFi trading are:

- UniSwap (Ethereum);

- 1inch (Aggregator for multiple chains);

- SushiSwap (Ethereum, Arbitrum, and more);

- PancakeSwap (BNB Chain).

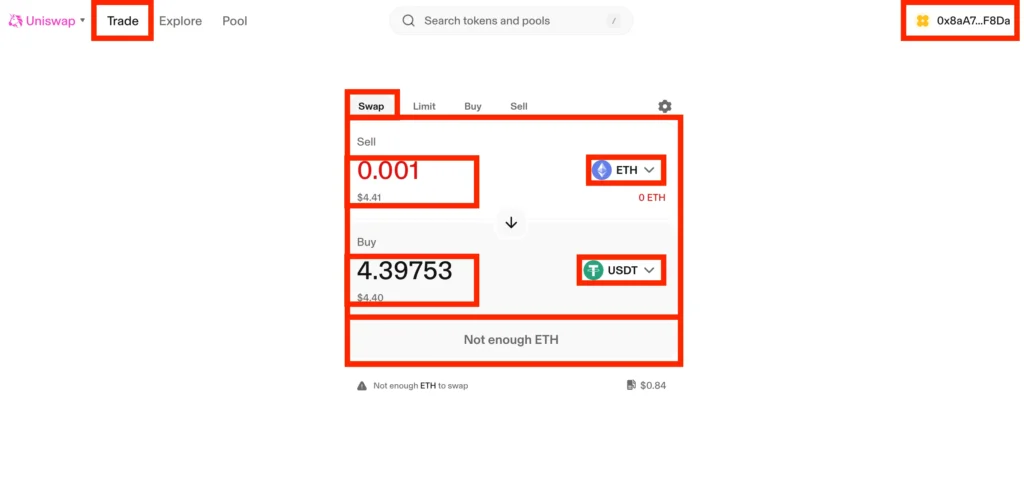

How to Invest in DeFi through Trading (Examplified Using UniSwap)

- Visit the official Uniswap website;

- Connect your MetaMask wallet;

- Choose the token pair (e.g., ETH to LINK);

- Enter the amount and review the transaction details;

- Click “Swap” and approve the token if required;

- Confirm the transaction in MetaMask.

The swapped token will appear in your wallet, and you now hold a different crypto asset that can be held, sold later, or used in other DeFi protocols.

3. DeFi Staking

Staking is locking up cryptocurrency in a proof-of-stake (PoS) blockchain or DeFi protocol to help maintain the network’s security and consensus. In return, participants receive staking rewards, typically in the form of additional tokens.

This is a fundamental part of many blockchain systems, replacing the resource-intensive proof-of-work (PoW) consensus of older blockchains.

Users commit their assets to a staking pool or directly to the protocol. The system uses these staked tokens to validate transactions, secure the network, and participate in on-chain governance. Rewards are distributed based on the amount and duration of tokens staked.

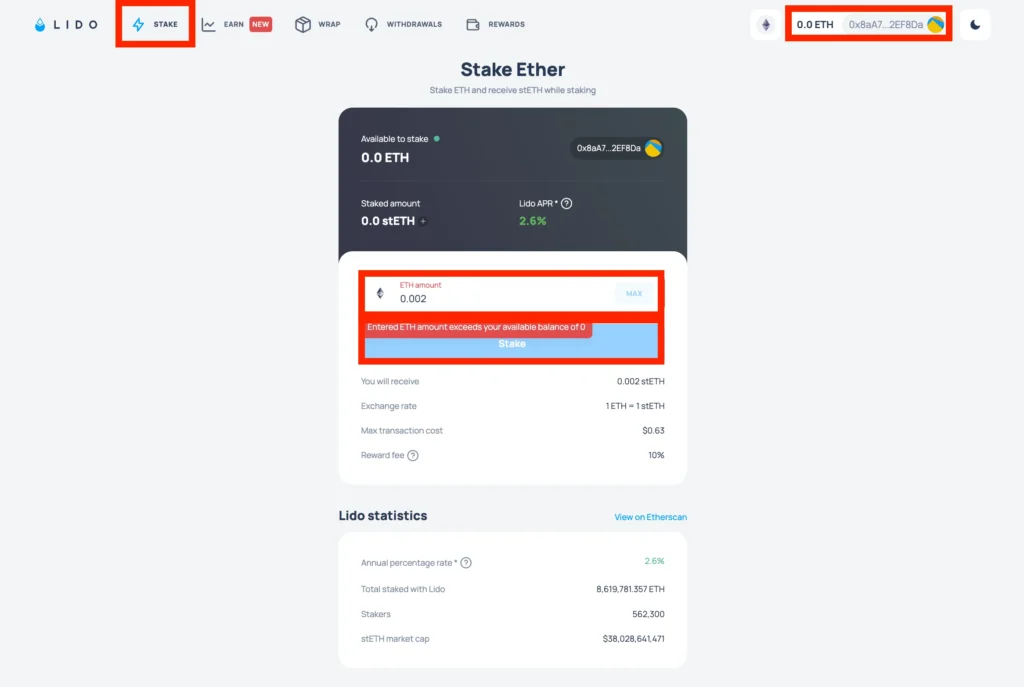

In liquid staking, platforms like Lido enable users to retain access to their assets through derivative tokens, such as stETH, which can be utilized across other DeFi applications while still earning rewards.

Some platforms that provide DeFi staking are:

- Lido (Liquid staking on Ethereum, Solana);

- Rocket Pool (Decentralized ETH staking);

- Ankr (Multi-chain staking);

- Binance DeFi Staking (non-custodial options available).

How to Invest in DeFi through Staking (Examplified Using Lido)

- Go to the Stake section on the official Lido website;

- Connect your MetaMask wallet;

- Select ETH as the token to stake;

- Input the amount and click “Stake Now.”

- Confirm the transaction in MetaMask.

You will receive stETH, a DeFi-compatible asset that reflects your staked ETH and continues to earn rewards.

4. Yield Farming

Yield farming is a decentralized finance strategy that maximizes crypto earnings by providing liquidity to DeFi protocols in return for rewards. This often involves pairing tokens in liquidity pools and earning both trading fees and incentive tokens, making it one of the more complex but high-yield options in DeFi.

You deposit two tokens into a liquidity pool, which allows others to trade between those assets. The protocol rewards you with a percentage of the transaction fees and sometimes additional native tokens. You receive LP tokens representing your pool share, which you can further stake in farming contracts for compounding returns.

Yield farming requires monitoring impermanent loss, market volatility, and gas fees, which can affect profitability. Some platforms that provide DeFi yield farming are:

- UniSwap V3 (Custom liquidity ranges);

- Curve Finance (Stablecoin pools);

- Balancer (Multi-token pools);

- PancakeSwap (Yield Farming on BNB Chain).

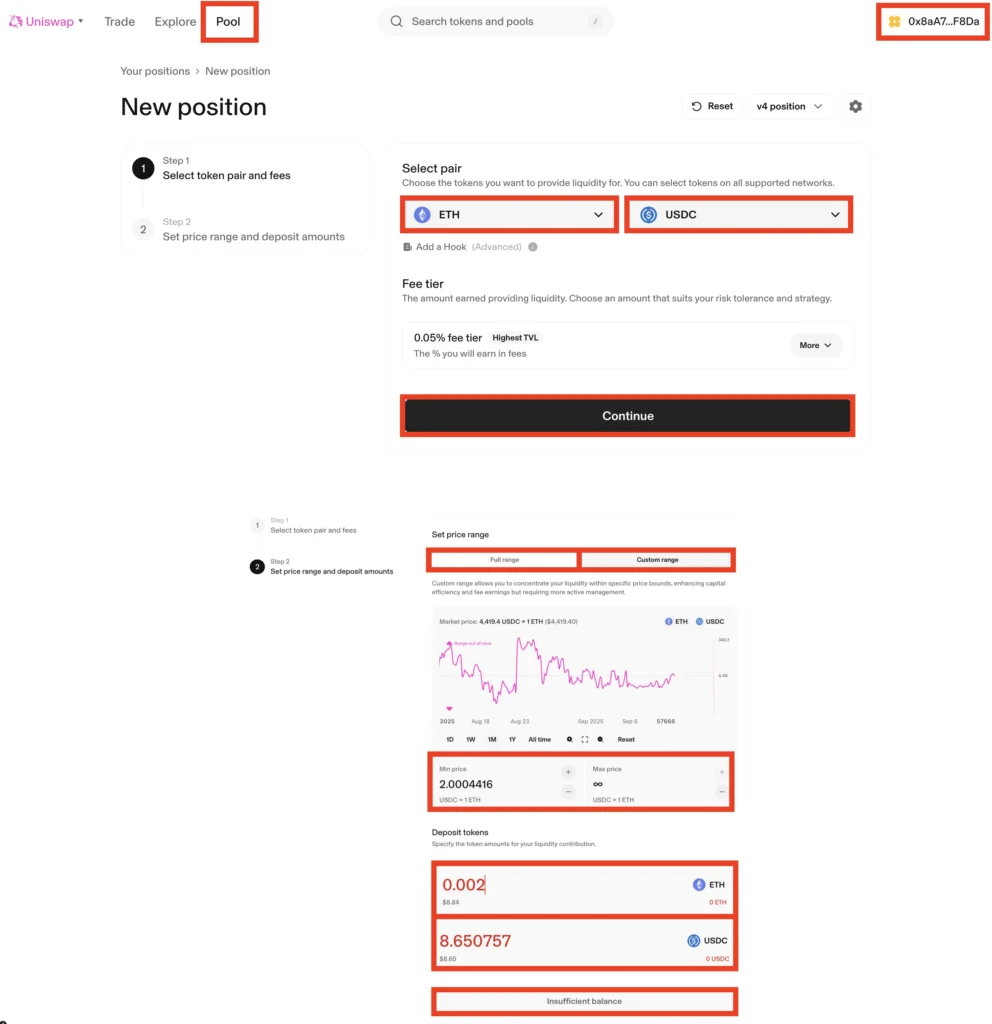

How to Invest in DeFi through Yield Farming (Examplified Using UniSwap V3)

- Go to the Pool section on the official Uniswap website;

- Click “New Position;”

- Select the token pair (e.g., ETH and USDC);

- Define the price range and input the token amounts;

- Click “Add Liquidity;”

- Confirm the transaction in MetaMask.

You will receive LP tokens, which represent your contribution to the pool. You now earn fees from every transaction in that pair and can compound this by using the LP tokens in other DeFi protocols.

FAQ

No. DeFi is a blockchain-based system of financial services built on smart contracts. Crypto is the asset, while DeFi provides apps for lending, staking, and exchange without third-party control.

DeFi platforms are designed to be secure, but risks exist if wallets are mismanaged or protocols are exploited. Start with trusted applications and research fees; never share your private keys.

The best investment depends on your goals, as staking, lending, and yield farming offer different performance and risk levels. Start small and diversify across DeFi protocols for balanced exposure.

Decentralized finance reduces reliance on third parties, but smart contract flaws or token volatility may expose users to risk. To protect your assets, choose audited protocols and secure wallets.

Bitcoin is a cryptocurrency, whereas DeFi is a comprehensive financial ecosystem of applications that run on blockchains, such as Ethereum. DeFi enables users to earn, lend, and trade assets directly, bypassing the need for a bank or intermediary.

Risks include smart contract bugs, market volatility, loss of access to your wallet, and protocol failure. Some DeFi tokens may also have poor liquidity or hidden fees.

Yes. You can earn interest, rewards, or tokens through staking, lending, or liquidity pools. Returns vary depending on market conditions, platform choice, and the performance of your strategy.

Many DeFi tokens are available, each tied to protocols, applications, and blockchain-based services. Always research to assess the project’s utility, security, and performance before investing.

You can start with as little as a few dollars, depending on network fees and the DeFi platform. Ensure your wallet is funded and that you meet the minimum transaction thresholds.

Conclusion

Investing in DeFi provides direct access to a new financial system, where you control your own assets, engage with protocols securely, and explore opportunities that far exceed what traditional banks offer.

Whether you choose lending, staking, trading, or yield farming, the key is to start with the right wallet, understand the tools, and build a strategy based on your portfolio goals.

As more people and investors enter the DeFi world, the ability to manage your crypto wisely will define your financial future. Begin cautiously, stay informed, and make your first move into decentralized finance with confidence.